July Newsletter – Second Quarter Ends with a Whimper

Second Quarter Ends with a Whimper

Balanced Portfolio Returns Hindered by Rising Interest Rates, Poor Foreign Stock Performance

Stock markets around the world took a turn for the worse after Ben Bernanke’s May 22nd testimony to Congress gave very subtle hints that the Federal Reserve might consider a gradual slowing of the $85 billion dollar per month money printing spree that has driven the markets in 2013.

U.S. company stocks have fallen 3.3% since that time. Foreign stocks have fared worse, declining almost 8%. The Dow Jones Moderate Portfolio Index, a measure of market returns for accounts that accept the risk of 60% of the world equity markets, dropped by 3.8%, losing just short of half of the gains enjoyed earlier this year.

We believe there is much more to this decline than just the nervous reactions of the casino-style investors who are betting on continued money printing. The prices we are paying for stocks cannot be justified by the long-term stream of earnings and dividends companies can generate. Analysts covering the companies that make up the S&P 500 are barking out expected earnings growth rates of 12% or more for the next two years, despite the fact that sales growth for these firms remain in the very low single digits and real economic growth remains well below long term levels.

Remember, investment markets can be driven well above their fundamental value by factors such as money printing, excess investor enthusiasm, or market wide technical momentum. In fact, those are the factors that brought us to today’s high market prices.

Those charged with the prudent investment of client funds, and, who take the challenge seriously, never forget the fundamental nature of the deal – and manage the risk levels of our portfolios appropriately. This investment environment continues to be one where a reduced level of risk makes the most sense.

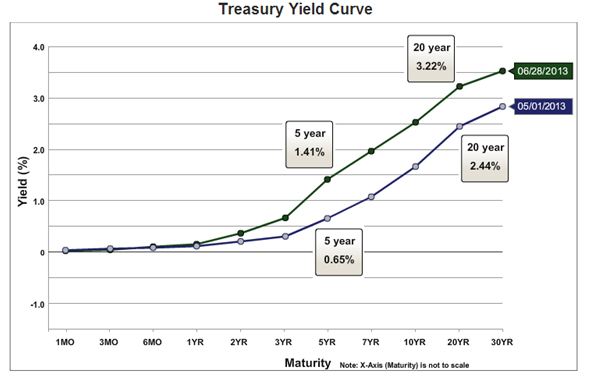

Interest Rate Spikes and Bond Returns

Interest rates rose rapidly over the last two months, driven by comments from various Federal Reserve officials about the state of our economy. Money market and stable value funds retain their value during periods of rising rates, but bond funds that hold longer term obligations drop in value – during this period, 3% or more.

Bond funds saw record absolute redemptions of $23 billion in the latest week. In percent of asset terms, the rate of redemptions is second only to those witnessed in the third and fourth quarters of 2008.

Bond funds saw record absolute redemptions of $23 billion in the latest week. In percent of asset terms, the rate of redemptions is second only to those witnessed in the third and fourth quarters of 2008.

We need to keep in mind that the 2008 decline in bond fund prices through the end of October was followed by a 7.8% positive return over the next ten weeks, through mid-January, 2009. So, those who made the decision abandon their bond investments at that time missed out on the subsequent increase.

Our focus for the bond fund portion of client portfolios remains as follows:

- Primary emphasis on higher quality funds that have demonstrated some measure of downside protection in the past

- Limited exposure to funds that emphasize longer-term maturities

- Avoidance of the use of low quality, high yield funds

Does This Inspire Confidence in the Financial Markets?

Punch Bowls and Liquor Holding up Asset Prices?

Below are comments from Federal Reserve Bank of Richmond President Jeffrey Lacker. Presented without comment….

“[O]ver the course of the next 12 months, the Committee will be reducing only the pace at which it is adding accommodation. In other words, the Federal Reserve is not only leaving the punch bowl in place, we’re continuing to spike the punch, though at a decreasing rate over the next year….

I seriously doubt additional monetary stimulus can provide much impetus to real growth right now. But further stimulus does increase the size of our balance sheet and correspondingly increases the risks associated with the “exit process” when it becomes time to withdraw stimulus. That is why I have not supported the current asset purchase program…

Bond and stock markets fell sharply in response, but that should not be too surprising. The Chairman’s statement forced financial market participants to re-evaluate the likely total amount of securities the Fed would buy under this open-ended purchase plan — in other words, how much liquor would ultimately be poured into the punch bowl.

Market participants also had to reconsider their estimate of when the Federal Reserve would begin to remove the punch bowl by raising interest rates. These reassessments appear to have warranted price changes across an array of financial assets. As market participants gain additional insight from the words of Federal Reserve officials or by policy actions in coming quarters, further asset price volatility seems likely.

“Are Your Current Investment Choices Appropriate for Your Age?”

Age Is Only One of Many Factors in Managing Your Portfolio

Many of you have heard from your 401k platform provider warning you that your portfolio’s asset allocation does not match that which is needed for your age. This may have come in the form of an email, a phone call, a letter, or a blurb in your online account.

If you are a BeManaged client, you can be confident that your asset allocation has been set according to your personal risk tolerance, which includes much more than simply calculating your age and assuming your planned retirement date.

We also focus on your tolerance for risk over the short and long term and current market conditions. We have many “older” clients who prefer aggressive portfolios, and “younger” participants who are content with slow and steady progress.

Additionally, we make strategic adjustments to the risk in your portfolio depending upon the current market environment, such as you see in your portfolio now.