Posts by Jay Jandasek

Why There Are No ‘Best’ Investments – BehaviorGap @ NYTimes

As you know, our friend Carl Richards is a writer for NYTimes.com. We have definitely encountered people trying to find the “silver bullet” investment that will magically create huge gains for their 401(k). Unfortunately, this typically results in some really outlandish investment “strategies” and chasing the performance of the “best fund.” The cost of those decisions to their nest egg is tremendous. The following is Carl’s most recent post, and I won’t try to water it down with a summary, for I think every investor should read it.

Read MoreVideo: Jason Roberts on 401(k) Fee Disclosure 408(b)2 Regulations

Our friend Jason Roberts of Reish and Reicher was recently interviewed on Dow Jones NewsWires regarding the proposed 408(b)2 regulations (fee disclosures/conflicts of interest), and what they mean for both employers and 401(k) advisors.

Read MoreBeManaged April ’10 Newsletter – Stocks Accelerate and the Use of Bonds/Money Markets in Your 401(k)

The following are some of the topics discussed in this month’s newsletter from John Whaley, CFA, AIF, the Director of our Research Department.

Stock Gains Accelerate in March

Trends in Savings and Investments Among Workers

Use of Stable Value/Money Market Funds and Bond Funds in Your Retirement Portfolio

A Model for 401(k) Advice, Pt. 2 – Must be Ongoing

A fiduciary relationship is one which is ongoing, in which the fiduciary is responsible for conducting ongoing due diligence on the various provisions for which they are responsible. A company fiduciary is charged with the responsibility of ongoing due diligence of the various fees, investment options, and vendor capabilities of the plan for the benefit of the participants. An ERISA fiduciary, regardless of the “flavor,” is hired to provide ongoing advice to the employer specific to investment due diligence and advice, vendor benchmarking, etc. Both of these more traditional fiduciary roles are ongoing relationships. Why isn’t employee fiduciary advice?

Read MoreFiduciary360 on Fox Business Regarding Financial Regulation

Our friend Blaine Aikin of Fiduciary360 was featured today on Fox Business regarding Senator Dodd’s financial regulation bill. While the bill is not all it could be, it is viewed as a step in the right direction by Blaine.

Read More401(k) Investors’ Achilles Heel #2: Goal-Based Investing – Good or Bad?

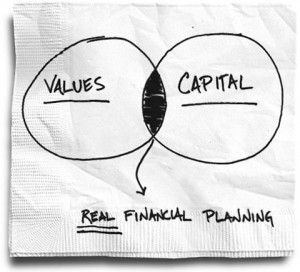

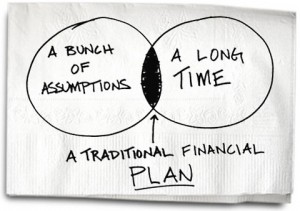

This month, our team has conducted dozens of 1-on-1 consultations. During these consultations, we walk the 401(k) investor through an investor questionnaire that takes into account their age, time horizon for accessing their 401(k) assets, and their risk tolerance. During this review of their account, we consistently run into investors who have an expectation of what they need to achieve from a performance standpoint in order to meet their goals. Just as I was considering this, Carl Richards wrote an article (click the napkin to read) specific to whether financial plans are worth the paper they are drawn up on.

Read More401(k) Investor Achilles Heel #1: Overconfidence

From time to time, all of us think we know what we are doing when clearly we do not, but it is not until we are proven wrong that we come to realize it. For me, it’s home repair. I know it’s not my strong suit, but my “man” button keeps blinding me to that fact until I am calling the repairman to fix the original problem and everything additional that I destroyed, broke, etc.

That, my friends, is humility. And humility is good for all of us. When it comes to investing, such overconfidence in our abilities can be extremely costly. In fact, the larger the balance of your 401(k), the more costly mistakes can be to you.

Read More18 Minutes on the New DoL 401(k) Advice Proposal

Our friend Jason Roberts, Partner at Reish and Reicher, has been closely monitoring the regulatory developments of 401(k) advice since the passage of the Pension Protection Act of ’06. The link below provides a brief, yet detailed overview of the regulations and what employers and advisors should take into consideration when it comes to the advice 401(k) investors receive. It is definitely worth the time.

Read MoreNew on LinkedIn: The 401(k) Fiduciary Advice Group

LinkedIn has been something I have been active on for over two years. It’s Groups feature has helped it evolve into a resource in which busy professionals can learn or get free guidance and feedback on various topics of interest. Personally, our company has benefited from other’s experience and expertise to the tune of saving thousands of dollars on various projects.

That being said, with the recent developments in 401(k) advice, we decided to create a group to help keep employers and advisors apprised of the regulatory and market developments that result from the clarifications. We launched the 401(k) Fiduciary Advice Group on Wednesday morning, and since then, there have been over 70 employers and 401(k) industry professionals join. Interested? Simply click the link below to join.

Read MoreBeManaged March ’10 Newsletter – The Advancing US Dollar and Your 401(k)

The following are some of the topics discussed in this month’s newsletter from John Whaley, CFA, AIF, the Director of our Research Department.

Advancing US Dollar Translates to Declining Foreign Stock Returns

Mutual Fund Fees and the Impact on Your Acccount

How Does Your 401(k) Account Growth Compare?