Another Study Shows 401(k) Advice/Help Improves Participant Outcomes

A recent study by Hewitt and Financial Engines found that people getting “help” outperformed those that did not by about 2%, after analyzing the performance of roughly 400,000 investors across seven retirement plans. The findings compliment the study by Charles Schwab in Nov. ’07, which found those that got help outperformed those that did not by nearly 3%. The studies compliment each other by the fact that each were conducted during different market cycles, the Schwab study during a bull market, the Hewitt study during a bear market. Thus, regardless of the market’s direction, studies show proper portfolio management superceded normal investment behavior (chasing performance, emotion based investing, etc.).

A recent study by Hewitt and Financial Engines found that people getting “help” outperformed those that did not by about 2%, after analyzing the performance of roughly 400,000 investors across seven retirement plans. The findings compliment the study by Charles Schwab in Nov. ’07, which found those that got help outperformed those that did not by nearly 3%. The studies compliment each other by the fact that each were conducted during different market cycles, the Schwab study during a bull market, the Hewitt study during a bear market. Thus, regardless of the market’s direction, studies show proper portfolio management superceded normal investment behavior (chasing performance, emotion based investing, etc.).

What is the impact on 401(k) investors?

The study’s findings revealed that, on average, the median annual return for participants using investment help was almost 2 percent (186 basis points, net of fees) higher than those who did not. For example, a 45-year old who uses professional investment help will have saved 47 percent more by age 65 than if he or she had not used help, assuming the almost 2 percent higher median annual return is maintained over the 20-year period. The difference becomes even more dramatic if the initial investment is made at a younger age. A 25-year-old who uses professional investment help when investing $10,000 could have $105,800 by age 65 compared to just $52,100 had he or she not used help—a 103 percent increase, again assuming the higher median annual return is maintained over the entire period. Read More

The Hewitt/Financial Engines study found that different types of “help” fit specific types of investors.

- Target Date Funds – Investors using target date funds tended to be younger, with shorter tenures with the employer, and thus a smaller account balance (likely defaulted into the option is our guess)

- Managed Accounts (Do-It-For-You Account Management) – Investors tended to be older with larger balances and longer tenures with the employer.

- Investment Advice – Investors tended to be younger with larger balances than the target date investors and more savvy with technology.

We have been sharing our experience that different types of investors tend to be best situated with different types of investment “help” as this study reinforces. Just as this study finds, it has been our experience that…

- Target Date Funds are Great for Small Balances/New Participants to the Plan – Target date funds (TDF) tend to be the ideal solution for these individuals, as while their account grows, they tend to use the TDF correctly as a one-stop investment option.

- Balances >$35k: Account Management and Investment Advice Becomes Attractive – It has been our experience as well as investment companies’ that investors often start misusing TDFs once they pass this threshold, such as using multiple target years (2040 and the 2020 funds) or co-mingle individual asset classes with the funds. For example, they will chase the hot fund(s) in the plan and unravel the asset allocation of their portfolio. Due to the account becoming more “relevant” to them, they want to maximize their money, hence the attraction of having a professional either manage or advise their account increases dramatically when given the option.

Key Takeaways from the Study(s)

Participants Doing it Themselves Take on More Risk – Ironically, we just conducted such a study for one of our clients, comparing those using our BeManaged service with those who were not. Our results mirrored those of the Hewitt study, though our sample size was obviously much smaller than that of the Hewitt study.

Participants Doing it Themselves Take on More Risk – Ironically, we just conducted such a study for one of our clients, comparing those using our BeManaged service with those who were not. Our results mirrored those of the Hewitt study, though our sample size was obviously much smaller than that of the Hewitt study.- Risk/Reward Is Difficult for Most Investors to Quantify – We have seen first hand that many investors’ perception of their risk tolerance ends up being very different from what they actually are, let alone how they believe they are invested. Let’s face it, if our car was making a strange sound, we could make some guesses as to what was wrong, but there is no way we would try fixing it ourselves unless we were a trained, certified mechanic on that specific make of vehicle. Shouldn’t 401(k) investors have the same option?

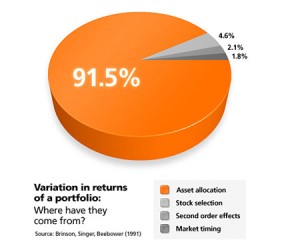

- Asset Allocation Can Help Manage Risk – Proper asset allocation, is critical to long term success for investors, as it is responsible for nearly 92% of investors’ performance (more to come on this). If participants cannot quantify how much risk exists in their portfolio, shouldn’t we provide them the help they need?

Interesting post. I have also focused my practice on 401(k) plans & IRAs. Many of my articles encourage investors go seek advice from a professional when it comes to their 401(k). The study shown above backs it up.

Thank you for the comment, Dean. We have found once wealth management advisors better understand the service/value we deliver to 401(k) investors, they recommend it to compliment the advice/account management for the investor’s non-401k assets/financial plan.