Posts Tagged ‘401k fiduciary’

Why Is Your 401(k) In Trouble? Because You Don’t Have Time To Read This Post

Our lives are as busy as ever. Family, school activities, committees, church, associations…oh, and that job thing too. These are the days of never really “disconnecting” with laptops, netbooks and smart phones constantly keeping us informed and “connected.”

Additionally, the multitude of responsibilities we are responsible for continues to increase. Your 401(k)? Yeah, that’s one of them. Lack of time is the #1 response people give us when they sign up for our BeManaged or BeAdvised service.

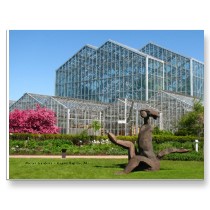

Read MoreAmway Demonstrates Employee Focus via 401(k) Advice and Financial Counseling

Late last year, Amway concluded a three year nationwide due diligence campaign for fiduciary 401(k) advice and hired BeManaged, powered by local firm Actium LLC, which provide professional ongoing account management and investment advice through Amway’s existing 401(k) plan, administered by Fidelity Investments. Over 1,000 Amway employees took advantage of BeManaged’s free 1on1 consultations provided over a 90 day period, which helped them understand what kind of investor they were, and then comparing that with how they were actually invested, and then allowed them to decide if they wanted to utilize BeManaged’s management or advice services.

Read More5 Dumb Investing Mistakes to Avoid

We don’t call anyone dumb, because when it comes to investing, really “smart” people make as many or more mistakes as investing novices. The underlying issue? Our behavior and choices, which are often misguided by emotions. Investment behavior’s impact on investors’ returns have been well documented over the past few years. This is evidenced by the book referenced in article below, Why Smart People Make Big Money Mistakes, as well as by our friends at BehaviorGap.com.

Read MoreW MI Fiduciary Forum Ruffles Feathers of Local Brokers

Last October, we organized the West MI Fiduciary Forum, a follow up to the ’07 Fiduciary Roundtable, a highly successful fiduciary education event that over 70 professionals attended, including 401(k) and 403(b) plan sponsors, investment providers, TPA’s, brokers and advisors. While the name Fiduciary Roundtable has been changed to Fiduciary Forum (Fiduciary RoundTable has been trademarked), the purpose of the event did not.

Read MoreREGULATION: New deadline granted for advice bill

After throwing the early ’09 DoL proposal in the trash, which would have allowed for conflicted advice to be delivered to 401k investors, there is some urgency in getting this done. Fast. And right.

Read MoreWhen is accepting a gift a problem for fiduciaries?

Christmas is upon us, and with that, showing our gratitude to our clients, as well as potentially advisors like us from providers and TPA’s can create potential conflicts of interest. Again, the esoteric term “reasonable” comes into play when determining the cost and scope of a gift.

Read MoreYouTube: 401(k) Fair Disclosure for Retirement Security Act of 2009: Rep. Miller

How picky is picky? Advice regs an unknown – Investment News

A hybrid of these regulatory offerings could be just want investment-advice-hungry 401(k) participants ordered, but we will have to wait and see.

Read MoreGrand Rapids 401(k) Expert is Featured Panelist at ’09 CFDD National Conference

The lingering and wide-reaching impact of the economic crisis and impending financial planning/services industry regulatory overhaul were at the forefront of this year’s fifth annual Center for Due Diligence, or CFDD, National Conference in Scottsdale, Ariz. Chad Griffeth, an Accredited Investment Fiduciary designee from BeManaged | Actium, was among those attending the three-day educational event, focused on lessons learned from the uncertain times, more ways to implement fiduciary practices and what to expect going forward with the current efforts to make rules, regulations and enforcement more consistent and create greater safeguards for investors.

Read MoreWho’s Minding the 401(k)?

A plan’s fiduciaries have the responsibility and duty to conduct ongoing management and oversight of the various moving pieces of a 401(k) plan for the express benefit of the beneficiaries of the plan, the employees investing in it. A critical part of this responsibility is putting in place a prudent process in conducting due diligence on everything from the recordkeeping provider, TPA, investment options, reasonableness of fees, etc. as well as documenting the due diligence process of monitoring these pieces. Unfortunately, most companies do not have such processes in place, as it can be atypical behavior to document every decision.

Read More