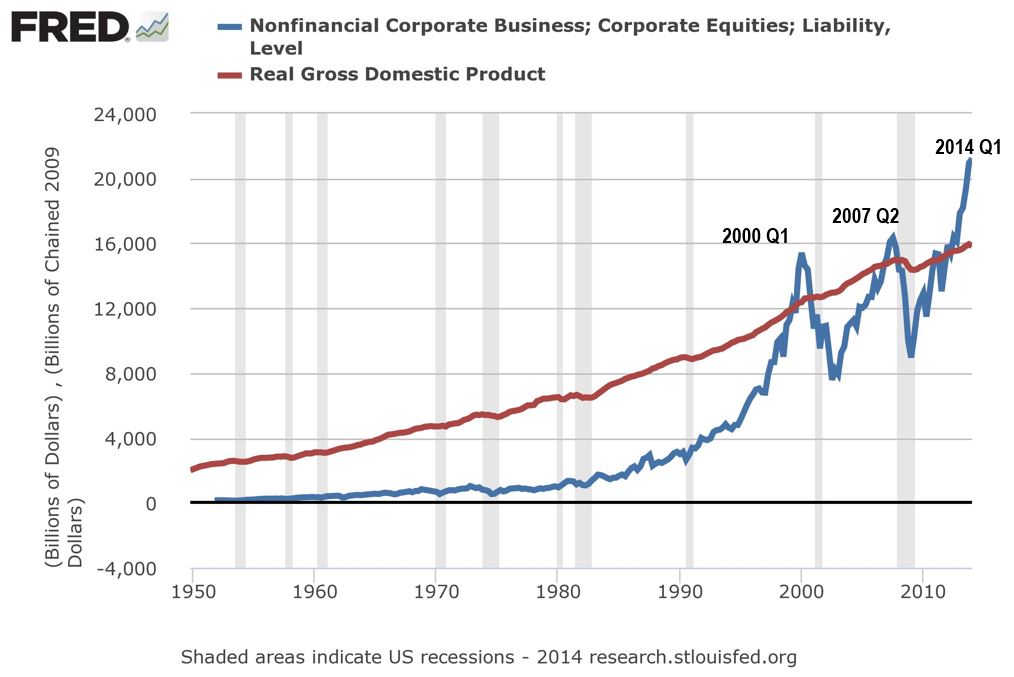

Summer 2014 Newsletter – Market Value of Stocks Now Exceeds GDP

Market Value of our Stocks Now Exceeds Total Value of our Production

Investors find themselves today in a climate of high and climbing stock prices. There are many potential causes. Individual companies may out-perform expectations and therefore justify a higher price, or the economic growth of the nation may create an environment where stock prices in general are pushed higher.

This stock market, however, has been climbing for several years at rates that are higher than the underlying economic and financial indicators can support. Despite an economic climate in which the national Gross Domestic Product (GDP) actually contracted in the first quarter of 2014, and in which individual companies show few signs of out-performing expectations, prices of stocks overall continue to rise.

This stock market, however, has been climbing for several years at rates that are higher than the underlying economic and financial indicators can support. Despite an economic climate in which the national Gross Domestic Product (GDP) actually contracted in the first quarter of 2014, and in which individual companies show few signs of out-performing expectations, prices of stocks overall continue to rise.

Think of it as paying a premium for most stock purchased today. Think of it as paying $1.30 for $1 worth of stock. And then consider the likelihood of achieving meaningful growth on that inflated $1.30 in the short-to-mid-term. This is where we find ourselves today.

These differences in price and value cannot sustain themselves. Eventually the prices will return to their proper value, or even below, before they begin to grow again. What will cause the return to proper value, and when, nobody knows. It may be an external event, or some crisis within the financial system, but it will eventually occur.

Until then, we believe the prudent course is a cautious one. We believe that portfolios should be allocated conservatively, as difficult as that may be to do, as the markets may continue to increase for some time before the correction. Now is certainly not the time to take on more risk.

As Warren Buffet is credited with saying: “The markets are designed to transfer money from the active to the patient.” Now is the time for patience.

What About My Five-Year Retirement Plan?

Here is a continuation from our previous newsletter about when to start thinking about retirement. Visit our last newsletter for information that investors 3 years from retirement should be thinking about.

2 Years from Retirement

- Do I need or want to work in retirement? Part time or full time work can help to supplement retirement income needs. Make sure to take into account any additional skills that may be needed to pursue these opportunities.

- Does your work have a phased out retirement plan? If so now is a good time to talk to your boss and start that program. Make sure you also have a good feel for retirement benefits offered by your employer.

- Do you plan on retirement before becoming Medicare eligible? If your employer does not offer retiree coverage, arrange for interim coverage through a private insurer.

Being able to answer these questions will help you to piece together your retirement puzzle. Taking time to address these areas helps create a more comfortable transition into retirement. Next newsletter, we will take a look at what we should be doing 1 year out!

“Ready to Retire? Here’s a Five-Year Pre-Retirement Plan.” The Wall Street Journal. 29 May 2011

Real Gross Domestic Product!

“THE OUTPUT OF GOODS AND SERVICES PRODUCED BY LABOR AND PROPERTY LOCATED IN THE UNITED STATES — DECREASED AT AN ANNUAL RATE OF 2.9 PERCENT IN THE FIRST QUARTER OF 2014 ACCORDING TO THE THIRD ESTIMATE RELEASED BY THE BUREAU OF ECONOMIC ANALYSIS.” – http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm

[…] 1.8%.Recall that we have been concerned about a market correction for several years. In our 2014 Summer newsletter, we remarked that the stock market "has been climbing for several years at rates that are higher […]