Are You an Investor or a Collector?

Our friend Carl Richards of BehaviorGap.com and the NYTimes.com Bucks blog just wrote an article illustrating how the ‘over diversification’ of portfolios can simply be ‘buying more’ instead of ‘buying different.’ Take a look:

Our friend Carl Richards of BehaviorGap.com and the NYTimes.com Bucks blog just wrote an article illustrating how the ‘over diversification’ of portfolios can simply be ‘buying more’ instead of ‘buying different.’ Take a look:

Over- or under-diversifying your investments remains one of the classic behavioral mistakes.

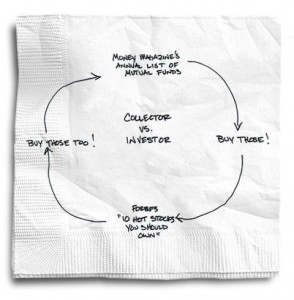

Over-diversification happens when we become collectors of investments instead of simply being investors. Think of the people who buy the mutual funds they read about in Smart Money magazine. Next year they buy the Top 10 Funds recommended by Money magazine. A year later they buy two or three new international funds because that’s what’s on the home page of Forbes.

Before they know it, they have a smorgasbord of unrelated investments, with no cohesive strategy at work. Then there are all of the taxes and transaction costs — and the impact on your life of having to keep track of it all.

For anyone with a portfolio that looks like this, consider a relatively simple suggestion: Each individual component of a portfolio should be there for a reason. Think of each investment that you own as a thread in a larger tapestry.

Being under-diversified is an equally troublesome problem. Under-diversification can take the form of owning only a single stock, or too much of one. For instance, maybe you work at Apple, and you’re convinced that Apple stock can only go up, so you put your life savings into Apple stock. We’ve seen why this choice can be a bad idea; ask anyone who had a lot of stock in A.I.G., Enron, Wachovia or Lehman Brothers.

Many people now know better than to put too much money into a single stock. But I still often meet people who own a number of mutual funds and believe they’re properly diversified. The reality is that fund overlap can leave you heavily invested in a relatively small number of individual stocks.

This happens because many mutual fund managers have similar ideas, or they create funds based on what’s popular at the time. If you look carefully at many of the largest mutual funds (the ones people are most likely to buy), they have significant overlap among the top 10 stock holdings.

Whether you’re under- or over-diversified, you are probably only doing what you thought you were supposed to do. You’ve spent a lot of energy, time and even money trying to pick the right investments. Unfortunately your efforts may have created the exact opposite of what you wanted to accomplish.

Remember, you’re not a collector. You’re an investor. You want stocks (or funds) that get you closer to the financial goals you’ve set for yourself. You also need to make sure that what you own doesn’t expose you to greater risk than you can handle, again based on your goals.

The end result should be a portfolio that reflects those goals, not the collection of magazines on your coffee table.

Isn’t diversification just a fancy word that investors made up to make losses seem normal? I mean really what you are saying is, “you are going to lose money if you invest, but we are going to try to just lose ‘less’ money.”