Posts Tagged ‘social security’

September Newsletter – Should You Move Your Money Out of Bonds?

Should You Move Your Money Out of Bonds? In the last four months we have seen some of the worst bond performance in history, and the volatility and potential downside has been a cause for concern for many of our clients. Figure 1 shows the performance of a typical US Bond Index Fund used in…

Read MoreAugust Newsletter – U.S. Equity Funds See Highest-Ever Inflows in July

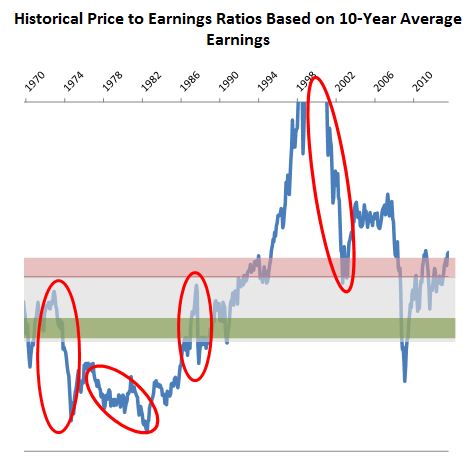

U.S. Equity Funds See Highest-Ever Inflows in July Bubbles, Bubbles, Bubbles Stock valuations (the price you pay to own a share of a company stock) have reached silly extremes with July’s market gains. Meanwhile, bond prices fell during the summer, with some bond funds suffering their worst three month period in recent history. How do…

Read MoreJuly Newsletter – Second Quarter Ends with a Whimper

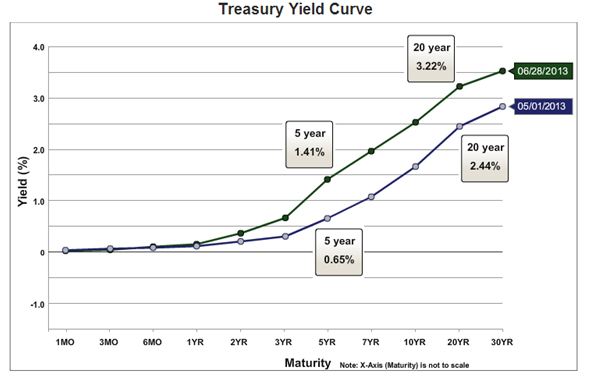

Second Quarter Ends with a Whimper Balanced Portfolio Returns Hindered by Rising Interest Rates, Poor Foreign Stock Performance Stock markets around the world took a turn for the worse after Ben Bernanke’s May 22nd testimony to Congress gave very subtle hints that the Federal Reserve might consider a gradual slowing of the $85 billion dollar…

Read MoreJune Newsletter – Prices Paid for U.S. Stocks Continue to Balloon

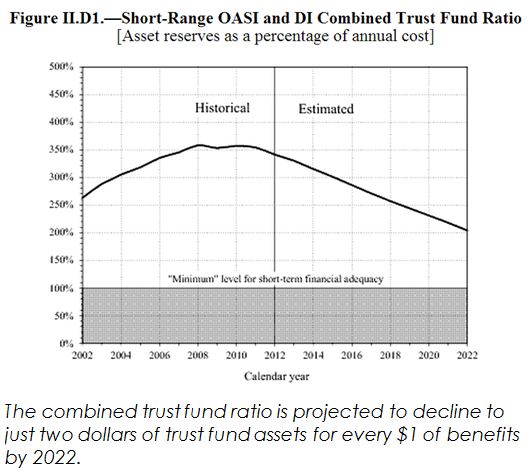

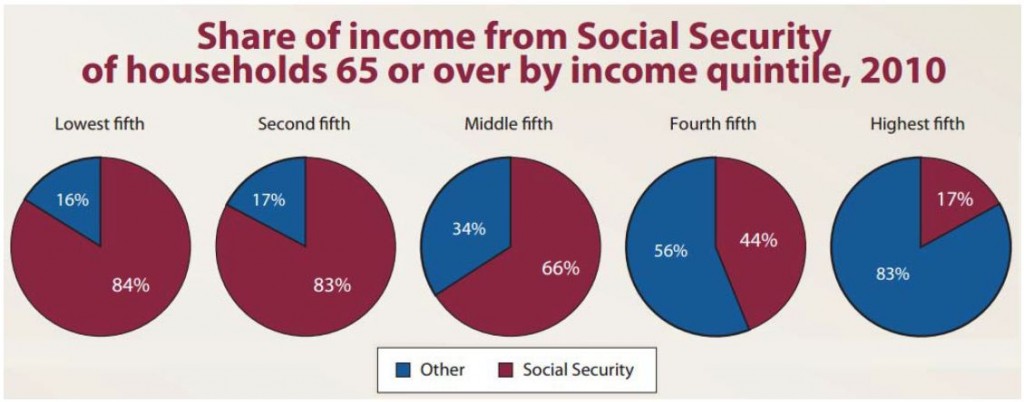

Social Security Trustees Report on Fund Status Disability Insurance “Trust Fund” projected to deplete in 2016 Old-Age and Survivors Insurance and Federal Disability Insurance (commonly referred to as Social Security) is providing benefit payments to about 40 million retired workers, 6 million survivors of deceased workers and 11 million disabled workers and dependents of disabled…

Read More9 Things You Should Know About Social Security

A very good article about Social Security was posted at money.usnews.com that provides a great summary for individuals. The following are some key highlights direct from USNews.com: You contribute 6.2% of your income: Workers pay 6.2 percent of their earnings into the Social Security system, up to $113,700 in 2013. Employers pay a matching 6.2 percent for…

Read MoreSeptember Newsletter – Declines in Median Household Income and the Long-Term Impact on Investment Returns

Three Month Rally Moves Domestic Stock Returns to Double-digits for 2012 The 2% gain in the S&P 500 in August pushed the returns for large cap funds above the 10% mark for 2012. Foreign stock funds continue to lag, returning less than 7%. Surprisingly, bond funds continue to do well in an environment where interest…

Read More