2011 Dalbar Study Finds That Investors are Still Their Own Worst Enemy

Going back to the early 2000’s, our friends at Dalbar have been conducting a study to determine whether investors’ investment decisions impacts their investment performance. Unfortunately, it does. In a BIG way. As with every year’s study so far, the results illustrate a big difference in what the S&P 500 gained versus the average equity mutual fund investor. The results of the twenty year numbers ending 12/31/10:

Going back to the early 2000’s, our friends at Dalbar have been conducting a study to determine whether investors’ investment decisions impacts their investment performance. Unfortunately, it does. In a BIG way. As with every year’s study so far, the results illustrate a big difference in what the S&P 500 gained versus the average equity mutual fund investor. The results of the twenty year numbers ending 12/31/10:

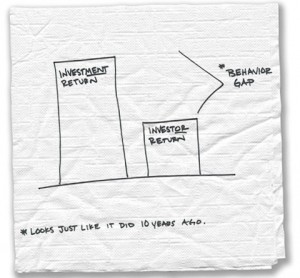

S&P 500 – 9.14%

Average Equity Mutual Fund Investor – 3.27%

The problem is, the 5.87% ‘behavior gap’ is actually an improvement over many years’ results. Additionally, now that many people have gone through the “Dot Com” and “Mortgage Crisis” bubbles, people are learning to avoid some of the behaviors that result from the greed and fear we experienced during those periods. In reality though, we see these harmful behaviors more often than not when working with investors. If we simply remember that human nature can often tell us to do the wrong thing at the wrong time, we can help ourselves and our portfolios.