Posts Tagged ‘personal finance’

September Newsletter – Should You Move Your Money Out of Bonds?

Should You Move Your Money Out of Bonds? In the last four months we have seen some of the worst bond performance in history, and the volatility and potential downside has been a cause for concern for many of our clients. Figure 1 shows the performance of a typical US Bond Index Fund used in…

Read MoreAugust Newsletter – U.S. Equity Funds See Highest-Ever Inflows in July

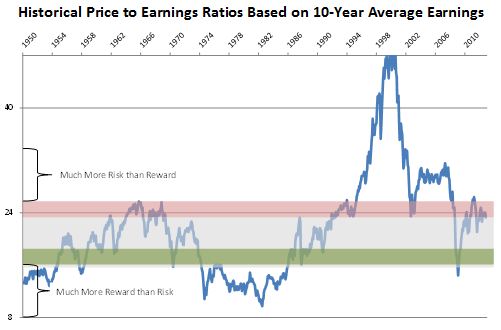

U.S. Equity Funds See Highest-Ever Inflows in July Bubbles, Bubbles, Bubbles Stock valuations (the price you pay to own a share of a company stock) have reached silly extremes with July’s market gains. Meanwhile, bond prices fell during the summer, with some bond funds suffering their worst three month period in recent history. How do…

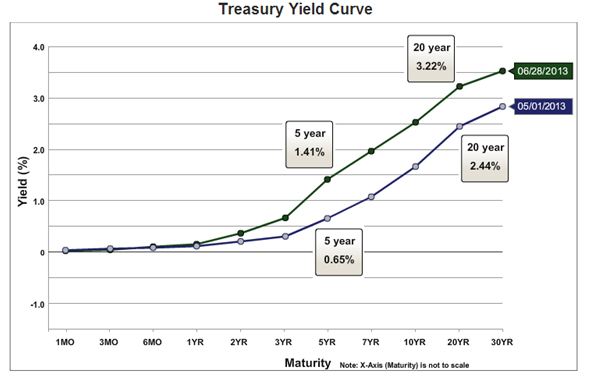

Read MoreJuly Newsletter – Second Quarter Ends with a Whimper

Second Quarter Ends with a Whimper Balanced Portfolio Returns Hindered by Rising Interest Rates, Poor Foreign Stock Performance Stock markets around the world took a turn for the worse after Ben Bernanke’s May 22nd testimony to Congress gave very subtle hints that the Federal Reserve might consider a gradual slowing of the $85 billion dollar…

Read MoreJune Newsletter – Prices Paid for U.S. Stocks Continue to Balloon

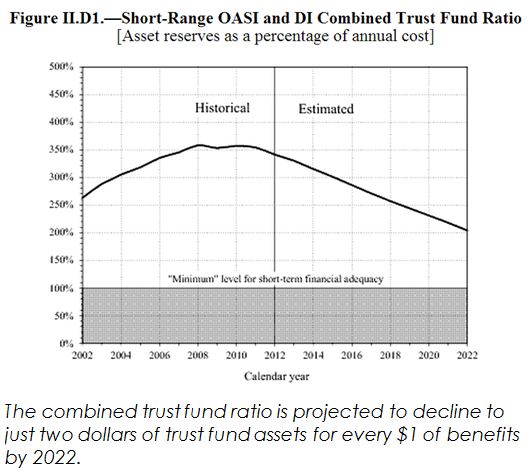

Social Security Trustees Report on Fund Status Disability Insurance “Trust Fund” projected to deplete in 2016 Old-Age and Survivors Insurance and Federal Disability Insurance (commonly referred to as Social Security) is providing benefit payments to about 40 million retired workers, 6 million survivors of deceased workers and 11 million disabled workers and dependents of disabled…

Read More9 Things You Should Know About Social Security

A very good article about Social Security was posted at money.usnews.com that provides a great summary for individuals. The following are some key highlights direct from USNews.com: You contribute 6.2% of your income: Workers pay 6.2 percent of their earnings into the Social Security system, up to $113,700 in 2013. Employers pay a matching 6.2 percent for…

Read More2013 401k Contribution Limits Increase Slightly

Today the IRS posted the 2013 retirement plan limits, and there are a few increases from 2012. The new limits are as follows: Elective Deferrals for 401k/403b/457: $17,500 (increased from $17,000 in 2012) Catch-Up Contributions for 401k/403b/457: $5,500 (no change) Annual Compensation: $255,000 (increased from $250,000 in 2012) Annual Additions Limit for Defined Contribution Plans: $51,000…

Read MoreVideo: Financial Goals Should be Written in Pencil, Not Pen

Our friend Carl Richards of BehaviorGap.com recently posted a video titled, “Do Your Goals Have Too Much Power,” which you can view via the link below. He makes a point similar to a recommendation of one of my favorite radio personalities, Colin Cowherd, makes: When outlining your life, use a pencil, not a pen. I…

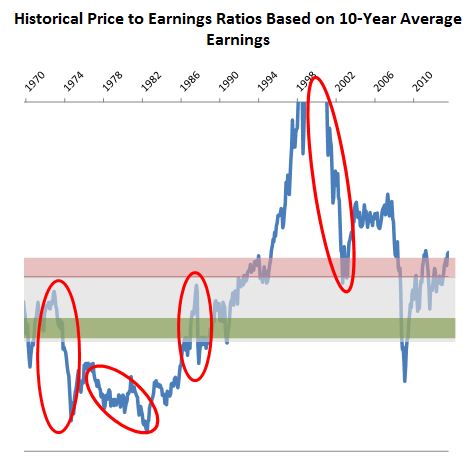

Read MoreA Mountain Climber’s Perspective on Risk

Imagine you’re a mountaineer about to scale the face of El Capitan in Yosemite National Park. As you hike to the bottom of the face your level of risk to injury is relatively low. You might trip and fall on your hike but any injury is nonetheless negligible. In this situation, your exposure to downside…

Read More7 Lies We Tell Ourselves About Saving Money (Video)

Recently, I have had some interesting conversations that centered around how we talk ourselves out of saving money. Simply put, we tell ourselves little lies we make up in our head. We end up talking about how we spend money, as if we manage that, saving it is easy. Let’s face it, it’s much more…

Read MoreIRS Contribution Limits for 2012

Today the IRS posted the 2012 retirement plan limits, and for the first time since 2009, they are increasing! The new limits are as follows: Elective Deferrals for 401k/403b/457: $17,000 (increased from $16,500 in 2011) Catch-Up Contributions for 401k/403b/457: Remains at $5,500 Annual Compensation: $250,000 (increased from $245,000 in 2011) Annual Additions Limit for Defined Contribution…

Read More