August Newsletter – U.S. Equity Funds See Highest-Ever Inflows in July

U.S. Equity Funds See Highest-Ever Inflows in July

Bubbles, Bubbles, Bubbles

Stock valuations (the price you pay to own a share of a company stock) have reached silly extremes with July’s market gains. Meanwhile, bond prices fell during the summer, with some bond funds suffering their worst three month period in recent history. How do investors react? – Well, based on the way they are behaving, they want more of the stuff that is overpriced and less of the stuff that is cheaper than in the spring.

Stock valuations (the price you pay to own a share of a company stock) have reached silly extremes with July’s market gains. Meanwhile, bond prices fell during the summer, with some bond funds suffering their worst three month period in recent history. How do investors react? – Well, based on the way they are behaving, they want more of the stuff that is overpriced and less of the stuff that is cheaper than in the spring.

According to a CNBC report, “U.S. equity funds saw a record inflow of $40.3 billion in July, according to data from TrimTabs, as the S&P 500 and Dow Jones Industrial Average scale new heights in what some are calling an “invincible summer” for the country’s stocks.”

“Fund investors ended their “love affair” with bonds this summer, pulling $21.1 billion out of debt mutual funds and exchange-traded funds (ETFs) in July, after record outflows of $69.1 billion in June. The outflows in June and July brought an end to 21 straight months of inflows.”

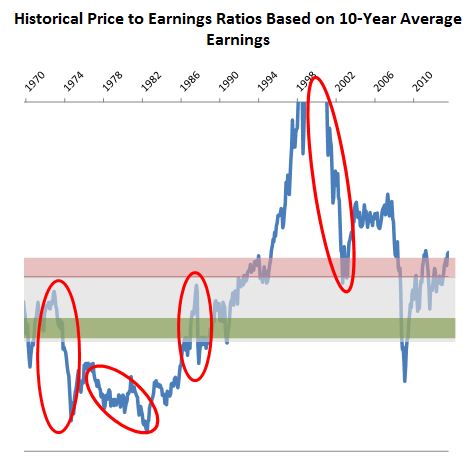

When headlines like “Fund Flows Surge as Stocks Party Like It’s New Years” become the norm and not the exception, red flags should fly everywhere! Stock prices have risen nearly 20% since August, 2011, while corporate earnings continue to languish behind the long-term trend. We’ve seen these excessive behaviors before; June, 1972, December, 1976, September, 1987 and October, 1999. In each of those four circumstances, outsized increases in the value of the S&P 500 were not supported by the earnings those 500 companies were generating. Market declines followed shortly – a 40% decline starting in mid-1972, a 28% decline in just two months starting in October, 1987, a 12% decline in 1976, and the 38% drop most of us remember in 2000. (The 2008 disaster was different; S&P earnings fell from $84.92 per share to just $6.86 per share in just 21 months, and stock prices rationally followed.)

Are we predicting that market declines are imminent? Well, no – it is impossible to tell when irrational behavior turns to rational behavior. But the odds are certainly not on the investor’s side, so chasing additional returns makes little sense.

We will continue to help our clients understand the consequences of reacting to the basic human instincts of greed and fear, as well as all of the biases long identified in the investment community.

Digging Deeper

Challenging you to deeper understanding

For those interested in a deeper understanding of the issues surrounding investing and the economy, we suggest the following links:

- David Stockman, author of The Great Deformation, on the Federal Reserve and unemployment http://goo.gl/tDWPq

- Bill Gross, head of PIMCO bond funds, on bond prices, growth rates, and the Fed. Video. http://goo.gl/5wrklg

- Rob Williams, Director of Income Planning, Schwab, on bond funds in the climate of rising interest rates. http://goo.gl/5Vx3Jp

- The Numbers Game With Russ Roberts: A Novel Perspective From Ed Leamer. http://goo.gl/09bJBz

Calculating Your Returns

How to find your rate of return

If you are interested in a rough estimate of how your investments are performing over any given period of time, you will need three pieces of information:

- Your beginning balance

- The net contributions during the period

- Your ending balance

To approximate your return, use the following equation:

Unless you have made big contributions or withdrawals during your measurement period, this calculation will provide you with a very good estimate of your return. Try it out sometime!

Remember When They Said…

“Overall, equities remain attractively valued for investors with a longer-term horizon as forecasts for sustained global economic growth bodes well for equities.” (First Trust Advisors, Weekly Market Update, Week Ending September 21, 2007)

“A “modestly elevated” P/E on record earnings at record profit margins is an exorbitant multiple on normalized earnings. Investors will learn this over the complete cycle.” (The Fed: Magical Fairies and Pixie Dust, Hussman Funds Weekly Market Comment, September 17, 2007)