March Newsletter – 10 Rules of Investing

A Look at Income Composition and Trends for Older Households

Information in this article comes from the Employee Benefit Research Institute, Brief #383; February, 2013

Information in this article comes from the Employee Benefit Research Institute, Brief #383; February, 2013

The Employee Benefit Research Institute released findings from an examination of the income patterns of older U.S. households. Among the findings:

• In 2009, households ages 65–74 and households with members age 85 or above received 54 percent and 66 percent of their total household incomes, respectively, from Social Security benefits.

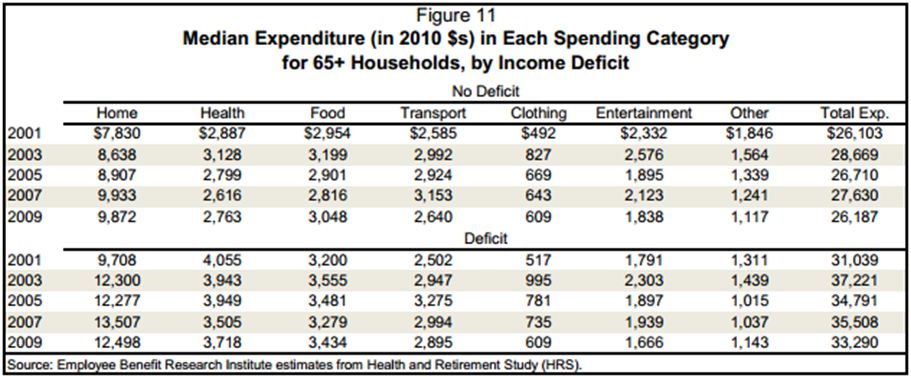

• In 2009, two-fifths of households with members age 65 and above had incomes less than their expenditures—meaning they had deficits. That percentage is down significantly from 2001, when over 55% of households had incomes lower than expenditures

• In 2009, 14.3 percent of households with members age 65 and above had spending that exceeded 175 percent of their household incomes.

Not surprisingly, those households who have prepared for retirement through savings in 401(k) and other tax-deferred accounts fare much better in retirement. For example, a retirement portfolio worth $600,000 today for a person aged 65 would put the household above the median retirement income level when combined with Social Security.

Keep in mind that this assumes a retirement at age 65. If you are considering an earlier retirement date, you need to work towards higher retirement balances because you must spread those balances over a longer period of time. If, for example, you have a target retirement age of 60 in mind, your portfolio will probably need to be over $750,000 to meet the higher income requirements in the early years (before Social Security is available) and your longer span of retirement years.

Keep in mind that this assumes a retirement at age 65. If you are considering an earlier retirement date, you need to work towards higher retirement balances because you must spread those balances over a longer period of time. If, for example, you have a target retirement age of 60 in mind, your portfolio will probably need to be over $750,000 to meet the higher income requirements in the early years (before Social Security is available) and your longer span of retirement years.

We are always ready to help you review your progress toward retirement. Just give us a call!

Ten Rules of Investing

Wisdom derived from fifty years of experience

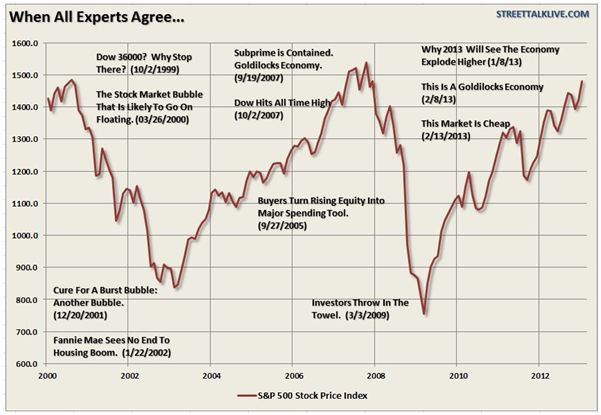

Bob Farrell began an investment career after receiving his master’s degree from Columbia in 1957. Over fifty years of technical and fundamental analysis work led to a list of ten rules of investing, a list recently discussed in Lance Robert’s column (www.streettalkadvisors.com, Tuesday, February 19th:

1. Markets tend to return to the average price over time.

2. Excesses in one direction will lead to an opposite excess in the other direction.

3. There are no new eras – excesses are never permanent.

4. Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways

5. The public buys the most at the top and the least at the bottom.

6. Fear and greed are stronger than long-term resolve.

7. Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.

8. Bear markets have three stages – sharp down, reflexive rebound and a drawn-out fundamental downtrend

9. When all the experts and forecasts agree – something else is going to happen.

10. Bull markets are more fun than bear markets.

Lance Robert’s conclusion?

“Individuals are long term investors only as long as the markets are rising. Despite endless warnings, repeated suggestions and outright recommendations – getting investors to sell, take profits and manage your portfolio risks is nearly a lost cause as long as the markets are rising. Unfortunately, by the time the fear, desperation or panic stages are reached it is far too late to act and I will only be able to say that I warned you.”