Posts Tagged ‘401k tips’

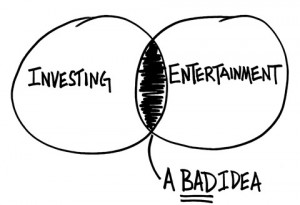

Investing Is Not Entertainment

As you know, we are big fans of the BehaviorGap. Our friend Carl Richards is now being featured in the New York Times website. His latest post there is two minutes of really good advice.

Am I investing to meet my most important financial goals or am I investing as a form of entertainment? For almost all of us, it can’t be both.

Video: Quick and Easy 401(k) Moves

We are a fan of keeping things simple, so when we run across tips on how to do so, we like to make sure we share them with you. The following video is an example of such tips; this one specific to your 401(k) plan.

There is one thing we would like to add to the idea of consolidating your old 401(k)s: If your company has BeManaged available, many of our clients prefer to roll those old 401(k) accounts into their current account to make sure it is managed for them, instead of having to figure out where and what to invest in themselves. Often times they are nearing or already past the capped fee we charge, so there is little to no financial benefit to us, but a big one for our clients.

Read MoreBeManaged February Newsletter – Do January’s Declines Portend the Rest of 2010?

Here are some of the topics discussed in this month’s newsletter from John Whaley, CFA, AIF, the director of our Research Department.

Do Late January Declines Portend the Rest of 2010?

Remember “Earnings Not as Bad as We Thought?”

Contributions Never More Critical Than Today

What Companies and Industries are in Your Portfolio?

5 Dumb Investing Mistakes to Avoid

We don’t call anyone dumb, because when it comes to investing, really “smart” people make as many or more mistakes as investing novices. The underlying issue? Our behavior and choices, which are often misguided by emotions. Investment behavior’s impact on investors’ returns have been well documented over the past few years. This is evidenced by the book referenced in article below, Why Smart People Make Big Money Mistakes, as well as by our friends at BehaviorGap.com.

Read More401(k) Investors: Keep Retirement Planning Simple

The video below is a very concise, simple advice on planning for your retirement by focusing on the KISS principle: Keep It Simple Stupid (I have to remind myself of this all of the time).

Here are some key points covered to focus on:

Save – You are responsible for your own future, do not expect the market’s returns to bail you out.

Understand Yourself – Risk is critical, so if you don’t understand it (most don’t), get some help.

Don’t Chase Returns – It’s a “loser’s game” based on the emotional response we have with this strategy.

401k Investors – Why Many Investors Keep Fooling Themselves

As an investor, understanding what is possible and what is fantasy is very important to understand. One of the biggest fantasies we see in our 1on1 consultations with 401(k) investors are those individuals that have a “return goal” for their account. Thus, they will chase returns throughout their plan, from one fund to another, often missing the actual big returns of that fund.

Read MoreJanuary ’10 Newsletter: A Look Back on 2009

Check out our new newsletter format! John Whaley, CFA, AIF has produced a great amount of information of the year in review and our Research Department’s thoughts on 2010. Some of the topics covered include:

All Winners, No Losers for the Year

A Look Back at our Thoughts in 2009

What Exactly is Irrational Exuberance?

Interest Rates Spike to End 2009

Growth Stocks Outperform Value in 2009

2010 Earnings to Remain Below Trend; Valuations Remain Historically High

401(k) Investors – 2010 Contribution Limits and Savings Tips

Every year, the IRS sets specific limits on how much money 401(k) investors can stuff away into their retirement account. In 2010, there are no changes from 2009, as you can see below:

Read MoreSlow & Steady: Winning the Investment Race – BehaviorGap.com

Our friend Carl Richards of BehaviorGap.com is a talented writer and communicator when it comes to investing concepts and the impact of behavior on investment performance. We can all identify with the concept of looking for the next hot investment versus a risk appropriate, savings-based approach to the retirement marathon. Which one are you?

Read MoreDecember ’09 Newsletter: Market Gains Continue Through November – Will They Hold?

Market gains continue through November – will they hold? Domestic stocks rose by 6% in November, the eighth monthly rise in the last nine. Foreign stocks gained 2%, and are up almost 30% for the year. Government policies have forced…

Read More