What is “The Right Price” to Pay for a Stock?

The amount of money we decide to place in common stocks in your investment portfolio is partially driven by the prices we have to pay for those stocks. The higher the price we pay for a dollar’s worth of earnings generated by a stock, the lower the chance that we receive the returns we need to keep you on a path toward a healthy retirement.

But exactly what is “The Right Price”?

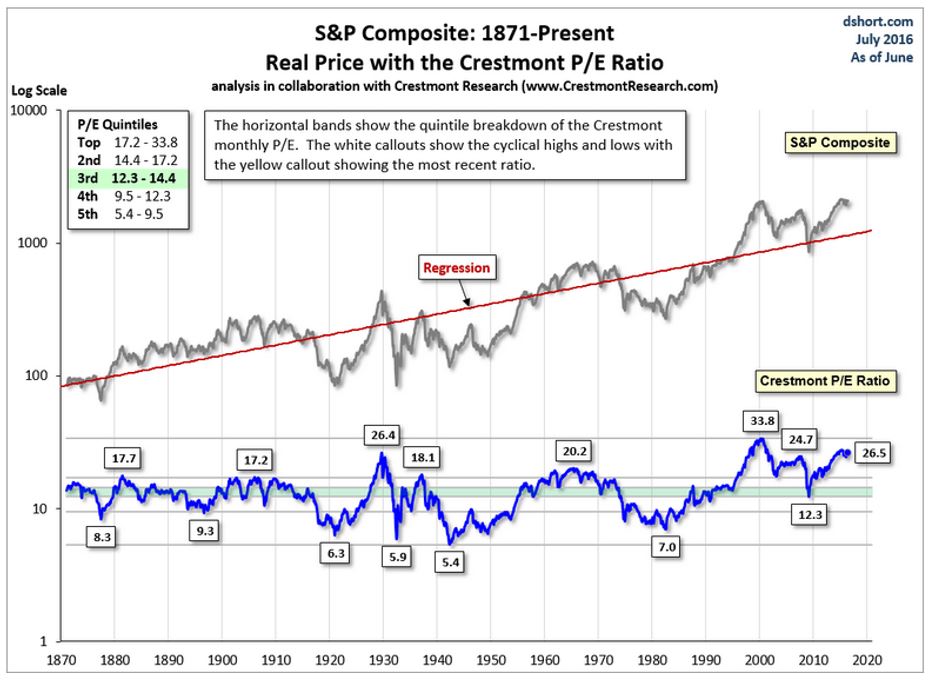

Here is a very long term look at historical prices. On the top left of this chart, prices are broken out into quintiles. The highlighted quintile shows that we have paid between $12.30 and $14.40 for a dollar’s worth of earnings 20% of the time since 1871. We have paid as little as $5.40 (in the early 1940s) and as much as $33.80 (during the tech bubble of the late 1990s). Only 20% of the time have we paid more than $17.20 for $1 of earnings. At the end of June, 2016, we are paying $26.50, more than 89% above the long run average!

For perspective, let’s say we are doing our research to decide on the right price for a house that is for sale. History tells you that house would be worth $150,000 at fair value. You call the realtor and find out the homeowner has a $284,000 asking price. Are you a buyer?