Posts Tagged ‘investment behavior’

How to Review the Performance of your Investments

Your investment statements are arriving, so many of us will take a look at our investment accounts to see how we (or our advisor) did. Unfortunately, it can be a bit confusing to determine if we did well, average or poorly. Let’s look at the items that will help you determine how you did. How…

Read MoreOur Thoughts on ‘Brexit’

Political events in Europe have taken center stage in the news and effects have rippled out across financial markets around the world. On Friday, the U.S. stock market, as measured by the S&P 500, fell by 3.6%. The rest of the world fared worse; Europe fell by 8.9% and the Europe/Asia/Far East index declined more…

Read MoreNovember Newsletter – Your Willingness, Ability and Need to Accept Risk

Your Willingness, Ability and NEED to Take Risk For our best savers, risk can and should be reduced When enrolling in our service, our clients are asked a short series of questions designed to help us understand the level of risk appropriate for their investment portfolio. Our goal is to best understand (at least initially),…

Read MoreVideo: Financial Goals Should be Written in Pencil, Not Pen

Our friend Carl Richards of BehaviorGap.com recently posted a video titled, “Do Your Goals Have Too Much Power,” which you can view via the link below. He makes a point similar to a recommendation of one of my favorite radio personalities, Colin Cowherd, makes: When outlining your life, use a pencil, not a pen. I…

Read MoreBeware of Confirmation Bias – And its Assault on Your 401k

There is a useful analogy that relates the observation a goldfish makes when looking through the rounded glass of his fish bowl and us – the human. As we might suspect, a goldfish observing the outside world through the lens of a glass bowl would see things differently than you or I. To the goldfish,…

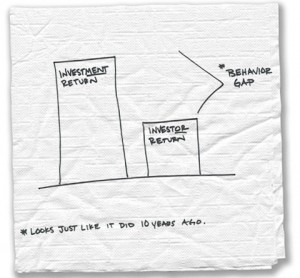

Read More2011 Dalbar Study Finds That Investors are Still Their Own Worst Enemy

Going back to the early 2000’s, our friends at Dalbar have been conducting a study to determine whether investors’ investment decisions impacts their investment performance. Unfortunately, it does. In a BIG way.

Read MoreBeManaged May Newsletter: More Equity Gains in April, Valuations are Concerning

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Worker Attitudes Toward Retirement Savings Needs

More Equity Gains in April – Valuations are Concerning

Survey Reveals 89% of 401k Investors Want Asset Allocation Help

A survey conducted by the Boston Consulting Group found that investors find retirement planning is confusing and 89% want help creating their ‘investment recipe’ (aka asset allocation). Here are the other findings of the 2,600 investors surveyed:

84% want help calculating and/or creating retirement income

79% would like an annual review “to set and measure their progress”

48% feel they are “in consult of their retirement plan investments”

5 Participant Success Features to Add to Your 401k Plan

Last month, we brought on a new client that was going through a provider change. During our interaction with their employees, we were shocked to find what their old 401k provider DIDN’T offer compared with what their new provider DID. For the sake of full disclosure, we tend to be a little naive in assuming that certain features are a given when it comes to the capabilities of 401k provider websites. That being said, it’s 2011. I can order a burrito from my phone. Thus, if your provider offers any of these functions, the following are some basic online tools (in our naive minds) that we have found participants enjoy, and quite frankly expect in today’s digital age:

Read MoreWSJ – Once Bitten, Twice Bold: Look Who’s Buying Stocks Now

Jason Zweig is one of my favorite writers at the Wall Street Journal. Last weekend, he wrote an interesting article regarding some of the classic sell low, buy high behaviors taking place due to the sustained gains of the market rally that is now nearing 24 months in length. It’s a must-read for anyone wanting to learn what NOT to do with their portfolio. Here are a few snippets from the article:

Read More