Reduced Future Returns Expected for Retirement Savings

Investment advisors and financial salespeople need to help retirement savers understand that we have entered a new era for investment returns, an era of much lower earnings growth for companies and significantly lower interest rates for stock and bond investments.

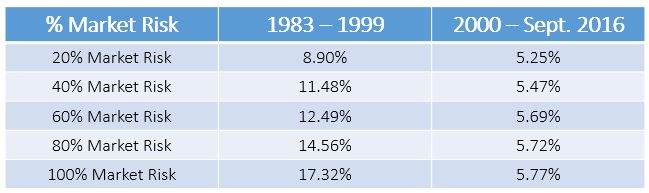

Let’s look at historic investment returns for portfolios with differing levels of market risk:

John Bogle, Founder of the Vanguard Group, presented a very cautionary view of market returns before costs for the next ten years.

Stock Returns for the Next Ten Years....................................... 4.0%

Bond Returns for the Next Ten Years....................................... 2.6%

50% Stock / 50% Bond Returns................................................. 3.3%

Investors need to prepare for the lower return environment in several ways:

- Younger investors need to start saving NOW, or increase their savings rate above historic norms, maybe as much as 20% of gross pay when possible.

- Make sure you are contributing at least the minimum to receive the full match available from your employer.

- Pay attention to investment costs within your 401(k) and hidden management fees from outside financial salespeople.