Annual Dalbar Study Shows Investors Are Still Behaving Badly

Dalbar releases an annual study gauging the impact of investor behavior on investors’ long term portfolio returns. Our friend Carl Richards of BehaviorGap.com, writing for the NYTimes.com Bucks blog, illustrates the impact of investors’ decisions on their long term portfolio performance via the findings of this year’s study.

Dalbar releases an annual study gauging the impact of investor behavior on investors’ long term portfolio returns. Our friend Carl Richards of BehaviorGap.com, writing for the NYTimes.com Bucks blog, illustrates the impact of investors’ decisions on their long term portfolio performance via the findings of this year’s study.

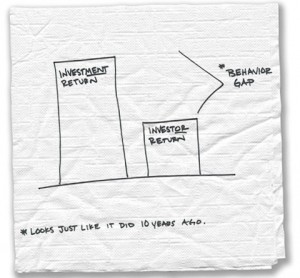

Every year the research firm Dalbar does a study that tries to quantify the impact of investor behavior on real-life returns by comparing investors’ earnings to the average investment (using the S&P 500 as a proxy).

The latest study looks at the 20-year period that ended Dec. 31, 2009:

Average investment return = 8.20 percent

Average equity investor return = 3.17 percentIf you had put money into an S&P 500 index fund 20 years ago and just left it there — no buying, no selling, just investing and forgetting about it — you would have earned (minus fees) about 8 percent.

But real people don’t invest that way. We trade. We watch CNBC and listen to Jim Cramer yell. Despite knowing better, we give into the genetic tendency to get more of those things that give us pleasure — buy high — and get rid of things that cause us pain — sell low. We’re just wired that way.

What is really interesting is how little this seems to change over the years. When it comes to investing, the tendency to behave badly is not going away.

So what do we do about it?

1. Admit it. Like any destructive behavior that first step to fixing it is to admit that there is a problem in the first place. Being honest with yourself and reviewing past decisions will help:

Did you get caught up in the tech bubble in 1999?

Real estate in 2006?

Did you sell in 2002, late 2007, or early 2008?2. Develop a checklist. Then go through that checklist before you make major investment decisions. It works for pilots and doctors. It will help you avoid mistakes in investment behavior, too.

Try writing down the proposed change and then let it sit for 24 hours, or call a trusted friend or adviser and walk them through your thinking before you make the change. Often just hearing yourself explain why you want to make the change will convince you to forget the whole thing.

3. Don’t play. Sometimes the answer might be to take our money and go home. There is nothing that says you have to invest in the stock market to be considered an intelligent human being. It is fine to recognize that it might work better to follow Will Rogers’s advice and focus on the return of your money instead of the return on your money.

The reality is investing successfully is hard. But hopefully by focusing on our behavior, we can close this gap in the next 20 years.

Great article. Thanks for sharing. I think this is the toughest job we have in attempting to maximize participant’s retirement income: getting them to stay the course.

I have a theory that many people have a healthy skepticism about the 401k and investment management industries. It is very difficult to stay true to an investment strategy if you do not fully understand it and trust the person who suggested it.

I have followed the Dalbar studies each year since they began in 1992 or 93. The relationship between investment and investor return has had similar deviations on every study. Some possible causes for the discrepancy include the negative effect of dollar cost averaging in what was primarily bull market periods. Unless there is an equal dollar investment during market corrections, the investor’s average share price will always be above the price of the index on the initial date of the study resulting in less return. As well, it is good to remember that the investment indices can only go up or down when transactions on the underlying securities actually occur. Since the turnover ratio on most NYSE securities is 100% or more per year, and much higher than that on some other market indices, that implies at least 2 or more shareholders for each share of stock for that holding period. Because those buying in at higher prices require even greater price increases to match those percentage returns, it would be foolish to expect that all shareholders match the index returns. I believe that we make an error assuming that every dollar for every investor will earn the historical index return. Projections from some software providers also assume a static index return each and every year, an even bigger mistake.

It’s a powerful reminder of just how powerful investor psychology is. We’re often our own worst enemy. And how important a trusted advisor can be – one who might keep us from harming ourselves.

Referring to comments by Mr Wood: I actually believe the OPPOSITE is the truth, that the old phrase ‘staying the course'(you mean buying something and never selling it???) is absolutely the largest part of the problem. Investing is NOT just buying a mutual fund, or stock, and leaving the room for 20 years. Investing is a constant, consistent, and aggravating process of watching, learning, selling, buying, trading, and MAKING MONEY with our money, NOT just sitting it somewhere for 20 years because some ‘professional’ investment advisor says that it’s the best way. BALONEY.