December Newsletter – Double Digit Stock Market Gains So Far in 2012

Double Digit Stock Market Gains So Far in 2012

Low Corporate Earnings Growth Offset by Expansion of Price/Earnings Ratio

World stock markets bounced back during the second half of November, turning near-term losses into small positive gains for November and for the fourth quarter.

World stock markets bounced back during the second half of November, turning near-term losses into small positive gains for November and for the fourth quarter.

Gains were small, but broad-based. Declines were witnessed only in the large cap value category. The category is dominated by energy and drug company stocks (Exxon Mobil, Chevron, Pfizer, Merck, etc.) and suffered a 1.8% decline in November.

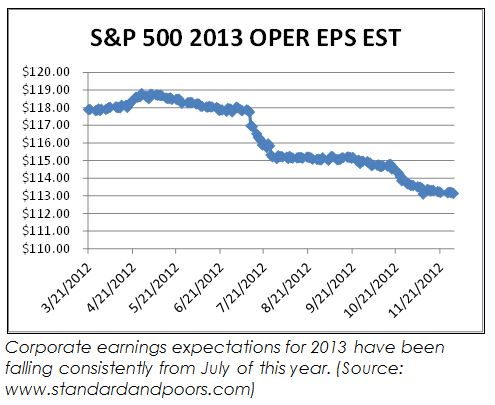

For the year to date, the S&P 500 has increased in value by almost 15%. Operating earnings for these companies have gained less than 1% over that period. But investors have decided to pay over 11% more for corporate earnings than they were willing to pay in December, 2011.

At this point, operating earnings are projected to increase 14% in 2012, despite projections of a slowing world economy and expected compression of corporate profit margins.

401(k) Account Balances Enjoying Significant Gains

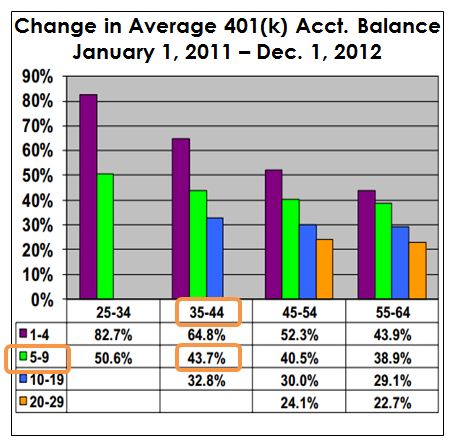

The chart at the right updates information on the gains retirement plan investors have enjoyed over the last 23 months. An example of how to read the chart:Contributions plus earnings providing double digit gains from the end of 2010.

The chart at the right updates information on the gains retirement plan investors have enjoyed over the last 23 months. An example of how to read the chart:Contributions plus earnings providing double digit gains from the end of 2010.

• Find your age range across the top of the table (we have circled the 35-44 age range).

• Find your years of employment with your company down the first column (we have circled the 5-9 year range).

• At the intersection of the two, you will see that the average 401(k) account has grown 43.7% over the last 23 months.

Manufacturing Index Declines in November

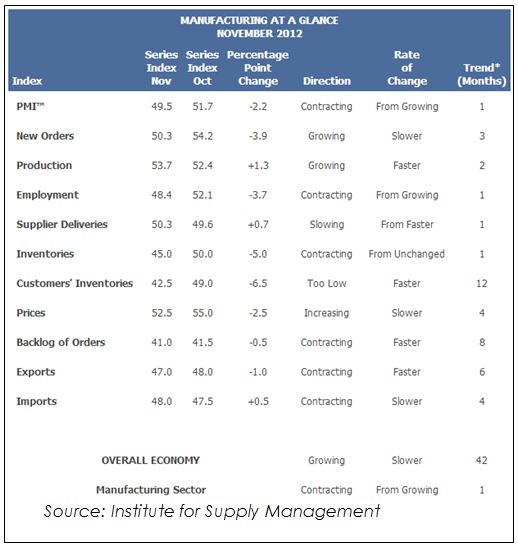

Reading below 50 indicates contraction in the manufacturing sector

The Institute for Supply Manufacturing Index declined to 49.5 from 51.7 in October. The current reading is the lowest since July, 2009. The employment portion of the index fell to 48.4, a reading below 50 for the first time since September, 2009.

Six of the eighteen manufacturing sectors showed increases:

• Petroleum & Coal Products;

• Paper Products;

• Furniture & Related Products;

• Electrical Equipment, Appliances & Components;

• Food, Beverage & Tobacco Products; and

• Computer & Electronic Products.

CFA Institute Integrity List:

50 Ways to Restore Trust in the Investment Industry

Following the 2008 financial crisis, and on the occasion of the Chartered Financial Analyst Institute’s 50th Anniversary, they published the Integrity List; 50 ways to restore trust in the investment industry. Last month, we offered up the first ten, here are numbers 41 through 50:

41. Take responsibility for the actions of your team.

42. Use social media to comment about the values you uphold.

43. Act as an expert resource for journalists.

44. Refuse to associate with anyone who takes advantage of clients.

45. Bring to justice those who take part in irresponsible and illegal activities.

46. Recommend companies with fair practices and good corporate governance.

47. Advocate for technology that makes the industry more transparent.

48. Engage and build relationships with local regulators and policy makers.

49. Serve on committees that advocate for regulatory reform.

50. Become a member of CFA Institute and sign the required annual ethics statement.