Why There Are No ‘Best’ Investments – BehaviorGap @ NYTimes

As you know, our friend Carl Richards is a writer for NYTimes.com. We have definitely encountered people trying to find the “silver bullet” investment that will magically create huge gains for their 401(k). Unfortunately, this typically results in some really outlandish investment “strategies” and chasing the performance of the “best fund.” The cost of those decisions to their nest egg is tremendous. The following is Carl’s most recent post, and I won’t try to water it down with a summary, for I think every investor should read it.

You make good financial decisions only within the context of your goals.

This may seem obvious, but think about the amount of time and energy spent trying to find the “best investment.” Magazine covers are devoted to it, and books are written about it. There seems to be an entire industry built around this wild goose chase.

But the reality is that there is no such thing as the best investment.

The idea that there is some mythical investment that we can label the best, without first considering how it fits into the context of your life, is crazy. It’s like getting in a debate with a friend about which car you should drive on a trip before you’ve even decided where you’re going. How can you decide on the vehicle before you determine the destination?

This is true for all financial products. Life insurance, mutual funds and even bank accounts can be judged only based on how well they help you reach your goals. Since your goals are unique, what might be right for you could be a disaster for someone else.

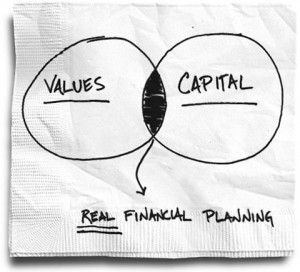

Instead of spending so much time searching for the best financial product, we’re much better off taking the time to reflect on what is really important to us and then aligning our use of capital with those values. What good would it do to find the mythical best investment and end up with a bankrupt personal life? David Brooks recently highlighted a similar issue: most of us are focusing on the wrong things if our goal is happiness.

So rather than reading the latest list of the “10 Best Investments for a Post Credit Crisis World,” try asking yourself some questions to discover what is really important to you. Here are two sites to spark some thought:

1) A discussion of George Kinder’s three questions about life planning on the Get Rich Slowly blog.

2) Krista Tippett’s discussion about the economic crisis and the questions it forces us to ask ourselves.

I have to warn you that this can be a painful process, because it forces you to think about things outside the confines of a spreadsheet. Be patient with the process and realize that in the end it’s not about the money. It’s about your life.

Great and unusual advice. Perhaps we can call it “Principled Investing.”