401(k) Investing, Diversification and Asset Allocation – In Plain English

The BeManaged Ingredients and Recipe Investment Analogy

Over the past number of years I have come to really enjoy cooking. It unknowingly led me to an analogy for investing that is simple to understand and better yet, visual. The analogy, consisting of ingredients and the underlying recipe, has helped hundreds of investors better understand what they can ‘control’ within their 401(k). Furthermore it helps investors understand confusing terms such as “diversification” and “asset allocation” and how they impact the ‘behavior’ of their portfolio.

Over the past number of years I have come to really enjoy cooking. It unknowingly led me to an analogy for investing that is simple to understand and better yet, visual. The analogy, consisting of ingredients and the underlying recipe, has helped hundreds of investors better understand what they can ‘control’ within their 401(k). Furthermore it helps investors understand confusing terms such as “diversification” and “asset allocation” and how they impact the ‘behavior’ of their portfolio.

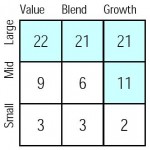

Step #1 – The Stylebox

The image to the right represents the entire US stock market compartmentalized into nine boxes. The idea is you do not want to compare funds in one box to funds in the other box, as they are each investing in distinctively different types of stocks. The market says diversify, diversify, diversify — but people get confused with what that really means. The visual aspect makes it easier to identify any gaps in your portfolio, would be issues with your portfolio’s diversification. (NOTE: This is ONLY illustrating the US Stock market, so also included is international stocks, bonds and cash. For simplicity sake, we are going to stay focused on the US stock portion of an investor’s portfolio.)

Step #2: Diversification / Ingredients

If you look at each of these boxes and the funds inside them as ingredients, diversification is simply making sure you have enough ingredients to complete a recipe. As you can see, funds rarely fit neatly inside their respective ‘box.’ In fact, the vast majority do not. Additionally, even though these are listed as US stock funds, a significant portions of these ingredients can include international stocks, bonds and cash. And finally, just as the Papa John’s commercial says — better ingredients, better portfolio.

Actual Portfolio Diversified Portfolio

Step #3: Asset Allocation – The Recipe

Now let’s say we have all of the ingredients we need to cook a pizza crust. Depending on the recipe we use and process used to cook it, the ingredients could result in a pizza crust or — a saltine cracker. We could use the same ingredients, but have two entirely different outcomes.

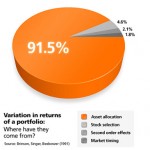

Investing is no different. In fact, studies have shown over 91% (Brinson, Singer, Beebower, 1991) of the reason for your portfolio’s performance is specific to the recipe used.

Therefore, there are reasons your portfolio has behaved the way it has over the past few years. It has to do with the specific ingredients (investment funds) used and the percentage put in each fund. Based on the investor profile you completed, we simply need to create a recipe that fits that specific level of risk. Does that make sense? (I know it doesn’t add up to 100%, the remaining portion is in bonds and international stocks)

Actual Recipe Proper Recipe

Decision: Do-It-Yourself, Get the Recipe (Advice), or Have it Cooked For You (Account Management)?

Just because I walk into a fully stocked kitchen with every tool and ingredient I could want, it does NOT make me Bobby Flay. Therefore, having a professional either provide you the recipe (401(k) advice) or simply cook it up for you (401(k) account management) can be better options than trying to do it yourself.

Copyright © 2010 BeManaged. All rights reserved.

Great analogy – especially since I like cooking. Great finish/conclusion.

It is our experience that the asset allocation decision, focused on the investment question, is only part of the problem faced by the plan participant. The buy or sell decision and risk mitigation through model selection, the securities selection, though important, have another aspect. The context. A particular participant may want to retire, but they may also want to, for example, buy a house, get kids thru school, pay off some high interest debt, fund an HSA, and buy a replacement refrigerator. Your example is excellent. Your method is clear. If we could just remove the human in the middle of it all!

I look forward to our talk, Chad. Have a nice weekend.

Only thing missing is the cook and their motivations and proclivities. Knowing one’s money personality can change the mix or create a time frame to invest as one needs to in order to have the right mix over time. After all, if the cook decides in the middle of cooking to do something differently, the recipe will fail, so we must know the cook’s motivations!

Kevin, I think what you could be alluding to is the ‘ongoing’ aspect of advice/management of the portfolio…and I couldn’t agree more. Just getting started, and then removing the ‘prudent investing wall’ that emotions can create, can help investors avoid the decisions that can unravel years of progress or down a path that will cost them thousands. However, helping people understand the three things they can ‘control’ with their portfolio — risk, behavior and contributions — this analogy has worked well to help them understand the risk piece, as it seems to be the most confusing to the majority of investors. And they are right.

This is a fresh approach at explaining one of the nuts & bolts components of retirement planning. I would definately use this analogy in a group participant presentation, where attention spans & average invester knowledge are minimal.