Special Report – Interest Rate Spikes and the Bonds in Your Portfolio

There is rising concern regarding the impact of higher interest rates on the bond funds in client portfolio. The purpose of holding bond funds is to provide a return above the level of cash while waiting for a more rational stock market environment. As always, the potential return over and above money market funds comes with a risk that bond fund prices may fall in value during a period of rising interest rates.

To help provide perspective on the current environment, consider the interest rate event in 2013 to see the impact on bond funds in client portfolios:

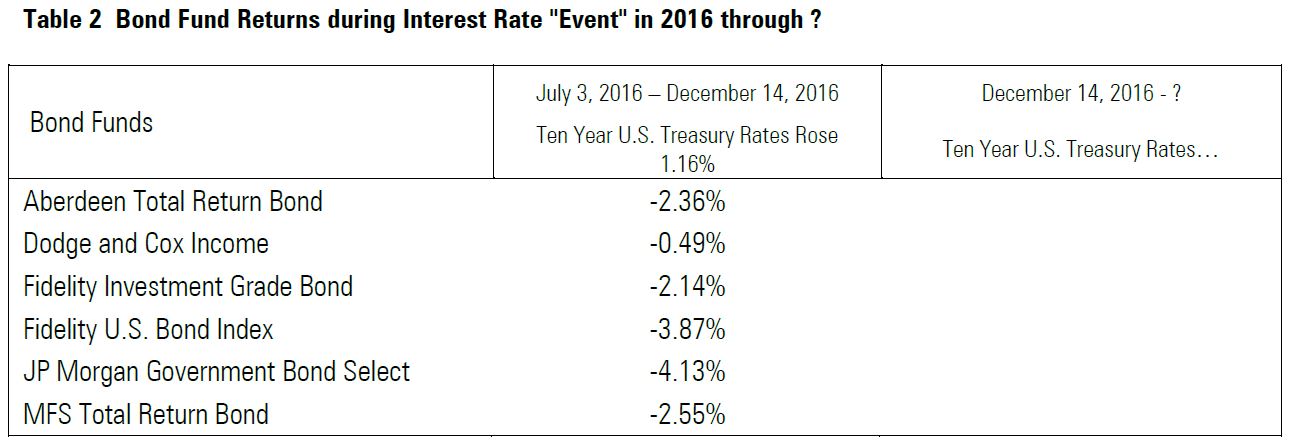

Now compare this data to where we are in our current interest rate event:

Your retirement account is a long-term investment, and trying to “time” short-term spikes and dips have been proven to be unproductive over the long term. We have reason to believe that this volatility surrounding the Federal Reserve’s interest rate hike is based on uncertainty, and once some perspective is regained, the bond market will stabilize. However, we will be monitoring the markets closely and are prepared to make changes when we believe it is in your best interest.

Concerned about your 401k/investment portfolio?

Schedule your free virtual/phone consultation.