Fiduciary Advice & Education Blog

Survey Demonstrates Better Results for 401k Participants Using Advice

A recent study illustrated finds that 401k participants using advice are better diversified and have larger balances. Here are some interesting findings of the survey:

Improved Diversification – Participants held 74% more funds in their portfolio (8.67 versus 4.98 funds)

Improved Performance – 3 Year Annualized Return was 2.67% better than do-it-yourself investors

Larger Balances Seek Advice – Average balance of participants using advice was $107,558 versus $44,178 of do-it-yourself investors

These results are very similar to our experience with 401k investors. We find that participants using advice (or managed accounts) are better diversified and experience better downside protection due to improved risk management. Additionally, the larger the balance, the more likely the participant is to seek advice.

Don’t Get Burned – Put More Focus on the Recipe Than the Ingredients

A few months ago, I made a big pot of chili. I have made my Mom’s recipe my own, and always enjoy how it turns out. However, I incorporated a few new ingredients that time, and the initial result was quite interesting. I discovered an important lesson – I have some learning to do when cooking with cayenne pepper. When I checked it after it had been cooking for a couple of hours, I found it to look and smell like chili. After tasting it however, it was so spicy that I thought it was molten lava going down my throat.

Read MoreA User’s Guide for 401(k) Education v. Advice – What Fits Your Participants?

Improving the ‘participant experience’ is taking shape. The biggest question becomes, “What will work best with our participants, and how is it best delivered so it is not something we will have to ‘re-do’ in the future?”

Read MoreFinal Regulation on 401(k) Advice Bill Due Early 2011

Even though it has been in the works for over four years now, it looks like we might finally receive clarification on the PPA ‘Fiduciary Adviser’ 401(k) advice regulations early next year. Understandably, with the many issues that have garnered more press such as the healthcare debate, 401(k) fee disclosure and target date funds, the regulations have been delayed.

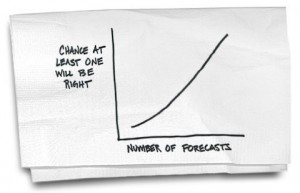

Read MoreMarket Forecasts, a.k.a. Market Guesses

Soothsayer. Prognosticator. The illusory crystal ball. The market forecasts that are lauded by the media…whose goal is to sell advertising…are simply speculation. We have told investors since day one that no one truly knows what the market is going to do by the end of the week, month or year. If you meet someone that claims they do…run…in the oppositive direction. Fast.

Read More(Podcast) 401(k) Participant Advice Best Practices on Talk 401(k) with Don Davidson

I was fortunate enough to be interviewed by Don Davidson of Manarin Investment Counsel for his Talk 401(k) podcast. While Don does an excellent job with this, I cannot say the same for myself. Therefore, if you are willing to overlook my stammerings (I was surprisingly nervous), the information might be helpful to you. Some of the topics included in the conversation include:

What is the difference between advice and guidance?

What is the liability for employers to provide advice to their participants?

The PPA Level Fee requirement

Why advice needs to be ongoing

Advice v. managed accounts

Technology and its impact on participant engagement

401(k) Fiduciary Best Practices Available on Your iPod

I am an iPod junkie. I admit it. However, I did not take advantage of the vast library of information available in the Podcast section of iTunes until just lately.

I was recently made aware of Don Davidson’s new “Talk 401k” podcast, and decided to take a listen. After hearing his first podcast with Tom Kmak of Fiduciary Benchmarks, I was sold. The 20 minute interview was concise and informative. I don’t know about you, but when I can listen in and take a break from having to read everything on 401(k) fiduciary best practices, it’s quite nice. I would highly recommend subscribing and listening in when you have a chance.

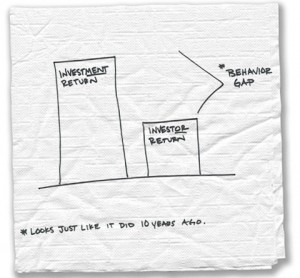

Read MoreAnnual Dalbar Study Shows Investors Are Still Behaving Badly

Dalbar releases an annual study gauging the impact of investor behavior on investors’ long term portfolio returns. Our friend Carl Richards of BehaviorGap.com, writing for the NYTimes.com Bucks blog, illustrates the impact of investors’ decisions on their long term portfolio performance via the findings of this year’s study.

Read More401(k) Investing, Diversification and Asset Allocation – In Plain English

The BeManaged Ingredients and Recipe Investment Analogy

Over the past number of years I have come to really enjoy cooking. It unknowingly led me to an analogy for investing that is simple to understand and better yet, visual. The analogy, consisting of ingredients and the underlying recipe, has helped hundreds of investors better understand what they can ‘control’ within their 401(k). Furthermore it helps investors understand confusing terms such as “diversification” and “asset allocation” and how they impact the ‘behavior’ of their portfolio.

Read MoreA Conversation on 401(k) Advice vs. Guidance – PPA Fiduciary Adviser v. The DoL 96-1 Opinion

When marketing our services to companies sponsoring 401(k) plans, we will often face confusion as to what is truly being offered to participants, guidance or advice. The reason being that the word advice has been used liberally by brokers, advisors, and service providers. Unfortunately, that will sometimes lead to companies assuming their participants are receiving the advice they need, rather than knowing what is actually taking place in those education meetings and any 1on1 interactions that follow. The guidance versus advice being so unclear, that the following is a mock conversation designed to educate plan sponsors and advisors as to what is and isn’t, should and shouldn’t, be taking place with participants so to protect the plan sponsor from fiduciary liability:

Read More