Posts Tagged ‘Market Insight’

Stock and Bond Markets Remain Overvalued – October 2016

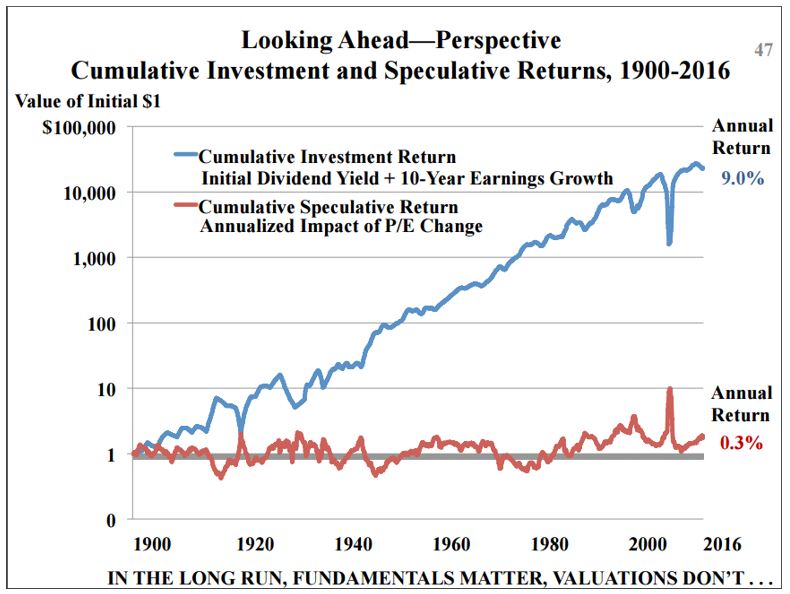

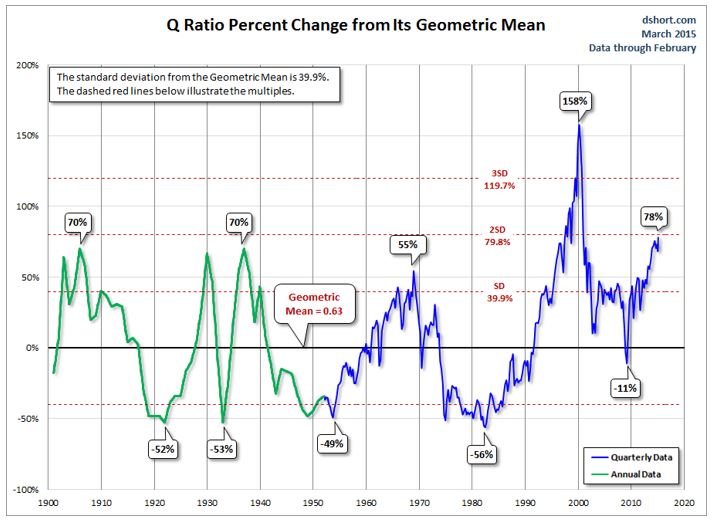

The average of four fundamental valuation measures shows a market nearly two standard deviations (82%) above its historical norm: Source: Advisor Perspectives, October 6, 2016 https://www.advisorperspectives.com/dshort/updates/2016/10/04/market-remains-overvalued Remember, asset price inflation (speculative return) contributes a very small amount towards total return over the long haul. Since 2012, however, speculative returns have been in the double digits…

Read MoreReduced Future Returns Expected for Retirement Savings

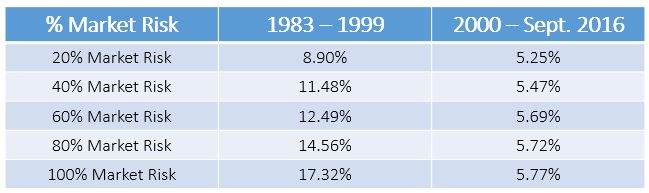

Investment advisors and financial salespeople need to help retirement savers understand that we have entered a new era for investment returns, an era of much lower earnings growth for companies and significantly lower interest rates for stock and bond investments. Let’s look at historic investment returns for portfolios with differing levels of market risk: John…

Read MoreOur Thoughts on ‘Brexit’

Political events in Europe have taken center stage in the news and effects have rippled out across financial markets around the world. On Friday, the U.S. stock market, as measured by the S&P 500, fell by 3.6%. The rest of the world fared worse; Europe fell by 8.9% and the Europe/Asia/Far East index declined more…

Read MoreApril 2015 – Starting Points Matter

Just a Reminder – Starting Points Matter Investors continue to insist on paying ridiculous prices for common stocks, investment grade bonds, and the funds that invest in them. The financial salespeople (those NOT acting as fiduciaries for your assets) continue to tout justifications for these high prices by citing statistics that have absolutely no historical…

Read More