Posts Tagged ‘personal finance’

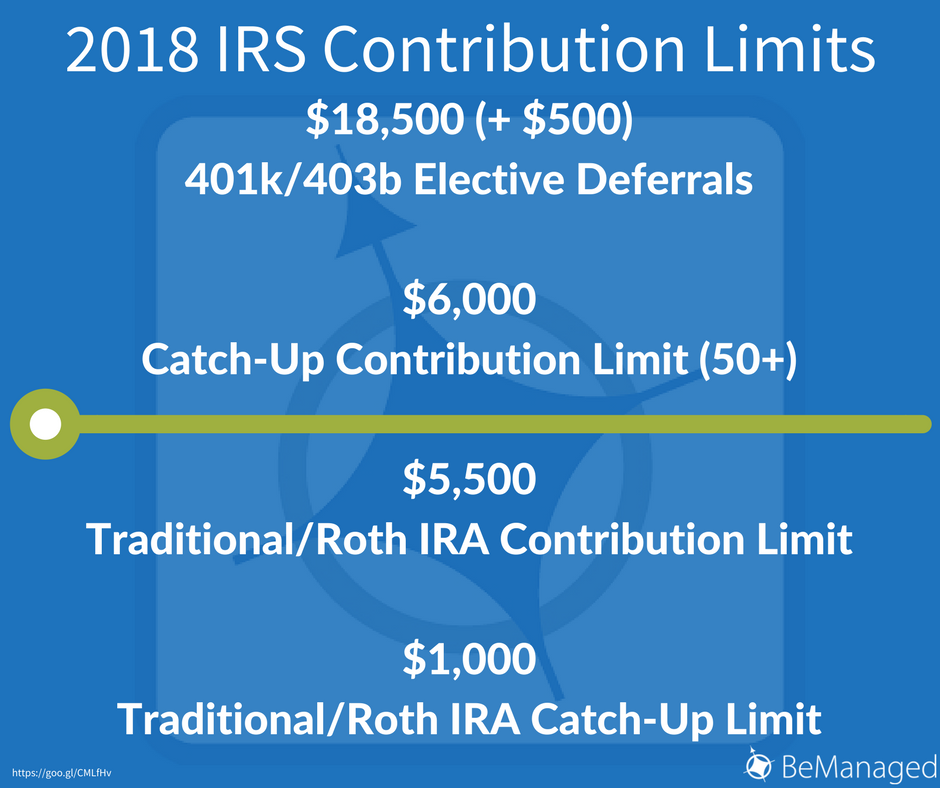

IRS Increases 401k Contribution Limits for 2018

Today, the IRS increased 401k contribution limits to $18,500 for 2018. It is good news for individuals looking to maximize their retirement contributions. Unfortunately, IRA contribution limits remain unchanged. Recommendation: Set a reminder on your phone or calendar to review your 401k/403b contribution in mid-to-late December to ensure you are maximizing your 2018 retirement savings.…

Read MoreSpecial Report – Interest Rate Spikes and the Bonds in Your Portfolio

There is rising concern regarding the impact of higher interest rates on the bond funds in client portfolio. The purpose of holding bond funds is to provide a return above the level of cash while waiting for a more rational stock market environment. As always, the potential return over and above money market funds comes…

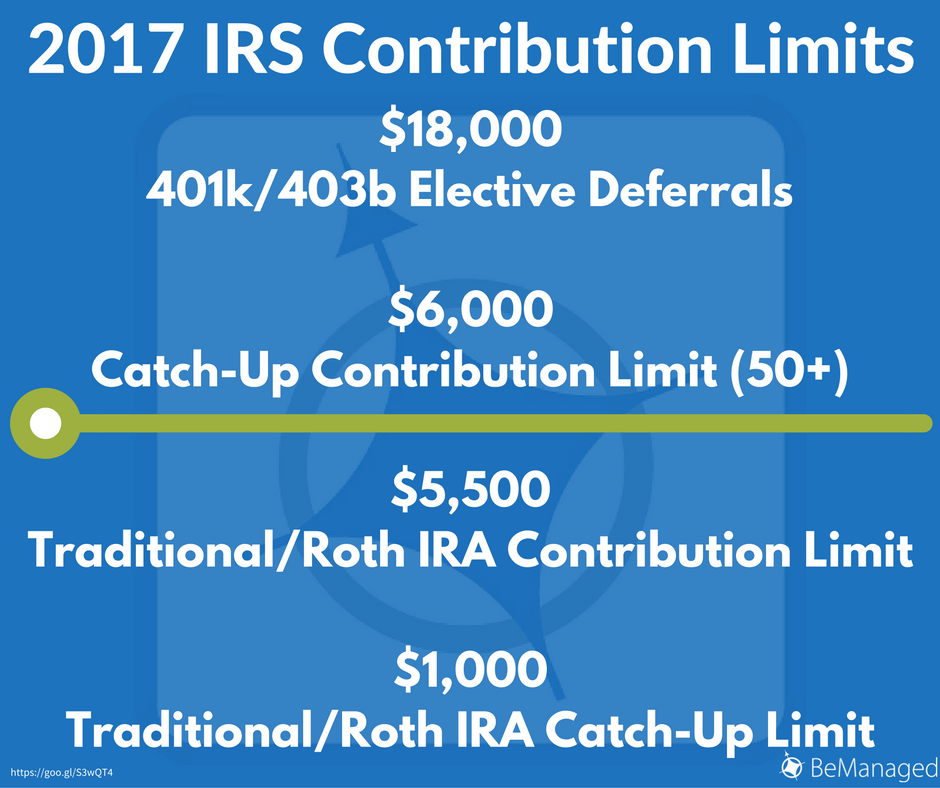

Read More2017 401k & IRA Contribution Limits Go Unchanged from 2016

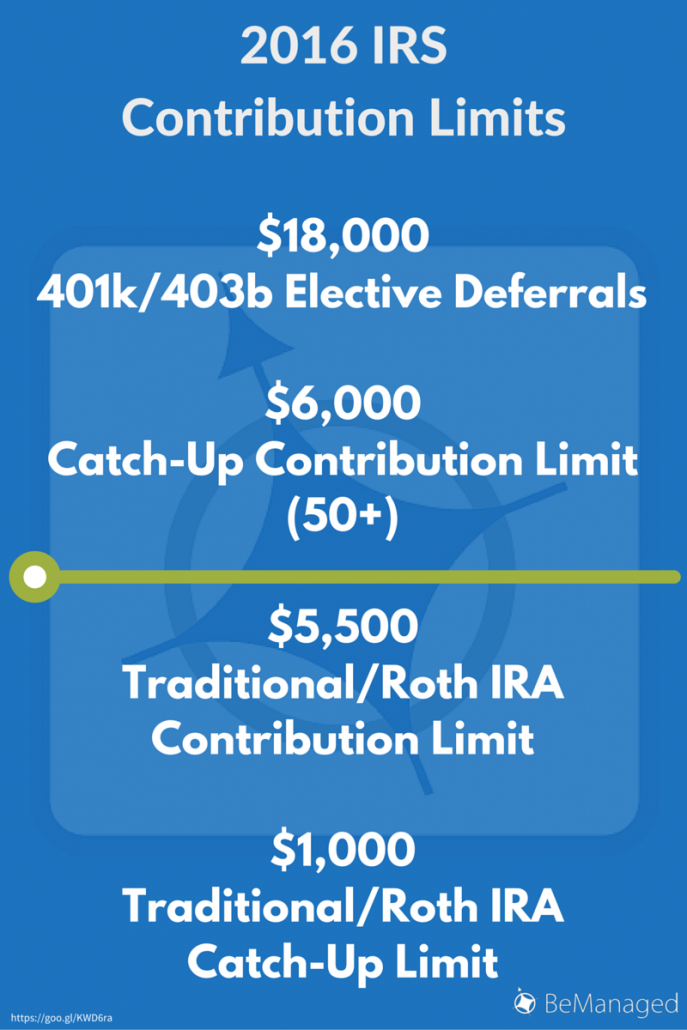

2017 IRS Contribution LimitsLook familiar? That’s because it is, because the 2017 IRS 401k and IRA contribution limits were announced and there are no significant changes from 2016. Below are the limits that affect most investors. Click to Read More Details at 401khelpcenter.com

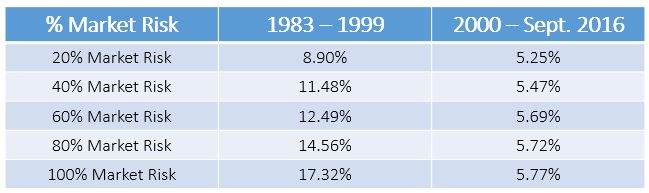

Read MoreReduced Future Returns Expected for Retirement Savings

Investment advisors and financial salespeople need to help retirement savers understand that we have entered a new era for investment returns, an era of much lower earnings growth for companies and significantly lower interest rates for stock and bond investments. Let’s look at historic investment returns for portfolios with differing levels of market risk: John…

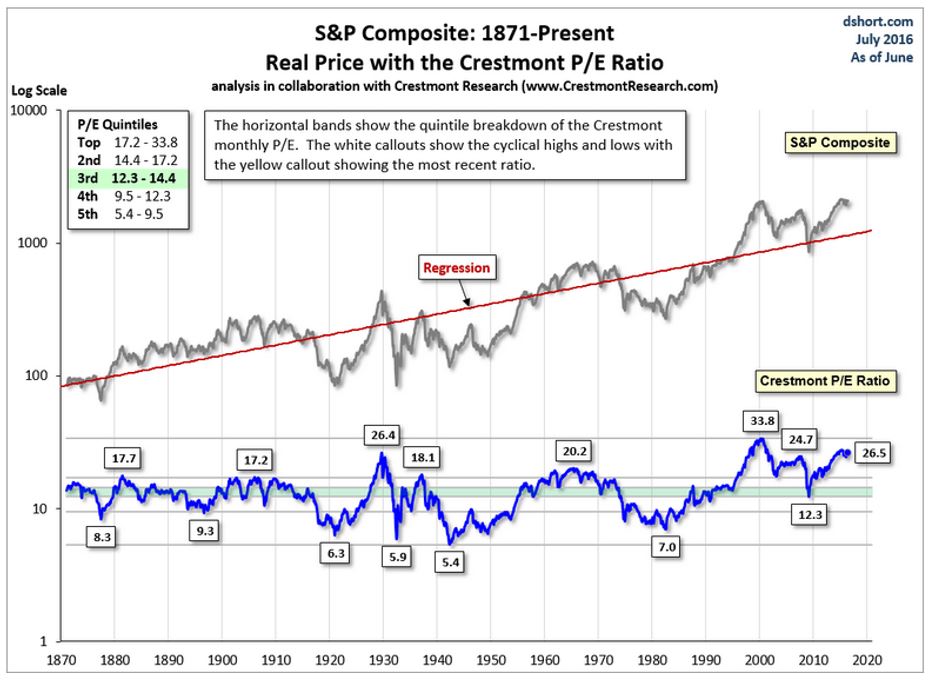

Read MoreWhat is “The Right Price” to Pay for a Stock?

The amount of money we decide to place in common stocks in your investment portfolio is partially driven by the prices we have to pay for those stocks. The higher the price we pay for a dollar’s worth of earnings generated by a stock, the lower the chance that we receive the returns we need…

Read More2016 401k & IRA Contribution Limits

2016 IRS Contribution LimitsThe 2016 IRS 401k contribution limits were announced and there is nothing significant changing from the 2015 limits. Below are the limits that affect most investors. Click to Read More Details at 401khelpcenter.com

Read MoreKeep Your Credit Score in Perspective

A credit score is important. It can be used when you apply for a new job and anytime you are looking to borrow money to finance a purchase (home, car, etc.). However, I have heard some people use their credit score almost as a defensive response to a poor financial picture as, “But my credit…

Read More2015 401k Contribution Limits Announced

New 2015 401k contribution limits were announced today by the IRS! Elective Deferrals for 401k/403b/457: $18,000 ($500 increase) Catch-Up Contributions for 401k/403b/457: $6,000 ($500 increase) Annual Compensation: $265,000 (increased from $260,000) Annual Additions Limit for Defined Contribution Plans: $53,000 (increased from $52,000) Highly Compensated Employees: $120,000 (increased from $115,000) Key Employee: $170,000 (no change) Click to Read…

Read More2014 401k Contribution Limits Announced

Unfortunately, there is nothing exciting to report regarding the 2014 401k contribution limits that were announced today by the IRS. Elective Deferrals for 401k/403b/457: $17,500 (no change) Catch-Up Contributions for 401k/403b/457: $5,500 (no change) Annual Compensation: $260,000 (increased from $255,000 in 2013) Annual Additions Limit for Defined Contribution Plans: $52,000 (increased from $51,000) Highly Compensated Employees:…

Read MoreOctober Newsletter – Bond Panic Subsides While the Fed’s Message is Ignored

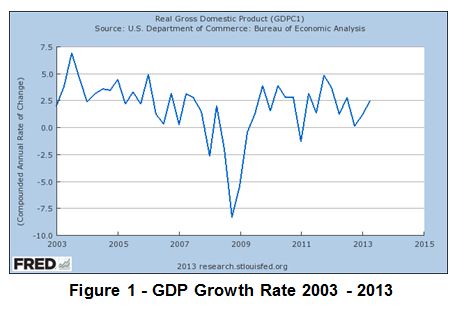

Bond Panic Subsides, Quietly Says “Nevermind” And the Fed’s Message Goes Largely Ignored In May, a rumor that the Fed might be considering reducing their bond purchasing (coined “Tapering”), instigated the worst losses in recent bond market history, as discussed in the September newsletter. In mid-September, in what was widely described as “a surprise move,”…

Read More