5 Tips to Help Stop Worrying About Money

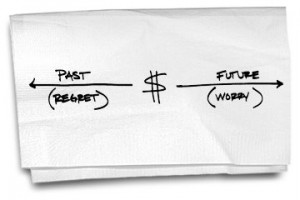

The following article by Carl Richards at the NYTimes.com examines our propensity to beat ourselves up over past mistakes as well as worrying about the future with respect to money. I have been guilty of this, so it hit home for me. Simply put, we are all human and make mistakes in many aspects of our lives, including financial decisions. That being said, here are some simple steps to immediately improve your financial/retirement picture:

- Get Rid of Credit Card Debt – Starting with your highest interest rate card, resolve to stop using it while focusing on getting it paid off ASAP. Keep the card and do NOT cancel it for credit score purposes, but definitely work to pay it off. Once it is done, roll the monthly payment you were paying toward the balance of your next highest interest credit card. This is the ‘debt snowball effect’ proposed by debt-free guru Dave Ramsey.

- At MINIMUM Contribute Enough to Receive the Full Company Match – Free money is beautiful and rare. If you aren’t sure, login to your 401k or check with Human Resources to verify you are not missing out.

- Target Saving 12% – 20% of Your Income for Retirement – If you are already there, congratulations. Your personal contributions to your 401(k) are like putting a dry log on the fire in your fireplace, it keeps the fire burning strong. Don’t worry, you cannot over-save for retirement…at least we haven’t received any complaints that our clients have too much money for retirement.

- Make Sure Your Mortgage Will Be Paid Off Before You Retire – A tip we share with numerous people nearing retirment is that you want minimize your expenses as much as possible entering retirement. Why? You have built a nest egg, so keep it as long as possible in case you live longer than you expect. The less money you need to pull from that nest egg to provide you the lifestyle you desire, the longer the money lasts. Thus, make sure your mortgage will be paid off before you enter retirement, as it will simply provide you a lot more flexibility and option, a definite plus.

- Monitor Your Emotions Regarding Purchases, Debt and Investments – If you find yourself being impulsive, be careful. I am highly impulsive, so this is something I have had to manage over the years. Buying a soda when checking out at the department store – no problem. Buying that 47″ flat screen because your credit card has plenty of room? That’s an entirely different issue. Trying to time the market because you think the market is going to boom/dive? Huge red flags should pop up. Being humble enough to realize you might need help? Don’t let pride get in the way of finding the answers that can help you maximize your portfolio. This means having a well-rounded plan in place to protect against downturns instead of narrowly focusing on squeezing every tenth of a percent out of a market rally.

Controlling how much I think about money and maintaining my balance may be easier if I remember to do a couple of things:

1) Take a media fast: A few days each month, I’ll specifically avoid thinking, reading and maybe even talking about the financial markets and the economy or anything related to personal finance.

2) Pay attention to my emotions: Money is an emotional subject for most of us. It certainly is for me, and I believe it will be helpful to me in the coming year to be more present and aware of my feelings about money. Doing so may be as simple as considering how I feel when I get my monthly investment statement or when a medical bill arrives in the mail. I’m not sure what I’ll do with what I learn, but I think acknowledging those feelings and being aware of their potential impact will be important.

Just a few comments.

#1: Dave Ramsey says to pay of the debts starting with the smallest debt and pay no attention to interest rate. This way you see things happen faster and don’t get frustrated. If you are killing off debts and putting the money that you were paying on the ones paid off on to the remaining debts this is how the ‘debt snowball’ works. If your highest interest rate credit card is also your biggest debt you may become frustrated because ‘nothing is happening’ or ‘things are just not getting better’ long before you pay that debt off.

Another thing that I think is VERY important that you do not mention here is the emergency fund. GET ONE NOW!!! Credit cards get used when there is an emergency and you have no money. Dave says when you are paying off debt have $1000 in cash in a bank account and do not touch it unless you have an emergency. Once you are out of debt shoot for 3 – 6 months (or more if you can).

Getting the house paid off I think is a huge deal. Many people are house poor and don’t realize it. We paid ours off a few years back and it’s a wonderful thing. Once you get over that hill most other money issues become easy.

Everyone needs to look in the mirror and figure out how to take care of themselves. I figure that if I want to retire I better be able to pay for 100% of it myself because who knows what the state of any government support will be like in 10 or 20 years.

Well said. The purpose of the post was to focus on some simple steps and then point them toward solutions such as DaveRamsey.com if they want additional information. I completely agree with your points on debt, thank you for the time you put into this comment.

I would, also, add: Learn to live in simplicity, but with elegance.

Something interesting I was pointed to was an article on the comparison of whether you should pay your mortgage off faster or invest that extra money into an investment account earning 8% per year. The crazy thing was there was way more money in the investment account than there was in the house value being paid off earlier and investing the full amount! Just goes to show you long term investing only works long term.