October Newsletter – 2012: A Profitable Year or is There Trouble Around the Corner?

Will the Fourth Quarter Finish off a Profitable Investment Year? – Or is Trouble Around the Corner?

Four straight months of positive returns for the S&P 500 have elevated stock prices to near-peak levels for 2012.

Four straight months of positive returns for the S&P 500 have elevated stock prices to near-peak levels for 2012.

Large cap stocks in the United Stated gained 2.6% last month, and smaller companies gained over 3%. A five percent decline in the U.S. Dollar index from late July’s highs led to a 3.8% gain in global stocks during September.

Moderately aggressive and aggressive investors will open their third quarter 401(k) statements and find high single digit gains, or even double digit gains, for the first nine months of this year. When retirement projections rely on returns of 5% – 6% per year, we start to feel pretty good about the progress our accounts have made in 2012.

Under no circumstances can we get complacent about the remainder of the year, especially with the presidential election looming. Let’s remind ourselves of some economic fundamentals that are creating excess market risk currently:

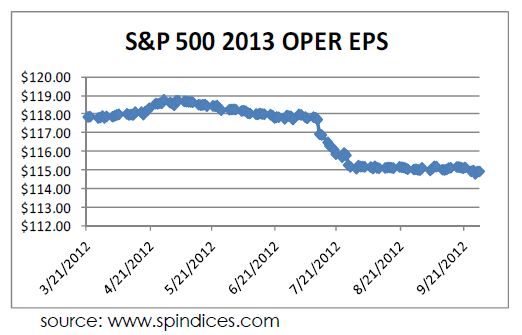

- Corporate earnings growth has declined in 2012 and 2013 estimates continue to fall. Analysts, on average, were about 8% – 10% too high coming into this year and first quarter 2013 estimates are dropping quickly.

- European economies have either slipped into a recession or are at near-recession growth rates.

- Unless there are significant legislative changes before the end of the year, a number of tax increases, including several relation to the Affordable Care Act, will place further burden on businesses of all sizes.

Current economic conditions have created an environment where high levels of market volatility are very likely. Positively perceived events could propel our portfolios to another successful year and significant progress toward our retirement goals. Conversely, any recognition of fundamental deterioration by market participants could lead to a rapid reversal in stock prices and a loss of most of this year’s gains.

What do Businesses Feel?

A recent poll released by the National Association of Manufacturers found that 67% of small business owners say there is too much uncertainty in the market today to expand, grow or hire new workers.

69% of small business owners and manufacturers say regulatory policies have hurt American small businesses and manufacturers.

55% say they would not start a business today given what they know now and in the current environment.

Age-Based Savings Guidelines Issued by Fidelity

Are you ready to work to age 67?

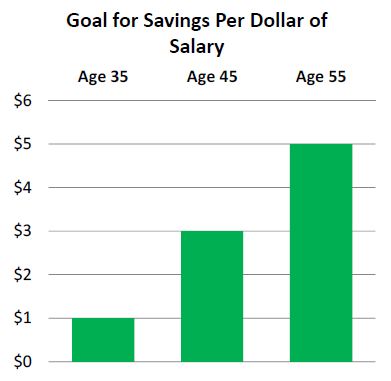

Fidelity Investments has released a set of interim and final targets for retirement savings as a multiple of your final year’s salary.

The study provides some tools for younger employees to gauge their progress as they move forward in their careers, including savings goals at age 35, 45 and 55.Fidelity estimates you should be able to replace 85% of your pre-retirement income at age 67 with assets equal to 8 times your ending salary. [By comparison, we have relied on estimated on a multiple of 11 to 12 times ending salary at the age of 65].

Meeting those targets will require a regular savings rate starting at 9% at age 25 and progressing to 15% (including company contributions) by the early 30s.

“The two factors that have the greatest impact on retirement savings over time are starting early and saving consistently,” said James M. MacDonald, President, Workplace Investing, Fidelity Investments.

The calculation assumes a lifetime hypothetical average annual portfolio growth rate of 5.5%.

CFA Institute Integrity List:

50 Ways to Restore Trust in the Investment Industry

Following the 2008 financial crisis, and on the occasion of the Chartered Financial Analyst Institute’s 50th Anniversary, they published the Integrity List; 50 ways to restore trust in the investment industry. Last month, we offered up the first ten, here are numbers 21 through 30:

21. Never engage in misleading sales promotions.

22. Mentor future investment industry professionals.

23. Vocally demand that your firm does what is right for clients.

24. Tip the balance between competing interests in favor of clients.

25. Outline exactly how you are managing a client’s funds.

26. Disseminate transparent, accurate and timely information.

27. Be clear about situational influences in your environment.

28. Base investment recommendations on strong analysis.

29. Adhere to high standards even if they are not required in your country.

30. Elevate the importance of integrity in the hiring process.