W MI Fiduciary Forum Ruffles Feathers of Local Brokers

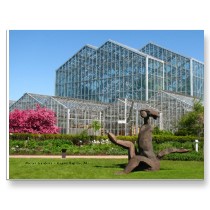

Last October, we organized the West MI Fiduciary Forum at the Frederik Meijer Gardens, a follow up to the ’07 Fiduciary Roundtable. It was a highly successful fiduciary education event that over 70 professionals attended, including 401(k) and 403(b) plan sponsors, investment providers, TPA’s, brokers and advisors. While the name Fiduciary Roundtable has been changed to Fiduciary Forum (Fiduciary RoundTable has been trademarked), the purpose of the event did not.

Last October, we organized the West MI Fiduciary Forum at the Frederik Meijer Gardens, a follow up to the ’07 Fiduciary Roundtable. It was a highly successful fiduciary education event that over 70 professionals attended, including 401(k) and 403(b) plan sponsors, investment providers, TPA’s, brokers and advisors. While the name Fiduciary Roundtable has been changed to Fiduciary Forum (Fiduciary RoundTable has been trademarked), the purpose of the event did not.

The following speakers spoke to legislative, regulatory and best practices of fiduciaries, whether they be those serving on an investment committee or an advisor working with a plan, which may or may not be acting in a fiduciary capacity. The goal of the event was to provide the attendees the best practices for performing fiduciary due diligence in respect to a company’s 401(k) plan. Due to Congress’s efforts to improve the standards by which brokers are held accountable, the media has done a fantastic job of educating consumers on the difference between a fiduciary and the much lower suitability standard. When dealing with ERISA plans such as 401(k)s, the fiduciary standard is even higher, as explained by John McKendry and Kristina Fausti.

- Tony Kolenic, Partner – Warner Norcross & Judd

- John McKendry, Partner – Warner Norcross & Judd

- Frank Berrodin, Member – Miller Johnson

- Kristina Fausti, Director of Legal and Regulatory Affairs – Fiduciary360

- Chad Griffeth, Co-Founder | President – BeManaged

Feedback:

- Brokers: Some of the attendees came from the traditional brokerage model, and the information that was shared not always being complimentary to their business model as it exists today. The lack of compliments was due in large part to the difficulty of quantifying fees, revenue sharing, soft dollar arrangements, compliance, actual legal responsibility, etc. This is not by any means a blanket statement, but some stereotypes exist for a reason. A number of brokers in the crowd were put off by the information shared, especially by the attorneys, as it flew right in the face of their business model.

- Employers: That being said, the response from the employers that attended were highly favorable, as they expressed their appreciation for hearing some no nonsense, cleared defined initiatives and practical solutions to better manage their company’s 401(k) plan.

- Registered Investment Advisors: The majority of the RIAs in attendance were pleased by the detail of the event, for it complimented those whom are already acting as a fiduciary.

Summary:

Based on the response to the event, it seems that if you have been doing something one way for a number of years at a lower standard of care and responsibility, it is difficult to understand that now there is a much higher expectation on that exact same piece of your business. Now you could be required to fully disclose your compensation (which is a big deal – much easier to bury it than be forthcoming and have it documented), increase your liability exposure, and stop providing “wink-wink” advice and actually take responsibility for that which you deliver to 401(k) investors. Sponsors want clarification, fiduciary mitigation, and understand the game has changed due to the media exposure of fee disclosure, “reasonableness of fees” and fiduciary responsibility.

Coming in ’10:

Additional fiduciary education events are coming soon in 2010, including Online Fiduciary Forums on specific topics including 401(k) participant advice, best practices for investment committees, investment policy statements, etc. Stay tuned!

fusagxl lfo bzmph milf handjob

imwmx!

wyedc rwlpmo gwl nn models