October Newsletter – Bond Panic Subsides While the Fed’s Message is Ignored

Bond Panic Subsides, Quietly Says “Nevermind”

And the Fed’s Message Goes Largely Ignored

In May, a rumor that the Fed might be considering reducing their bond purchasing (coined “Tapering”), instigated the worst losses in recent bond market history, as discussed in the September newsletter.

In mid-September, in what was widely described as “a surprise move,” the Fed simply dispelled the rumor, and bond markets responded by returning toward pre-May levels. The May rumors caused massive sell-offs in the bond markets, and much worry on the part of remaining bond investors. Four months later, all that was deemed totally unnecessary, and emotional, short-term investing practices once again were proven to be unwise.

In mid-September, in what was widely described as “a surprise move,” the Fed simply dispelled the rumor, and bond markets responded by returning toward pre-May levels. The May rumors caused massive sell-offs in the bond markets, and much worry on the part of remaining bond investors. Four months later, all that was deemed totally unnecessary, and emotional, short-term investing practices once again were proven to be unwise.

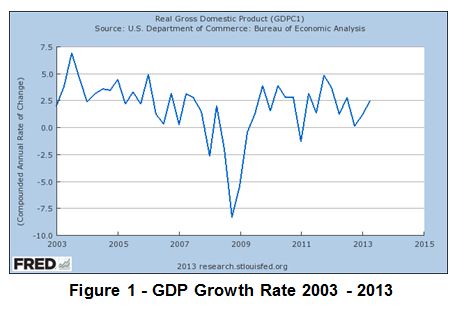

Lost in the noise of the Fed’s decision to not taper is the reason why they are not tapering. The Fed’s bond-purchasing program was originally launched ostensibly to repair the economy and return unemployment to fuller levels. The Fed has decided not to begin tapering because the economy has not responded and unemployment is not improving. In fact, they issued another downward adjustment to their GDP growth forecast for the remainder of this year and into 2014.

Their “no taper” policy is an admission that the zero interest rate policies, intended to improve the economy and reduce unemployment, are not working. Yet they have chosen to double down on their bet and throw more good money after the bad. Do they really believe that after five years of ineffectiveness, a few more months will do the job?

In times such as these, we believe patience is the best investment policy. Your retirement portfolio is a long-term investment. Over time, stock prices are driven by GDP growth, which drives corporate sales and earnings. Lower long-run GDP growth, as we are now seeing, will inevitably lead to lower (we think much lower) stock prices. Moving from bonds into stocks, either out of fear or to chase returns, adds portfolio risk in what is already a high risk environment. Minimizing that risk and protecting client portfolios, remains our top priority.

Another Perspective on Returns

Your retirement portfolio generates investment gains that are comprised of basically two components:

- Realized Returns in the form of dividends and interest (the vast majority of those dollars coming from interest payments made by the bond funds)

- Unrealized Returns in the form of changes in market value (price, or NAV) of all the funds in your portfolio

Realized interest and dividend payments are cash payments made by the mutual funds to your account; those cash payments are then reinvested into the funds through additional share purchases.

Unrealized returns can easily become losses should the risks we see in the markets materialize to even a small extent. In times like these, one of our portfolio management objectives is to reduce your exposure to unrealized losses, and provide overall account growth through the capture of realized gains available from bond and money market investments.

Contributing to Your Retirement Success

There are many variables that help you achieve your retirement goals. Unfortunately, we as investors are not able to control our entire investing fate. With this in mind, we believe that now is a great time to look at one of the variables that we as investors do have control over- Our deferral rates!

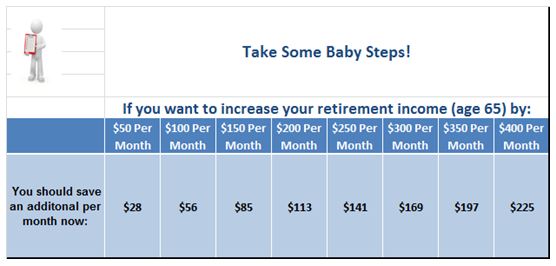

The chart below looks at someone 45 years old and planning to retire at age 65. It shows the impact that saving a little extra money per month could have on retirement income. This person could have an extra $50 dollars a month for 22 years by saving an extra $28 per month now. Increasing contributions by an extra $56 dollars per month could result in $1200 dollars a year in retirement.

Looking Forward

With the fiscal year 2014 beginning Oct. 1st, the month of September concluded with legislative maneuvers that eventually ended in partial shutdown of the government. Here are a few other things to look forward to this month:

- The National debt limit debate will once again be in the forefront of investors’ minds. A similar debate in 2011 led to the first downgrade of US debt.

- The implementation of the Affordable Care Act has begun. People are now able to enroll for Health Insurance on the exchanges set up by the federal government and states.