Advisors – An Analogy to Understanding A Fiduciary Vs. A Non-Fiduciary Advisor

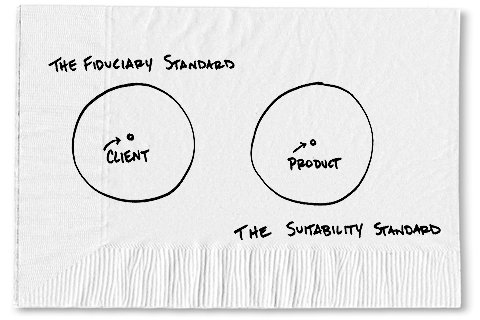

Those who guide individuals on their personal financial decisions generally fall under two categories: those who manage assets acting as a Fiduciary and those who advise clients acting as a Non-Fiduciary. The greatest distinction between these two groups is the incentives behind their guidance. I’ll help clarify what we mean by an analogy.

First, the specifics. Federal law mandates that those acting as fiduciary advisors are required to adhere to the following standards:

- Act with undivided loyalty and good faith

- Avoid taking part in any activities that result in a possible conflict of interest

- Disclose any possible conflicts of interest that might arise during the management process

- Provide full disclosure regarding any advice they may offer

Advisors who act as non-fiduciaries are those who generally earn compensation through commissions from the sale of investment products, life insurance programs or the sale of stocks (stock brokers). Because titles for non-fiduciaries are unregulated, they are free to avoid titles such as broker or insurance agent, and instead are free to adopt titles such as investment advisors, financial planners, or financial consultants. Additionally, these advisors are not regulated by the federal law and its requirements mentioned above.

It is important that investors understand the difference between these two categories and address this when seeking investment advice. Although it is possible for non-fiduciary consultants to provide honest advice, we must never forget they’re generally compensated by the sale of a product and not your financial well-being. This, by nature, provides a favored bias towards particular investment products by non fiduciary consultants that may not be in the clients best interest.

There is a useful analogy HighTower Advisors came up with to help understand the difference between a fiduciary and a non-fiduciary: “you wouldn’t expect your butcher to give objective dietary advice … If you want advice about what to eat, you go to a dietician, and by analogy when you want financial advice, you go to a fiduciary.”

In the analogy, the butcher is acting as a non-fiduciary by advising you on the best diet. As we might suspect, the butcher would probably include a favored bias towards eating cows – and preferably his cows . However, the dietician, acting as a fiduciary, while advising you to include some meat in your diet, would likely encourage you to consume food from other sources as well. The dietician is compensated based upon the continued health of you – the client – where the butcher is compensated upon the sale of his product.

If ever there is a lesson to learn from the world of socio-economics, it’s that incentives matter. If you are interested in running a smooth business or organization, remember that putting the proper incentives in the right places induce the best outcomes. It’s important that we apply this understanding to the world of financial advisors.