Posts Tagged ‘401k education’

2013 401k Contribution Limits Increase Slightly

Today the IRS posted the 2013 retirement plan limits, and there are a few increases from 2012. The new limits are as follows: Elective Deferrals for 401k/403b/457: $17,500 (increased from $17,000 in 2012) Catch-Up Contributions for 401k/403b/457: $5,500 (no change) Annual Compensation: $255,000 (increased from $250,000 in 2012) Annual Additions Limit for Defined Contribution Plans: $51,000…

Read MoreThe Surprising Paradox of Choice in 401k Plans

You may have heard about experimental studies that aim to capture the human experience when provided a large variety of options. Consumers today are often bombarded with a very high number of choices when they enter shopping malls, department stores, restaurants, mobile phone stores, etc. It is likely we have all experienced a certain level…

Read More5 Tips to Help Stop Worrying About Money

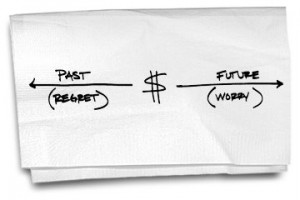

The following article by Carl Richards at the NYTimes.com made some really good points regarding our propensity to beat ourselves up over past mistakes as well as worrying about the future with respect to money. I have been guilty of this, so this really hit home for me. Simply put, we are all human and make mistakes in many aspects of our lives, including financial decisions.

Read More2011 IRS Contributions Limits for Your 401k/403b

Last week, the IRS released the contribution limits for 401k/403b investors, and the amounts remain unchanged for 2011. Here are the numbers:

Elective Deferral (traditional limits) – $16,500

Catch-up Contribution for Investors 50 yrs and Older – $5,500

The reality is, your contributions to your 401k/403b is the #1 reason for your success as an investor. Here are some strategies for increasing your contributions:

A User’s Guide for 401(k) Education v. Advice – What Fits Your Participants?

Improving the ‘participant experience’ is taking shape. The biggest question becomes, “What will work best with our participants, and how is it best delivered so it is not something we will have to ‘re-do’ in the future?”

Read More