Don’t Ignore Inflation’s Impact on Your Portfolio

Purchasing Power for Your Investment Dollar Continues to Erode

A wise consumer consistently looks for the best deals on the stuff they buy every day. If steak prices get too high, maybe we consume more hamburger or chicken. Car prices get too high, maybe we opt to hold on the car we have a little longer. But when it comes to stock prices, the “experts” overwhelmingly recommend you keep buying, no matter the price.

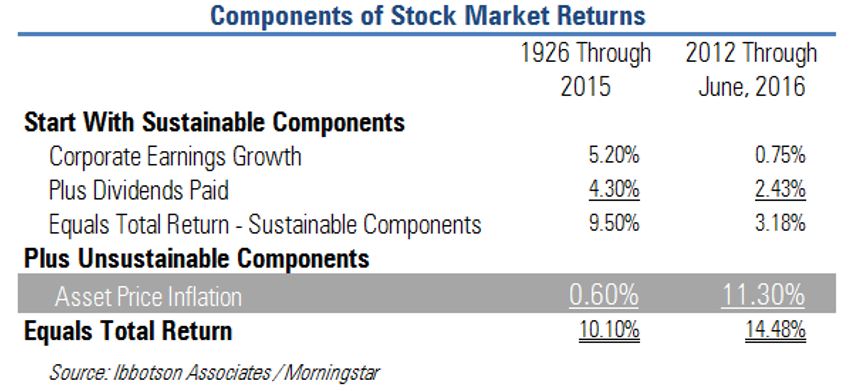

Here’s a look at how inflation has impacted your investment portfolio in recent years versus the long term:

The return components that have provided the overwhelming portion of investment returns over the last 90 years (earnings growth plus dividends paid) have provided less than one-quarter of the returns over the last 4 ½ years. The asset price inflation rate of 11.3% per year has overwhelmed this decline and led to overall investment gains above the long term averages.

We provide more details on the reverse side of this newsletter. One thing we keep in mind as we manage our client portfolios: Other than the tech bubble of the late 1990s, which ended very badly for investors, the prices we are paying for a dollar’s worth of corporate earnings today is higher than only two other months in history, August and September, 1929.

Source: P/E analysis from Crestmont Research (www.crestmontresearch.com)

Download the August 2016 Newsletter

Including Risk-Based YTD Returns