Posts Tagged ‘Carl Richards’

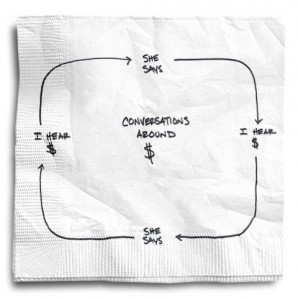

Conversations About Money…Even When They Are Not

If you follow this blog at all, you know I am a fan of Carl Richards, who does a fantastic job of simplifying investing concepts but also our behaviors around money. The following post from the New York Times is a fantastic example and advice from which we can all (mostly us men) can benefit from.

Read MoreAre You an Investor or a Collector?

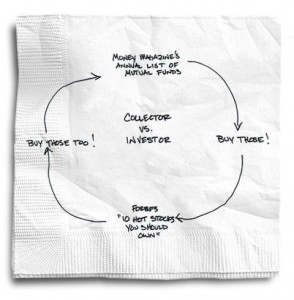

Our friend Carl Richards of BehaviorGap.com and the NYTimes.com Bucks blog has done a great job of illustrating how the ‘over diversification’ of portfolios can simply be ‘buying more’ instead of ‘buying different.’

Over- or under-diversifying your investments remains one of the classic behavioral mistakes.

Over-diversification happens when we become collectors of investments instead of simply being investors. Think of the people who buy the mutual funds they read about in Smart Money magazine. Next year they buy the Top 10 Funds recommended by Money magazine. A year later they buy two or three new international funds because that’s what’s on the home page of Forbes.

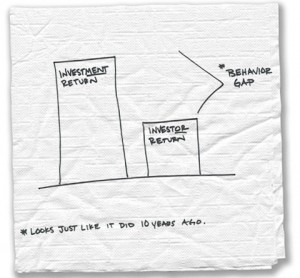

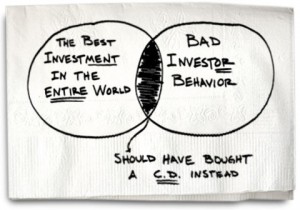

Read MoreAnnual Dalbar Study Shows Investors Are Still Behaving Badly

Dalbar releases an annual study gauging the impact of investor behavior on investors’ long term portfolio returns. Our friend Carl Richards of BehaviorGap.com, writing for the NYTimes.com Bucks blog, illustrates the impact of investors’ decisions on their long term portfolio performance via the findings of this year’s study.

Read MoreEveryone Makes Investing Mistakes, Just Don’t Create ‘Anchors’

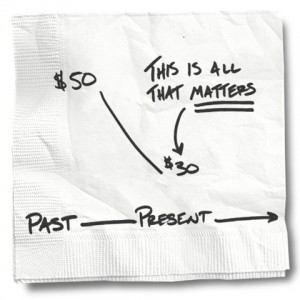

Our friend Carl Richards, writing for the NYTimes.com Bucks blog, does an excellent job of speaking to the ‘waiting-until-I-get-back-to-even’ mistake many investors make. It’s called anchoring. Essentially, we create a value in our mind for an investment we want to receive before selling.

Read MoreIgnore Generic 401(k) Guidance Posed as Advice

We have seen people follow guidance from the likes of the Jim Cramers, Suze Ormans and Dave Ramsey (though we are big fans of his debt reduction advice), which more often than not steers people into an inappropriate portfolio. Many 401(k) providers will even provide some general guidance as well, but they leave investors to figure out the ideal recipe (asset allocation) to create from their plan’s ingredients (investment options).

Read MoreAre All Investment Mistakes Investor Mistakes Instead?

Carl Richard’s latest article brings up a very interesting perspective on investing. The following sums is up pretty well,

We’re quick to focus on the reward but fail to appreciate the consequences of our choice. If an investment performs well, we like to think, “I picked a winner.” If it’s the reverse, and the investment fails, it’s someone else’s fault.

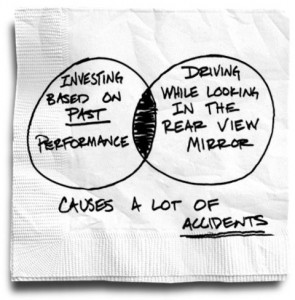

Read MoreThe Temptation (and Danger) of Past Investment Performance – NYTimes Bucks Blog

It’s understandable. You are looking to invest in something different in your 401(k), and what is the most accessible bogey to judge the funds in your plan? Past performance. It tugs at the foundation of human nature, greed and fear.

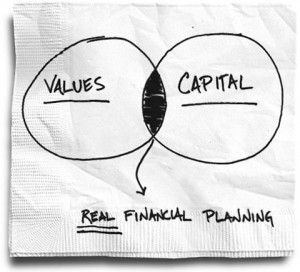

Read MoreWhy There Are No ‘Best’ Investments – BehaviorGap @ NYTimes

As you know, our friend Carl Richards is a writer for NYTimes.com. We have definitely encountered people trying to find the “silver bullet” investment that will magically create huge gains for their 401(k). Unfortunately, this typically results in some really outlandish investment “strategies” and chasing the performance of the “best fund.” The cost of those decisions to their nest egg is tremendous. The following is Carl’s most recent post, and I won’t try to water it down with a summary, for I think every investor should read it.

Read More401(k) Investors’ Achilles Heel #2: Goal-Based Investing – Good or Bad?

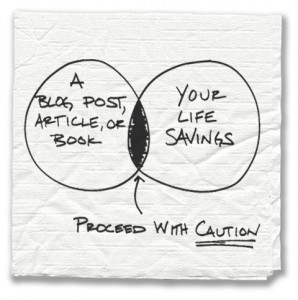

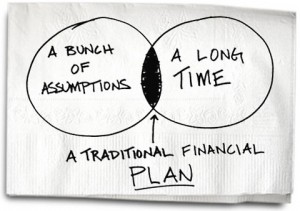

This month, our team has conducted dozens of 1-on-1 consultations. During these consultations, we walk the 401(k) investor through an investor questionnaire that takes into account their age, time horizon for accessing their 401(k) assets, and their risk tolerance. During this review of their account, we consistently run into investors who have an expectation of what they need to achieve from a performance standpoint in order to meet their goals. Just as I was considering this, Carl Richards wrote an article (click the napkin to read) specific to whether financial plans are worth the paper they are drawn up on.

Read More401(k) Investor Achilles Heel #1: Overconfidence

From time to time, all of us think we know what we are doing when clearly we do not, but it is not until we are proven wrong that we come to realize it. For me, it’s home repair. I know it’s not my strong suit, but my “man” button keeps blinding me to that fact until I am calling the repairman to fix the original problem and everything additional that I destroyed, broke, etc.

That, my friends, is humility. And humility is good for all of us. When it comes to investing, such overconfidence in our abilities can be extremely costly. In fact, the larger the balance of your 401(k), the more costly mistakes can be to you.

Read More