Posts by Jay Jandasek

Jay Jandasek Passes Level II of Chartered Financial Analyst Exam

We want to congratulate Jay Jandasek for passing Level II of the Chartered Financial Analyst (CFA) exam! It is an incredible accomplishment and we were very relieved (for the sake of Jay’s stress level) that he passed. Fortunately, he has a few months to relax…before beginning to study for Level III. Congratulations Jay! “The Chartered…

Read MoreSummer 2015 Investment Notes

Findings from the Latest Retirement Confidence Survey Sponsored by the Employee Benefit Research Institute (EBRI), the American Savings Education Council (ASEC), and Mathew Greenwald & Associates (Greenwald), the annual Retirement Confidence Survey is a random, nationally representative survey of 1,000 individuals age 25 and over. Below we present a few interesting findings from the April,…

Read MoreJune 2015 – Take Our 1-Question Downside Risk Quiz

Our Risk Quiz – How Much Money are You Comfortable Losing? How would you answer the following? You are 55 years old and have managed to accumulate $337,400 in your retirement savings account. During the next market correction, how much of that balance are you willing to lose? $0 $25,440 $37,400 $67,480 $158,900 The last…

Read MoreCyber Security Threats and Your Private Information

Throughout 2014, news headlines contained stories about the breach, and theft, of Non-Public Information; or NPI. From retailers to financial institutions to movie producers, it is evident that our private information is under attack more than ever. In response to this new wave of cyber security threats, the SEC has announced a Cybersecurity Initiative. This…

Read MoreApril 2015 – Starting Points Matter

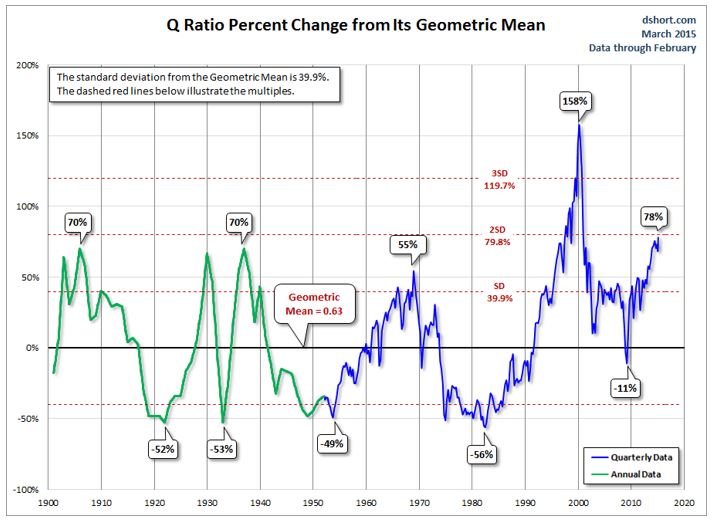

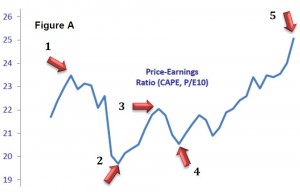

Just a Reminder – Starting Points Matter Investors continue to insist on paying ridiculous prices for common stocks, investment grade bonds, and the funds that invest in them. The financial salespeople (those NOT acting as fiduciaries for your assets) continue to tout justifications for these high prices by citing statistics that have absolutely no historical…

Read More2015 401k Contribution Limits Announced

New 2015 401k contribution limits were announced today by the IRS! Elective Deferrals for 401k/403b/457: $18,000 ($500 increase) Catch-Up Contributions for 401k/403b/457: $6,000 ($500 increase) Annual Compensation: $265,000 (increased from $260,000) Annual Additions Limit for Defined Contribution Plans: $53,000 (increased from $52,000) Highly Compensated Employees: $120,000 (increased from $115,000) Key Employee: $170,000 (no change) Click to Read…

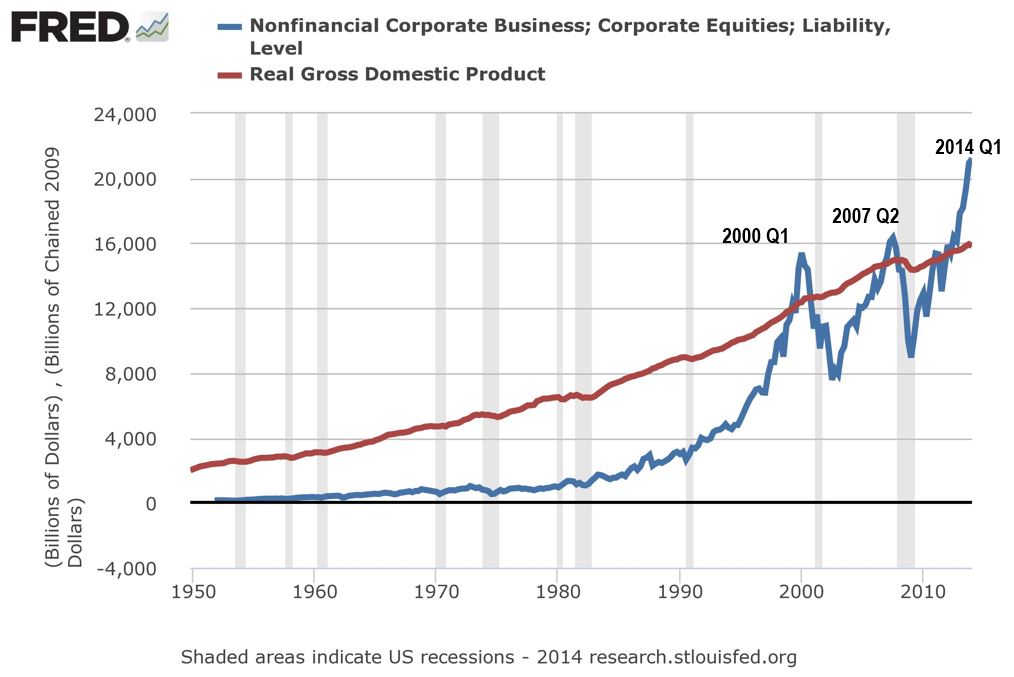

Read MoreSummer 2014 Newsletter – Market Value of Stocks Now Exceeds GDP

Market Value of our Stocks Now Exceeds Total Value of our Production Investors find themselves today in a climate of high and climbing stock prices. There are many potential causes. Individual companies may out-perform expectations and therefore justify a higher price, or the economic growth of the nation may create an environment where stock prices…

Read MoreDraper, Inc. Wins 2014 PlanSponsor of the Year by PlanSponsor Magazine

BeManaged is honored to be the advice provider for the Draper, Inc. retirement plan, which won the 2014 PlanSponsor of the Year for plans <$50MM. Draper’s diligence and commitment to the success of their participants is impressive and it is great to see them recognized for their efforts. We would like to note that utilization…

Read MoreDecember Newsletter – Tis the Season for Chasing Returns

How Investment Bubbles Work “Keep in mind how investment bubbles work. A bubble always starts with some real factor that takes on increasingly exaggerated importance in the eyes of investors. The bubble expands not on facts but on untethered imagination. People imagine that X will result in ever-increasing prices, and assume that an endless crowd…

Read MoreNovember Newsletter – Your Willingness, Ability and Need to Accept Risk

Your Willingness, Ability and NEED to Take Risk For our best savers, risk can and should be reduced When enrolling in our service, our clients are asked a short series of questions designed to help us understand the level of risk appropriate for their investment portfolio. Our goal is to best understand (at least initially),…

Read More