May Newsletter – Fiscal Debt and Investment Returns

Investment Returns and Overall Account Growth

Your contribution level critical to a successful retirement

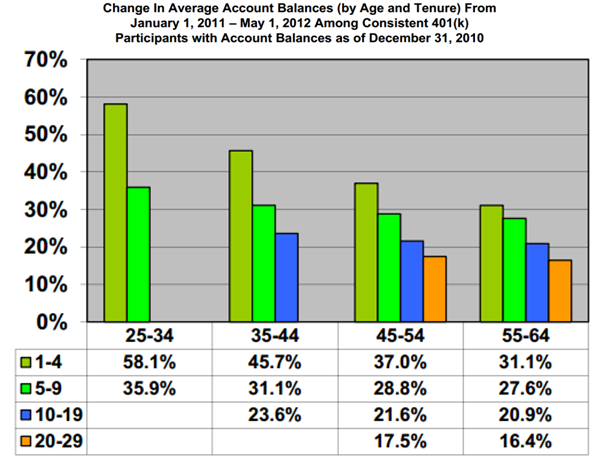

The Employee Benefit Research Institute’s latest survey of 401(k) valuations looks at account growth by age and tenure (number of years participating in the plan). From January 1, 2011 through January 31, 2012, account values of newcomers under the age of 35 have risen in value by 58%. On the other side of the spectrum, those who are over 55 years old and have been in the plan at least twenty years saw account increases near 16%.

When you have an opportunity, compare your January 1, 2011 balance to your current balance and see if your growth is in line with your peers. If you are falling a little short, it might be a good time to revisit your contribution level!

“Illinois residents, whose income taxes rose by a record last year to help close a budget deficit, are paying the price again for the state’s fiscal mismanagement. With its pile of unpaid bills growing about 30% this year, the weakest pension-funding ratio among states and falling federal aid, Illinois and its municipalities are paying a penalty above AAA debt that’s twice their five-year average. Illinois plans to issue $1.8 billion of debt as soon as next week…”

April 24 – Bloomberg (Tim Jones and Brian Chappatta)

Excessive Levels of Debt and Future Economic Growth

The Effect of “Crowding Out”

Borrowing from tomorrow’s taxpayers to get economic results today would be fine so long as the results mitigate the negative consequences imposed on the future. Robust productivity and steady employment growth are the keys to long-term economic success.

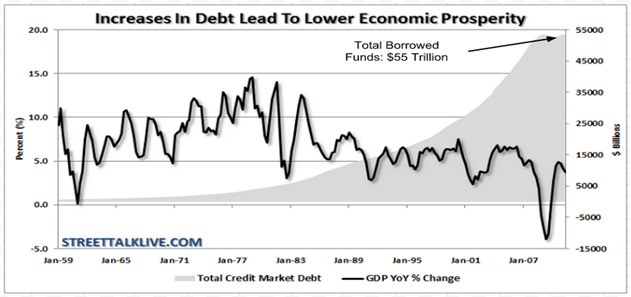

In the long run, however, excessive borrowing can lead to an extended period of slow economic growth. The accrued debt load on society acts as a parasite diverting capital away from productive assets towards paying down principal and interest on accumulated debt.

The table below illustrates the effect excessive government spending has caused on economic growth worldwide in recent years. For an interesting case study, look no further than Japan, which has a debt to GDP ratio of roughly 220%, stagnant population growth, and has experienced two decades of meager economic growth (tradingeconimics.com).

As large amounts of credit are forced through one body (for example, the U.S. Treasury) private market participants are “crowded out” – the supply of credit is reduced which eventually drives up the cost of private sector borrowing. Central bank policy is accommodating current U.S. fiscal policy by expanding the monetary base (reference “Monetary Base” April BeManaged newsletter). As a result, we have been able to get away with excessive government borrowing without the negative effects of crowding out… at least for now.

Future economic growth is absolutely critical to support corporate earnings and, subsequently, stock prices and retirement account balances. Muted economic growth resulting from short-sighted monetary and fiscal policies will eventually translate into lower long term rates of return for financial assets.

In the aftermath of the 2001 terrorist attacks, the Federal Reserve increased bank reserve balances to $67 billion from a level below $10 billion to assure market liquidity. Those balances were quickly withdrawn, and we returned to normal levels by the end of the following week.

During the 2008 financial crisis, the Federal Reserve added over $800 billion in reserves in just over three months. Reserve balances have continued to increase – as of the end of April, over $1.5 trillion sits in Federal Reserve Banks as required or excess reserves.

“Tuesday Never Comes”

“The global economy is floating on an ocean of credit, and a good thing too as our cartoon friend Wimpy reminds us. Without it, he would be a hungry puppy by next Tuesday and nearly seven billion world citizens would be worse off if barter, and not credit, was the oil that lubricated trade…

Not suddenly, but over time, gradually higher rates of inflation should be the result of QE policies and zero bound yields that were initiated in late 2008 and which will likely continue for years to come. We are hooked on cheap credit just as Wimpy was hooked on Friday’s burgers.”

-William Gross, “Tuesday Never Comes”, www.pimco.com