401(k) Investors’ Achilles Heel #3: Expecting Investment Performance to do All of the Work

I have to give it to the NYTimes. Their new “Bucks” blog includes great insight from our friend Carl Richards of BehaviorGap.com. Just yesterday they posted a very easy to use, interactive 401(k) savings calculator that illustrates how increasing your contributions just 1% creates a very different retirement picture for you upon retirement, while avoiding “paycheck shock.” There is the point beyond the calculator. When working with 401(k) investors, we meet with people who expect the performance of their investments to drive them toward a successful, dignified retirement while being unwilling to save beyond the company match. The idea tends to be that they need to be more aggressive in order to meet their goals, but there is no way they are going to increase their savings. Well, unfortunately that only works well during bull markets. When a down market strikes, it can send them reeling and headed on a dangerous cycle of investment decisions (more on this in the next segment). I am not trying to say times are easy for anyone. Regardless of what CNBC says, this economy hasn’t improved, only the markets have. That being said, our team has had so many conversations with 401(k) investors that we feel it’s kind of an epidemic among a large segment of investors. Here is how the conversation typically goes:

Investor: “I would like to become more aggressive, as I need to make more money.”

Us: “No problem, let’s review your risk profile and make sure you are comfortable with the consequences of increasing your risk.”

Investor: “Consequences?”

Us: “Yes, you see, it’s easy to be aggressive when the market is having a fantastic bull run as we have had over the last 13 months. However, the downside is that if the market turns and heads the other way, it will open you up to more losses.”

Investor: “Well I don’t want that, that’s why I hired you to help me.”

(After reviewing the risk profile questions and finding that nothing has change with his desired risk tolerance)

Us: “Unfortunately, we can’t press a button and make sure the market is always going up. No one truly knows where the market is going to close on Friday, at the end of the month, or at the end of the year. Right?”

Investor: “Right.”

Us: “That is why we are making sure your portfolio is managed to the level of risk you have instructed, so you are exposed only to that amount of risk. Therefore, instead of increasing your risk, let’s look at your contributions. You can definitely control how much you put into the account, but not the market’s performance.”

Investor: “That makes sense.”

Here is a few very simple secrets from what we have learned through our experience with investors:

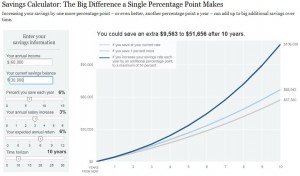

- The most successful 401(k) investors are not actually investors. They are SAVERS. Small increases (see image below) can make a huge difference. Just consider your savings as the fuel for your retirement fire. Click here to find out for yourself

- We have never met anyone that had TOO MUCH MONEY when they retired.

- Many 401(k) plans now have Automatic Increase functions, in which you choose a date and percentage, and your contributions will automatically increase by 1%-3% (your choice) per year on a specific date. Turn it on. Life often gets in the way of doing this manually, so this allows you to put your retirement savings on auto-pilot.

Wow, what a refreshing read. The professional community has a tendency to get caught up in conversations about investment fees, glide paths, merits of insurance products in retirement plans, etc, but the single biggest determining factor for retirement savings success is participant behavior. After all, the very decision to save anything is made by the participant.

Save, save, save. Advisors need to take every opportunity to impress upon partiticants AND plan sponsor’s that “You can definitely control how much you put into the account.”