Posts Tagged ‘Asset Allocation’

Special Report – Interest Rate Spikes and the Bonds in Your Portfolio

There is rising concern regarding the impact of higher interest rates on the bond funds in client portfolio. The purpose of holding bond funds is to provide a return above the level of cash while waiting for a more rational stock market environment. As always, the potential return over and above money market funds comes…

Read MoreWhen Investing, Trusting Your Gut Can Be Bad For Your Health

I believe in trusting my instincts when making decisions. However, when it comes to investment decisions, I have learned firsthand that my gut will often lead me down the wrong path. Many studies and surveys continue to support I am not the only one in that camp.

Read MoreBeManaged May Newsletter: More Equity Gains in April, Valuations are Concerning

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Worker Attitudes Toward Retirement Savings Needs

More Equity Gains in April – Valuations are Concerning

Survey Reveals 89% of 401k Investors Want Asset Allocation Help

A survey conducted by the Boston Consulting Group found that investors find retirement planning is confusing and 89% want help creating their ‘investment recipe’ (aka asset allocation). Here are the other findings of the 2,600 investors surveyed:

84% want help calculating and/or creating retirement income

79% would like an annual review “to set and measure their progress”

48% feel they are “in consult of their retirement plan investments”

5 Participant Success Features to Add to Your 401k Plan

Last month, we brought on a new client that was going through a provider change. During our interaction with their employees, we were shocked to find what their old 401k provider DIDN’T offer compared with what their new provider DID. For the sake of full disclosure, we tend to be a little naive in assuming that certain features are a given when it comes to the capabilities of 401k provider websites. That being said, it’s 2011. I can order a burrito from my phone. Thus, if your provider offers any of these functions, the following are some basic online tools (in our naive minds) that we have found participants enjoy, and quite frankly expect in today’s digital age:

Read MoreDon’t Get Burned – Put More Focus on the Recipe Than the Ingredients

A few months ago, I made a big pot of chili. I have made my Mom’s recipe my own, and always enjoy how it turns out. However, I incorporated a few new ingredients that time, and the initial result was quite interesting. I discovered an important lesson – I have some learning to do when cooking with cayenne pepper. When I checked it after it had been cooking for a couple of hours, I found it to look and smell like chili. After tasting it however, it was so spicy that I thought it was molten lava going down my throat.

Read MoreAre You an Investor or a Collector?

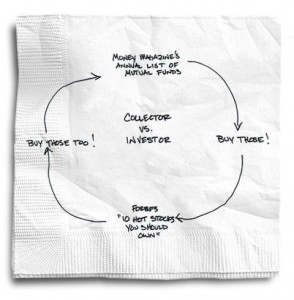

Our friend Carl Richards of BehaviorGap.com and the NYTimes.com Bucks blog has done a great job of illustrating how the ‘over diversification’ of portfolios can simply be ‘buying more’ instead of ‘buying different.’

Over- or under-diversifying your investments remains one of the classic behavioral mistakes.

Over-diversification happens when we become collectors of investments instead of simply being investors. Think of the people who buy the mutual funds they read about in Smart Money magazine. Next year they buy the Top 10 Funds recommended by Money magazine. A year later they buy two or three new international funds because that’s what’s on the home page of Forbes.

Read MoreBeManaged October Research Newsletter – Asset Class Correlations and Your Portfolio

The following are some topics covered in this month’s Research Newsletter from John Whaley, CFA, AIF, Director of the BeManaged Research Department.

Third Quarter Ends on Positive Note

Pension Plans Continue Rosy Expectations

Asset Class Correlations and Your Portfolio

3 Ways to Spot a Bad Investor (Video)

CBS Marketwatch.com just put out a handy little video to help identify whether you, your friend or your advisor is a bad investor. It’s brief, and definitely true.

Read MoreAnnual Dalbar Study Shows Investors Are Still Behaving Badly

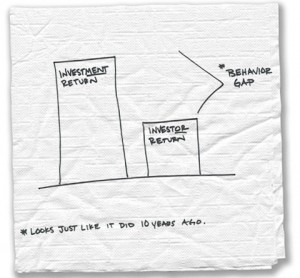

Dalbar releases an annual study gauging the impact of investor behavior on investors’ long term portfolio returns. Our friend Carl Richards of BehaviorGap.com, writing for the NYTimes.com Bucks blog, illustrates the impact of investors’ decisions on their long term portfolio performance via the findings of this year’s study.

Read More