The Surprising Paradox of Choice in 401k Plans

You may have heard about experimental studies that aim to capture the human experience when provided a large variety of options. Consumers today are often bombarded with a very high number of choices when they enter shopping malls, department stores, restaurants, mobile phone stores, etc. It is likely we have all experienced a certain level of paralysis when forced to choose a wine flavor from a menu containing 37 different wine choices. That overwhelming feeling we get when we are introduced to a vast array of choices can bring about discomfort and is ultimately unfavorable.

You may have heard about experimental studies that aim to capture the human experience when provided a large variety of options. Consumers today are often bombarded with a very high number of choices when they enter shopping malls, department stores, restaurants, mobile phone stores, etc. It is likely we have all experienced a certain level of paralysis when forced to choose a wine flavor from a menu containing 37 different wine choices. That overwhelming feeling we get when we are introduced to a vast array of choices can bring about discomfort and is ultimately unfavorable.

There seems to have been an accepted dogma among marketers in the past that a greater variety of choice leads to a better customer experience. When waiters place menus at the dinner table with 22 different entrees as opposed to 6, they might think they are doing you a favor by giving you the chance to choose the “perfect” option among several others. However, it’s becoming increasingly clear that perhaps, as humans, we may be better off with only 6 options as opposed to 22. When faced with 22 different options, we may experience a level of anxiety as we jockey between whether we’re in the mood for the filet mignon or the flank steak as opposed to whether or not we’re in the mood for a steak or instead some pasta -an easier choice, no doubt!

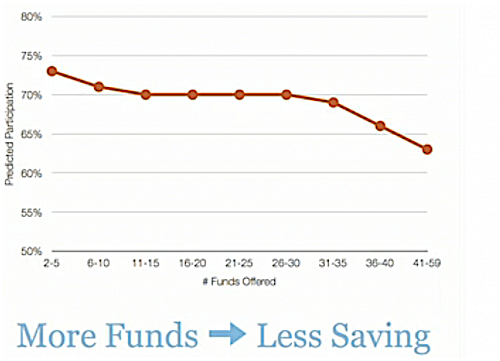

Although some may disagree with this notion that a greater number of choices is not beneficial to the consumer, it appears that on an aggregate level, a greater number of choices does reduce customer and user experience and in this case, participation. An interesting study conducted by Psycho-Economist Sheena Lyengar, along with her team of researchers from the Columbia Business School, suggests that greater consumer choices leads to less participation in retirement savings plans. In the study, Sheena and her team surveyed nearly 1 million Americans participating in 650 different retirement plans with regards to their decisions to save for retirement. What they found was a negative correlation between the participation rate among retirees and the amount of funds being offered. In other words, participation rates among consumers being offered 3 funds was in the mid 70’s percentile, while those plans offering nearly 60 funds saw participation rates drop the 60th percentile.

Sheena and her team found that as more choices are made available to the consumer (and perhaps you could relate to this) three things happen:

- Folks procrastinate even when it goes against their best self-interest

- They’re more likely to make worse choices (worse medical choices, financial choices, et cetera)

- They’re more likely to make choices that leave them less satisfied

It is important we recognize this as not a sign to give up and forgo saving when faced with an overwhelming amount of choices, but instead as a cue to seek professional help from those offering responsible advice. We live in an age where we are routinely subjected to a large number of options. It is important we recognize this as a possible threat to our well-being and make the appropriate steps to improve the outcome. The old adage that knowledge is power can yet again yield some value as your awareness to this situation should help with future decisions. Understanding that it’s natural to feel overwhelmed when choosing the optimal location for retirement funds should encourage you to take an offensive stance and make the appropriate steps to remedy your anxiety.

Click here to view Sheena’s presentation.