March Newsletter – Earnings Estimates Dropping

February Market Returns

Good news for aggressive investors

Aggressive investors were rewarded in the month of February with the Dow Jones Aggressive benchmark returning 4.63% on investor capital. The S&P 500 index, the broadest and most comprehensive measure of U.S. equities, returned 4.32%. International investors did equally a well with the Morgan Stanley Capital International index returning 5.74% for investors in the month of February.

Aggressive investors were rewarded in the month of February with the Dow Jones Aggressive benchmark returning 4.63% on investor capital. The S&P 500 index, the broadest and most comprehensive measure of U.S. equities, returned 4.32%. International investors did equally a well with the Morgan Stanley Capital International index returning 5.74% for investors in the month of February.

The Now: Among other things, the apparent resolution to Greece’s debt problem seems to have propped up equities around the world. However, we are skeptical these solutions will yield long term growth in value. It will be many years before the outcome in Europe is truly understood and realized.

The Future: Tensions in the Middle East will continue adding pressure to oil prices. As oil prices rise, so too does the price we pay at the pump. If tensions continue escalating, we may see prices on a national average reaching $5 per gallon of gasoline. These developments may add price volatility in the equity markets for the months ahead.

Earnings Estimates Dropping

Negative momentum ignored by market……so far

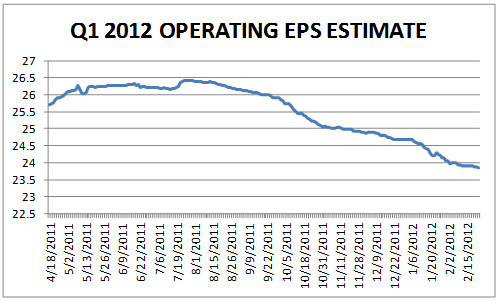

Analyst guesstimates of earnings for the first quarter of this year have fallen 10% from the peak estimate made in early July. This decline is largely ignored in today’s financial press, yet trends like this are often an indication of future market direction.

* Source: Howard Silverblatt, Standard and Poor’s (www.marketattributes.standardandpoors.com)

The Apple Effect

Largest U.S. firm may be creating a skewed picture of reality

Apple Inc. – the maker of everyone’s favorite consumer electronic gadgets. If you haven’t noticed, the Cupertino based Apple Inc. is now the largest company in the United States with a total market capitalization hovering around half a trillion dollars. To help put this in perspective, Apple is now larger than Google, Intel and Amazon combined!

As Americans, we celebrate the success of companies like Apple; however, as investors we must be weary of its effect on the market’s overall performance. In a recent article published in the Wall Street Journal, authors Jonathan Cheng and Brendan Intindola highlight the affect Apple is currently having on the major market indexes. For example:

• The S&P 500’s (the U.S.’s 500 largest public companies by market capitalization) earnings are on track to post a year-over-year rise of 6.8% growth in the fourth quarter of 2011. However, factor out Apple, and the year-over-year rise in earnings falls to a meager 2.8%, according to UBS.

• Year-over-year growth in profit margins (the percentage of every dollar a company makes in profit after subtracting expenses and taxes) in the S&P 500 was 0.05% in the fourth quarter of 2011. Remove Apple from the equation, and we’re left with a decline of 0.22%.

Although you might argue that Apple’s success is a positive sign of economic health, after all, the wealth created by Apple is returning to its shareholders. However, it’s important to remember that Apple’s success does not represent a broader market trend. Instead, it represents a company that has been exceptionally successful in an exceptionally difficult environment.

The Current State of Private Investment

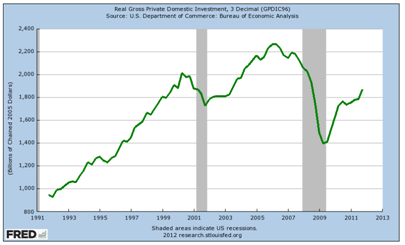

Gross private domestic investment provides us with a snapshot of investment spending outside of the government sector. The inflation adjusted peak for this measure occurred in the first quarter of 2006 ($2.26 trillion).

Gross private domestic investment provides us with a snapshot of investment spending outside of the government sector. The inflation adjusted peak for this measure occurred in the first quarter of 2006 ($2.26 trillion).

This measure fell to $1.39 trillion in the second quarter of 2009, and has partially recovered to $1.87 trillion in the fourth quarter of 2011. Still, that level is 18% below the 2006 highs.

Private domestic investment represents less than 14% of our total gross domestic product currently; well below the most recent peak (17.2%) reached in 2005 and 2006.