Posts Tagged ‘retirement’

BeManaged March ’10 Newsletter – The Advancing US Dollar and Your 401(k)

The following are some of the topics discussed in this month’s newsletter from John Whaley, CFA, AIF, the Director of our Research Department.

Advancing US Dollar Translates to Declining Foreign Stock Returns

Mutual Fund Fees and the Impact on Your Acccount

How Does Your 401(k) Account Growth Compare?

Brokers Win, Investors Lose Key Reform – WSJ

Every investor working with a financial planner/wealth manager/financial advisor/stockbroker…whatever title is used…should read at least the following quote. In Jason Zwieg’s article on WSJ.com, he provides one of the easiest to understand summaries I have read on the responsibility that person has to you:

As of now, the roughly 630,000 brokers, bankers and insurance agents registered to sell securities must determine whether investments are “suitable”—based on how wealthy you are, what else you have invested in, your tax status and your investment objectives.

Securities salespeople generally aren’t obligated to act in your best interest. They needn’t tell you that they make extra money pushing one particular investment or that cheaper alternatives might provide you a higher return.

Suppose two mutual funds are “suitable,” but one of them pays the broker a fatter fee. You may well end up in that one—without finding out that your broker had an incentive to favor it.

On the other hand, financial advisers—who are regulated as “fiduciaries” under the federal Investment Advisers Act—are obligated to put you first. They must explain their fees, disclose conflicts of interest and disclose past infractions. If they get paid extra to recommend a fund or sell an insurance product, they have to tell you.

Read MoreStudies Show the Less You Do With Your 401(k), the More You Earn

ometimes, it helps to hear this from an independent source…

Don’t take this too personally, but the less you are involved with investment decisions for your 401(k) the better off you may be.

Sometimes, it helps to hear this type of thing from an independent source. As we have said before, we don’t fix our own cars, why should we be expected to be professional investment managers?

Don’t take this too personally, but the less you are involved with investment decisions for your 401(k) the better off you may be.

A new study of more than 400,000 401(k) participants in seven corporate plans found that the median return earned by individuals who sought out help in managing their 401(k) was 1.86 percentage points more than participants who made their own allocation/investment decisions.

Read MoreA Model for 401(k) Advice, Pt. 1 – Must be Conflict-Free

Many 401(k) sponsors, providers and advisors eagerly await the DoL’s new advice proposal, which is due to be released within the next 30-45 days. In an effort to put in our two cents, we thought we would share our hopes for the proposal based on our experience in delivering advice, our understanding of other options in the marketplace, and the feedback we have received from employers and investors alike. Keep in mind most of our clients exist in the top end of the small market (250+ employees) to large sized employers (1,000+ employees).

Goal #1 – Advice Must be 100% Conflict-Free

We believe advice for 401(k) investors must be start with being conflict-free. If there are conflicts in providing participants advice, then 401(k) advice is doomed to fail. So, let’s look at how to ensure this holds true for participants and the employers that are required to do their due diligence on service providers, including advice providers.

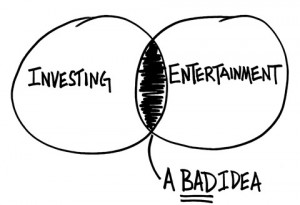

Investing Is Not Entertainment

As you know, we are big fans of the BehaviorGap. Our friend Carl Richards is now being featured in the New York Times website. His latest post there is two minutes of really good advice.

Am I investing to meet my most important financial goals or am I investing as a form of entertainment? For almost all of us, it can’t be both.

Video: Quick and Easy 401(k) Moves

We are a fan of keeping things simple, so when we run across tips on how to do so, we like to make sure we share them with you. The following video is an example of such tips; this one specific to your 401(k) plan.

There is one thing we would like to add to the idea of consolidating your old 401(k)s: If your company has BeManaged available, many of our clients prefer to roll those old 401(k) accounts into their current account to make sure it is managed for them, instead of having to figure out where and what to invest in themselves. Often times they are nearing or already past the capped fee we charge, so there is little to no financial benefit to us, but a big one for our clients.

Read MoreNew 401(k) Advice Rules Set By End of February

The Department of Labor has declared their hopes for releasing the provisions for 401(k) advice by the end of February. Fair warning: The PPA was passed 4 1/2 years ago, and they still have not finalized said provisions. However, after the DoL was a bit embarrassed by the industry backlash by the legal, consumer protection and fiduciary experts, I actually feel optimistic they will get it right this time. In reading Phyllis Borzi’s comments below, we are hopeful the provisions will look something like this:

Read MoreBeManaged February Newsletter – Do January’s Declines Portend the Rest of 2010?

Here are some of the topics discussed in this month’s newsletter from John Whaley, CFA, AIF, the director of our Research Department.

Do Late January Declines Portend the Rest of 2010?

Remember “Earnings Not as Bad as We Thought?”

Contributions Never More Critical Than Today

What Companies and Industries are in Your Portfolio?

Another Study Shows 401(k) Advice/Help Improves Participant Outcomes

A recent study by Hewitt and Financial Engines found that people getting “help” outperformed those that did not by about 2%, after analyzing the performance of roughly 400,000 investors across seven retirement plans. The findings compliment the study by Charles Schwab in Nov. ’07, which found those that got help outperformed those that did not by nearly 3%. The studies compliment each other by the fact that each were conducted during different market cycles, the Schwab study during a bull market, the Hewitt study during a bear market. Thus, regardless of the market’s direction, studies show proper portfolio management superceded normal investment behavior (chasing performance, emotion based investing, etc.).

Read MoreMore Plan Sponsors Crossing the Line from Education to Advice – CFO.com

Since 401(k) plans were created, education was seen as a way of “moving the needle” to help participants make better investment decisions and improve plan participation. Does education help make investors investment managers?

Read More