Posts Tagged ‘401k tips’

IRS Contribution Limits for 2012

Today the IRS posted the 2012 retirement plan limits, and for the first time since 2009, they are increasing! The new limits are as follows: Elective Deferrals for 401k/403b/457: $17,000 (increased from $16,500 in 2011) Catch-Up Contributions for 401k/403b/457: Remains at $5,500 Annual Compensation: $250,000 (increased from $245,000 in 2011) Annual Additions Limit for Defined Contribution…

Read MoreBeManaged October Newsletter: 3rd Quarter Ends on Down Note

The following topics are covered in this month’s Research Newsletter from the BeManaged Research Department.

4 Straight Months of Decline for the S&P 500

5 Yr Gains on Bonds Significantly Outpace Stock Returns

Older Workers: Who’s Working?

BeManaged September Newsletter: World Markets Fall Again

The following topics are covered in this month’s Research Newsletter from the BeManaged Research Department.

4 Straight Months of Decline for the S&P 500

5 Yr Gains on Bonds Significantly Outpace Stock Returns

Older Workers: Who’s Working?

BeManaged August Newsletter: Economic Growth Weak in 2nd Quarter

The following topics are covered in this month’s Research Newsletter from the BeManaged Research Department.

Measures of Economic Growth Weak in Second Quarter

Behaviors to Avoid When Market Returns Fall

BeManaged July Newsletter: Late Rally Saves 2nd Quarter

The following topics are covered in this month’s Research Newsletter from the BeManaged Research Department.

Late Rally Saves Second Quarter Statements

Fiduciary and Suitability Standards: Copybook Headings for Investors

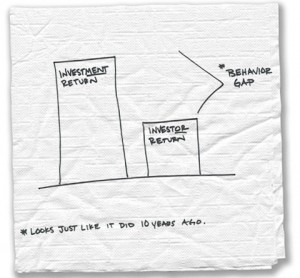

2011 Dalbar Study Finds That Investors are Still Their Own Worst Enemy

Going back to the early 2000’s, our friends at Dalbar have been conducting a study to determine whether investors’ investment decisions impacts their investment performance. Unfortunately, it does. In a BIG way.

Read MoreBeManaged June Newsletter: Modest Declines in World Equity Markets

The following topics are covered in this month’s Research Newsletter from the BeManaged Research Department.

Modest Declines in World Equity Markets in May

Consumer Confidence Dives in Latest Reading

When Investing, Trusting Your Gut Can Be Bad For Your Health

I believe in trusting my instincts when making decisions. However, when it comes to investment decisions, I have learned firsthand that my gut will often lead me down the wrong path. Many studies and surveys continue to support I am not the only one in that camp.

Read MoreBeManaged May Newsletter: More Equity Gains in April, Valuations are Concerning

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Worker Attitudes Toward Retirement Savings Needs

More Equity Gains in April – Valuations are Concerning

Survey Reveals 89% of 401k Investors Want Asset Allocation Help

A survey conducted by the Boston Consulting Group found that investors find retirement planning is confusing and 89% want help creating their ‘investment recipe’ (aka asset allocation). Here are the other findings of the 2,600 investors surveyed:

84% want help calculating and/or creating retirement income

79% would like an annual review “to set and measure their progress”

48% feel they are “in consult of their retirement plan investments”