BeManaged December Newsletter – Unemployment Rate Voodoo and Retirees’ Financial Health

Unemployment Rate Voodoo

Producers Continue to Leave the Labor Force

The announcement of a decline in the nation’s unemployment rate from 9.0% to 8.6% was treated gleefully in news headlines. Unfortunately, there is more to the story.

The announcement of a decline in the nation’s unemployment rate from 9.0% to 8.6% was treated gleefully in news headlines. Unfortunately, there is more to the story.

Over the past 60+ years, the number of people who are participating in the labor force grows an average of 4% – 5% every three years. Over the last three years, however, the civilian labor force has declined. This is the first decline over a three year period since statistics were first gathered in 1948.

If labor force participation rates grew at near normal levels from 2008 to the present, the calculated unemployment rate would probably exceed 13%.

Labor force growth affects economic growth, which eventually affects stock market prices. Caution remains the prudent course.

Housing Inventories Continue to Drop

This is a good thing!

Residential real estate values may have the largest single impact on the health of the United States consumer and the economy as a whole. Consumer spending typically represents two-thirds of total U.S. production; the wealth effect of rising (or falling) home prices weighs heavily on consumer attitudes.

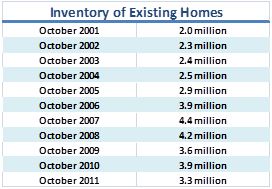

According to the National Association of Realtors (NAR), inventories of existing homes continue to slide, though at a snail’s pace. As inventories fall, prices may begin to stabilize. Price stability in the housing market will attract investment from those seeking exposure to the tangible asset.

Although we are nowhere near the long term historical average for housing inventories, it is, among other things, an encouraging sign that we are inching ever closer to a balanced inventory. We should applaud this drop in inventory as a sign of continued digestion by the market of its former housing binge.

Retirees’ Financial Health

A Snaphot

There is no question the financial upheaval in recent years has impacted the behavior of investors across the board. From private equity funds to retirement investing, strategies have changed to accommodate the ever evolving financial landscape.

In a study conducted by the Society of Actuaries (SOA), LIMRA, and the International Foundation for Retirement Education (InFRE), individual retirees were questioned in three consecutive surveys to gauge the degree to which the financial crisis has affected their investment behavior. The survey was issued prior to the financial crisis of 2008, in April of 2009, and again in the summer of 2011, and as a result it captured the change in sentiment during these unique times.

The results of this study show a recovery in the level of confidence retirees have in regards to the amount of savings accrued for comfortable retirement living. Only 25% of retirees polled in 2009 were “very confident” they had enough money to live comfortably along with 54% who were “somewhat confident.” In 2011, the percentage of those who were “very confident” rose to 31% as well as 54% for those who are “somewhat confident.”

Perhaps the most encouraging among the changes in retiree behavior is the drop in the amount of household debt. Roughly 35% more households claim to hold absolutely no debt at all as a result of the ongoing financial crises. This data bodes well for a healthier consumer base in our consumer driven economy.

To conclude the study, retirement investors continue to remove risk from the table. Few can question the motivation behind such a trend as “risk” has become an exceptional foe to stable returns as of late. However, confidence levels are up among retirees and as a result we would expect to see spending levels creep back to pre-recession levels.

Nonetheless, a more conservative approach to retirement finances should help cushion retirees from financial losses in the event of a second recession. It is encouraging to see proactive measures being taken to combat future uncertainty.