Posts Tagged ‘401k tips’

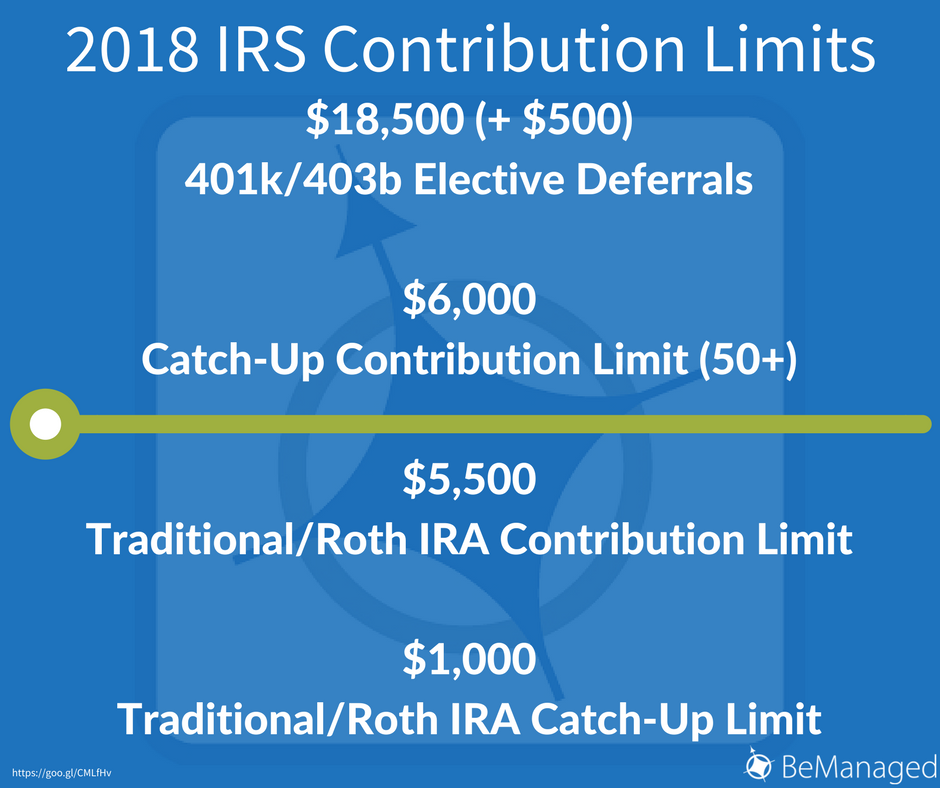

IRS Increases 401k Contribution Limits for 2018

Today, the IRS increased 401k contribution limits to $18,500 for 2018. It is good news for individuals looking to maximize their retirement contributions. Unfortunately, IRA contribution limits remain unchanged. Recommendation: Set a reminder on your phone or calendar to review your 401k/403b contribution in mid-to-late December to ensure you are maximizing your 2018 retirement savings.…

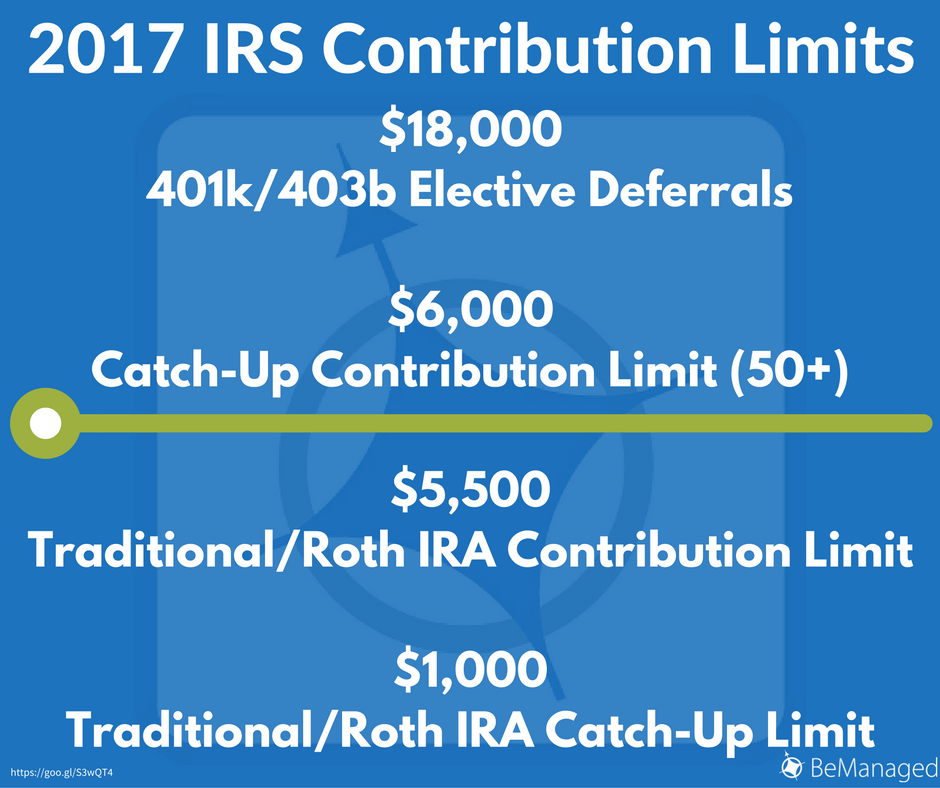

Read More2017 401k & IRA Contribution Limits Go Unchanged from 2016

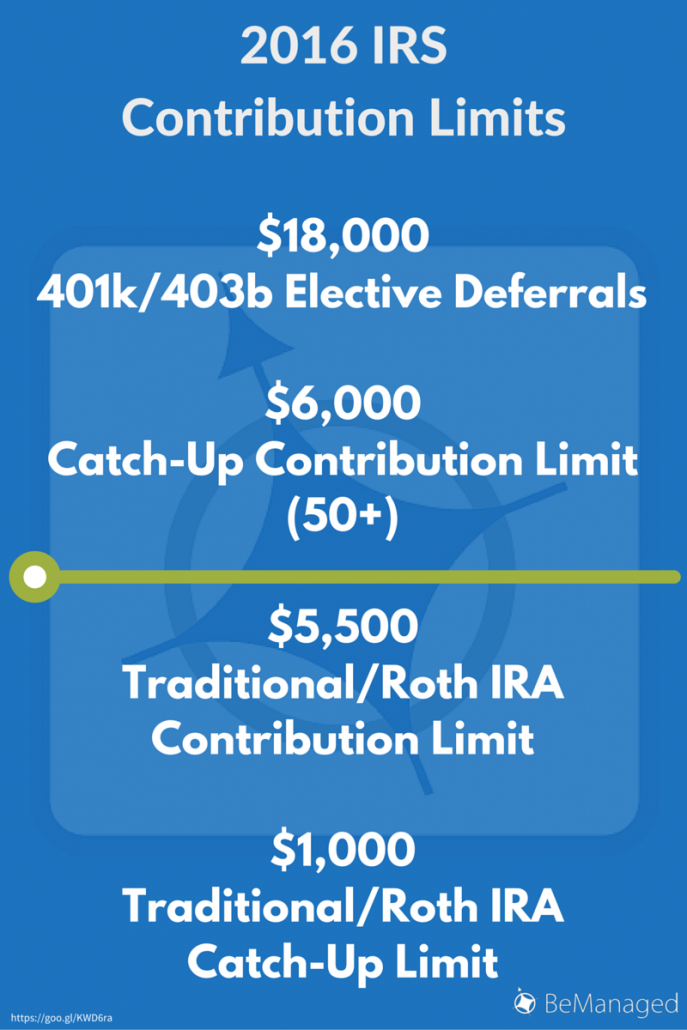

2017 IRS Contribution LimitsLook familiar? That’s because it is, because the 2017 IRS 401k and IRA contribution limits were announced and there are no significant changes from 2016. Below are the limits that affect most investors. Click to Read More Details at 401khelpcenter.com

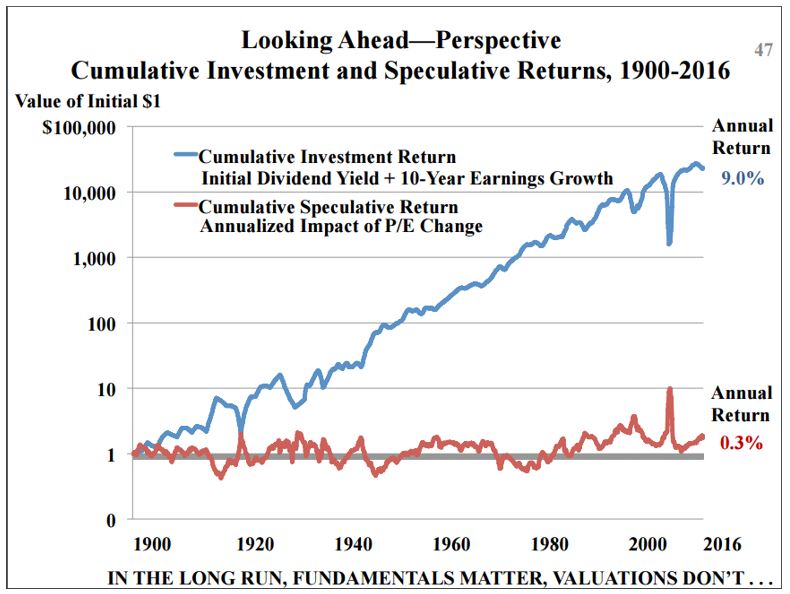

Read MoreStock and Bond Markets Remain Overvalued – October 2016

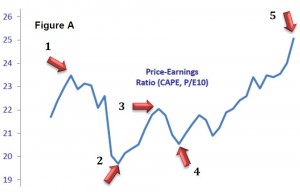

The average of four fundamental valuation measures shows a market nearly two standard deviations (82%) above its historical norm: Source: Advisor Perspectives, October 6, 2016 https://www.advisorperspectives.com/dshort/updates/2016/10/04/market-remains-overvalued Remember, asset price inflation (speculative return) contributes a very small amount towards total return over the long haul. Since 2012, however, speculative returns have been in the double digits…

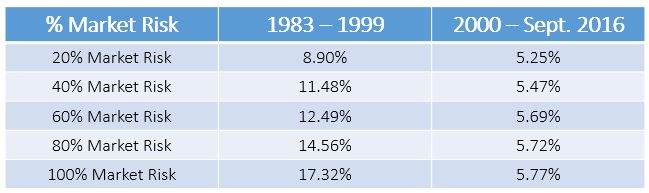

Read MoreReduced Future Returns Expected for Retirement Savings

Investment advisors and financial salespeople need to help retirement savers understand that we have entered a new era for investment returns, an era of much lower earnings growth for companies and significantly lower interest rates for stock and bond investments. Let’s look at historic investment returns for portfolios with differing levels of market risk: John…

Read More2016 401k & IRA Contribution Limits

2016 IRS Contribution LimitsThe 2016 IRS 401k contribution limits were announced and there is nothing significant changing from the 2015 limits. Below are the limits that affect most investors. Click to Read More Details at 401khelpcenter.com

Read More2015 401k Contribution Limits Announced

New 2015 401k contribution limits were announced today by the IRS! Elective Deferrals for 401k/403b/457: $18,000 ($500 increase) Catch-Up Contributions for 401k/403b/457: $6,000 ($500 increase) Annual Compensation: $265,000 (increased from $260,000) Annual Additions Limit for Defined Contribution Plans: $53,000 (increased from $52,000) Highly Compensated Employees: $120,000 (increased from $115,000) Key Employee: $170,000 (no change) Click to Read…

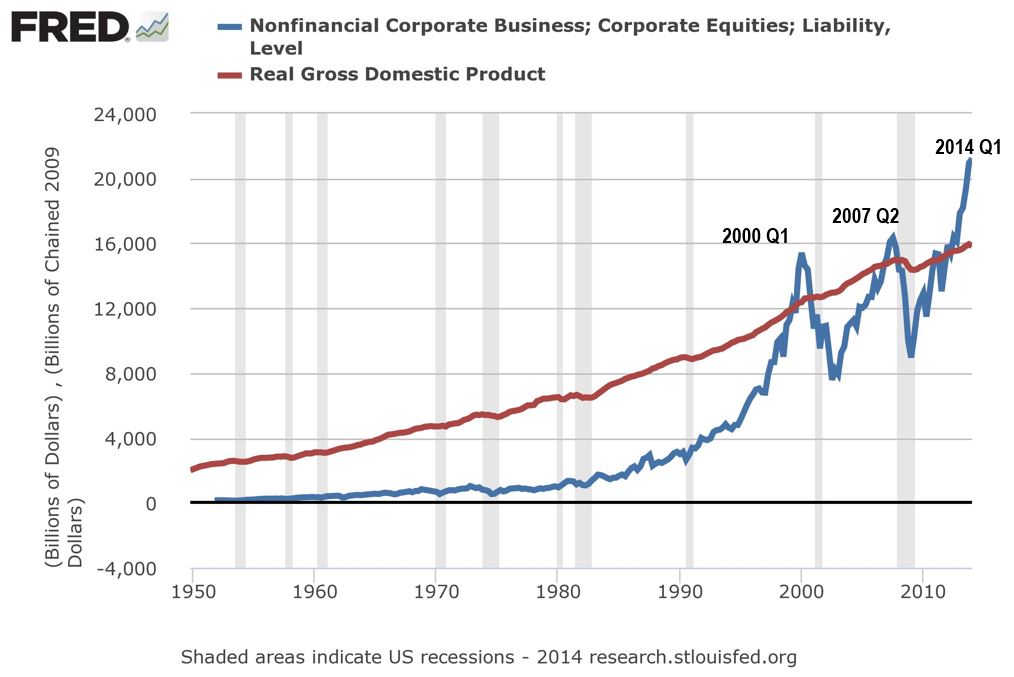

Read MoreSummer 2014 Newsletter – Market Value of Stocks Now Exceeds GDP

Market Value of our Stocks Now Exceeds Total Value of our Production Investors find themselves today in a climate of high and climbing stock prices. There are many potential causes. Individual companies may out-perform expectations and therefore justify a higher price, or the economic growth of the nation may create an environment where stock prices…

Read MoreDecember Newsletter – Tis the Season for Chasing Returns

How Investment Bubbles Work “Keep in mind how investment bubbles work. A bubble always starts with some real factor that takes on increasingly exaggerated importance in the eyes of investors. The bubble expands not on facts but on untethered imagination. People imagine that X will result in ever-increasing prices, and assume that an endless crowd…

Read MoreNovember Newsletter – Your Willingness, Ability and Need to Accept Risk

Your Willingness, Ability and NEED to Take Risk For our best savers, risk can and should be reduced When enrolling in our service, our clients are asked a short series of questions designed to help us understand the level of risk appropriate for their investment portfolio. Our goal is to best understand (at least initially),…

Read More2014 401k Contribution Limits Announced

Unfortunately, there is nothing exciting to report regarding the 2014 401k contribution limits that were announced today by the IRS. Elective Deferrals for 401k/403b/457: $17,500 (no change) Catch-Up Contributions for 401k/403b/457: $5,500 (no change) Annual Compensation: $260,000 (increased from $255,000 in 2013) Annual Additions Limit for Defined Contribution Plans: $52,000 (increased from $51,000) Highly Compensated Employees:…

Read More