Posts Tagged ‘retirement’

June Newsletter – Prices Paid for U.S. Stocks Continue to Balloon

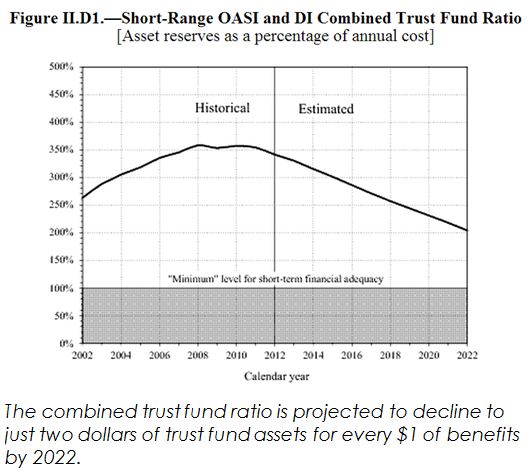

Social Security Trustees Report on Fund Status Disability Insurance “Trust Fund” projected to deplete in 2016 Old-Age and Survivors Insurance and Federal Disability Insurance (commonly referred to as Social Security) is providing benefit payments to about 40 million retired workers, 6 million survivors of deceased workers and 11 million disabled workers and dependents of disabled…

Read More9 Things You Should Know About Social Security

A very good article about Social Security was posted at money.usnews.com that provides a great summary for individuals. The following are some key highlights direct from USNews.com: You contribute 6.2% of your income: Workers pay 6.2 percent of their earnings into the Social Security system, up to $113,700 in 2013. Employers pay a matching 6.2 percent for…

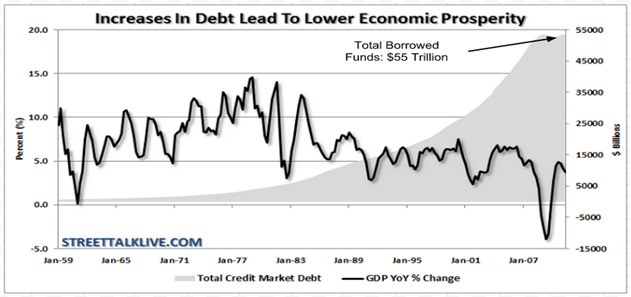

Read MoreFebruary Newsletter – GDP Declines in 4Q 2012

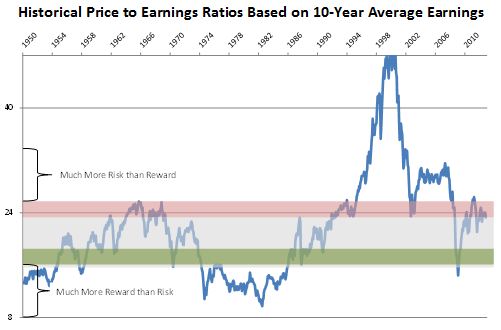

Why We Continue to be so Protective of Your Money Stock market gains continue – will they ever correct? January is just the latest in the sixteen month push upward for the U.S. stock market. Over that period, the S&P 500 has gained 35%. During this rise, we have seen only one monthly period where…

Read More2013 401k Contribution Limits Increase Slightly

Today the IRS posted the 2013 retirement plan limits, and there are a few increases from 2012. The new limits are as follows: Elective Deferrals for 401k/403b/457: $17,500 (increased from $17,000 in 2012) Catch-Up Contributions for 401k/403b/457: $5,500 (no change) Annual Compensation: $255,000 (increased from $250,000 in 2012) Annual Additions Limit for Defined Contribution Plans: $51,000…

Read MoreVideo: Financial Goals Should be Written in Pencil, Not Pen

Our friend Carl Richards of BehaviorGap.com recently posted a video titled, “Do Your Goals Have Too Much Power,” which you can view via the link below. He makes a point similar to a recommendation of one of my favorite radio personalities, Colin Cowherd, makes: When outlining your life, use a pencil, not a pen. I…

Read MoreMay Newsletter – Fiscal Debt and Investment Returns

Investment Returns and Overall Account Growth Your contribution level critical to a successful retirement The Employee Benefit Research Institute’s latest survey of 401(k) valuations looks at account growth by age and tenure (number of years participating in the plan). From January 1, 2011 through January 31, 2012, account values of newcomers under the age of…

Read MoreA Mountain Climber’s Perspective on Risk

Imagine you’re a mountaineer about to scale the face of El Capitan in Yosemite National Park. As you hike to the bottom of the face your level of risk to injury is relatively low. You might trip and fall on your hike but any injury is nonetheless negligible. In this situation, your exposure to downside…

Read MoreIRS Contribution Limits for 2012

Today the IRS posted the 2012 retirement plan limits, and for the first time since 2009, they are increasing! The new limits are as follows: Elective Deferrals for 401k/403b/457: $17,000 (increased from $16,500 in 2011) Catch-Up Contributions for 401k/403b/457: Remains at $5,500 Annual Compensation: $250,000 (increased from $245,000 in 2011) Annual Additions Limit for Defined Contribution…

Read MoreBeManaged May Newsletter: More Equity Gains in April, Valuations are Concerning

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Worker Attitudes Toward Retirement Savings Needs

More Equity Gains in April – Valuations are Concerning

Survey Reveals 89% of 401k Investors Want Asset Allocation Help

A survey conducted by the Boston Consulting Group found that investors find retirement planning is confusing and 89% want help creating their ‘investment recipe’ (aka asset allocation). Here are the other findings of the 2,600 investors surveyed:

84% want help calculating and/or creating retirement income

79% would like an annual review “to set and measure their progress”

48% feel they are “in consult of their retirement plan investments”