401(k) Investors’ Achilles Heel #2: Goal-Based Investing – Good or Bad?

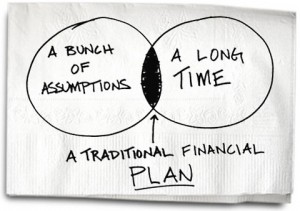

This month, our team has conducted dozens of 1-on-1 consultations. During these consultations, we walk the 401(k) investor through an investor questionnaire that takes into account their age, time horizon for accessing their 401(k) assets, and their risk tolerance. During this review of their account, we consistently run into investors who have an expectation of what they need to achieve from a performance standpoint in order to meet their goals. Just as I was considering this, Carl Richards wrote an article (click the napkin to read) specific to whether financial plans are worth the paper they are drawn up on.

This month, our team has conducted dozens of 1-on-1 consultations. During these consultations, we walk the 401(k) investor through an investor questionnaire that takes into account their age, time horizon for accessing their 401(k) assets, and their risk tolerance. During this review of their account, we consistently run into investors who have an expectation of what they need to achieve from a performance standpoint in order to meet their goals. Just as I was considering this, Carl Richards wrote an article (click the napkin to read) specific to whether financial plans are worth the paper they are drawn up on.

The following is an example of some of the things we hear:

“I think that I can consistently get 8%, but if I work with someone that knows what they are doing, I think I should be able to get12%.”

“I need to get to $XXX,XXX in order to meet my goal for my 401(k).”

Right. For the next 10 minutes, we had to discuss how such a scenario would likely have to work.

Us: “Would you agree that no one knows where the market is going to close at the end of the week, month or year?”

Investor: “Yeah…”

Us: “So let’s say it’s the end of June, and your account is -4% for the year. What would you have to do in order to produce the 16% turnaround to get to a +12%?

Investor: No response

Us: “Would you agree that you would likely have to take on more risk in order to generate that return?”

Investor: “That makes sense”

Us: “By increasing that risk from where you want to be, that is an absolute bet that the market is going to be positive from July 1st – December 31st. What would happen if the market drops 10% across the board?”

Investor: Silently waiting for me to answer my question…

Us: “If you increased your risk in order to achieve your goal of 12%, you could likely lose a lot more than the 10% that the market dropped, right?”

Investor: (Nodding…)

Us: “So it’s fair to say that since we cannot control performance, we should instead focus on controlling what we can, specifically risk?”

Investor: “That makes sense.”

The conversation above has happened so many times, it leads me to believe that financial “plans” can be very deceiving when it comes to the reality of investing. It has really made me call into question the true value of financial plans if it leads people to have misconstrued beliefs that lead them toward making poor decisions. For example, if someone has a goal of $X when they retire, they might want to increase their risk 3 years before retirement. Well that’s great when someone is absolutely positive the market will be positive during that time period, but what if it is not? Is that investor willing to pay the price of that increased risk?

I appreciate goals, I do. However, truly helping investors includes clear, concise communication, articulating a plan of action that is within their ability to control, not creating a pipe dream in order to sell products.

Unfortunately, their “number” and projections of performance can lead investors to make decisions which fly in the face of prudent investment principles. Like the saying goes, if you want to make God laugh, make a plan.

Instead, I think the following can be a very simple plan that works for 98% of people:

- Be a Saver – Save as much as you can afford, then work to save more.

- Manage Risk – No one knows where the market will close at the end of the week, month or year. If they tell you they can, run in the opposite direction. Fast. No one can control the market, but you can control risk in your portfolio.

- Be Aware of Greed, Fear and Overconfidence in Your Investment Decisions – People are funny about their money. Emotional attachments to specific investments, buying high, selling low, and assuming you understand how much risk exists in your portfolio without an independent assessment are recipes for 401(k) failure.

We would welcome your feedback via the Comments section below.

This is a great post. Investor behavior and expectations are still rooted in 1990’s market returns. Quite honestly I am happy with 6% and re-balance my mix periodically al a David Swensen.