April Newsletter – What Risk? Aggressive Investors Rewarded in First Quarter

What Risk? Aggressive Investors Rewarded in First Quarter

Some historical perspective on risk-based returns

Some historical perspective on risk-based returns

The headlines are trumpeting another great quarter of returns for the equity markets. The S&P 500 gained more than 10% in the first three months of this year, in spite of a slowing economy, slowing sales growth for companies worldwide, and a worldwide debt burden that has forced one country to confiscate personal property (in the form of bank accounts) to cover the losses from investments in other bankrupt countries.

So, are we just silly to continue to focus on the unrealized risks in the market? Isn’t it obvious that the markets can only continue to move upward? Why shouldn’t I own more stocks and make more money? You may be asking yourself these very questions.

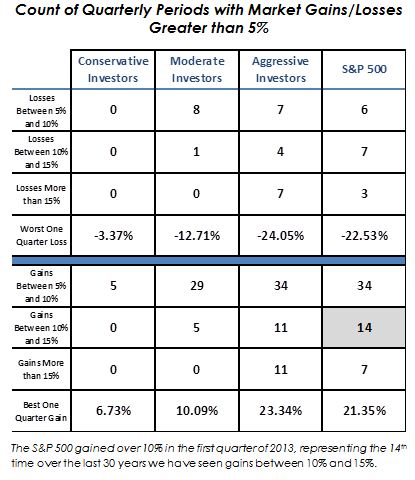

At the right, we present an analysis of market movements over the last thirty years. We look at calendar quarters where market moves, either up or down, have exceed 5%, 10%, or 15%, and break those moves down by the type of investor. We also look at the moves for the U.S. stock market as a whole (represented by the S&P 500).

Aggressive investors have experienced quarterly losses of 15% or more seven times over the last 30 years. Our research shows us the common theme for each of those seven periods is the high price investors are willing to pay for a dollar of corporate earnings. The current market is priced as high as or higher than five of those seven periods, with the only two exceptions occurring during the stock market bubble of the late 1990s. This certainly does not mean that stock markets will not be able to continue the march upward, but the levels of risk we see in world markets is simply too high to ignore.

Corporate Profits Rise to Historic Highs

Special tax circumstances may be the explanation

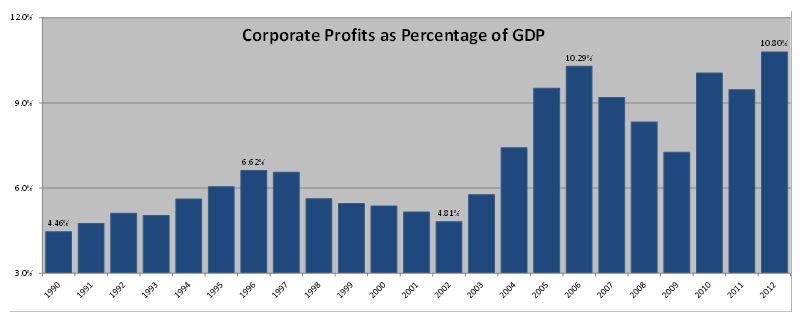

According to data gathered by the Federal Reserve, corporate profits rose sharply during the 4th quarter of 2012, pushing them to all-time highs. While rising a lackluster 0.4% over the first 3 quarters of 2012, in the 4th quarter corporate profits shot up 3.3%. This is a good sign, is it not?

Allow yourself to think back to the end of last year; remember the raucous fight over tax policy, with the scheduled sunset of the Bush tax cuts and upcoming sequestration? Although the exact outcome of the tax battle was unknowable at the time, it was pre-ordained that corporations were going to pay higher tax rates. Additionally, dividend and capital gains income was also going to be taxed at higher rates. This led to an onslaught of year-end corporate financial maneuvering, much of it involving some form of profit-declaring in order to avoid increased taxation in the future.

Earnings estimates for the first and second quarters of 2013 are declining rapidly. It is probable that many analysts are recognizing that corporations pulled profits forward to have them taxed at the lower 2012 rates.

“Financial Capability Month”

And now, as if on cue with an April fool’s joke, our U.S. Government has announced April as “Financial Capability Month.”

Kicking off the festivities for the month, an entire potpourri of gevernment departments will host a webinar entitled, “Starting Early: Financial Preparation for Disasters and Emergencies.”

We have no reason to doubt that they are entirely earnest and sincere; which makes it all the more disconcerting.