August Newsletter – Is Government Stimulus Really an Economic Stimulus?

What Does Brittany Wenger Have to Do With My Retirement Portfolio?

Will continued insistence on borrowing from the capital of future generations lead to a long period of decline?

Brittany Wenger is a 17-year-old South Florida resident entering her senior year of high school.

Brittany wrote a computer program utilizing artificial intelligence technology to detect complex biological patterns to make diagnostic calls on breast cancer, correctly identifying malignant tumors with a 99% success rate.

The human mind is an incredible creation. Around the world, individuals like Brittany impact our lives – providing us with ways to improve our standard of living in very complex ways (like detecting breast cancer) or very simple ways (like new car wash technologies or freaky fast sandwich assembly).

The United States, from our founding, recognized the power of individual creativity and provided the environment necessary to leverage that power. As a result, we have been able to rely on a consistent march forward in our economic growth and our standard of living.

Over the short term (and by short, we mean months, or quarters, or several years) the consistent march forward has little correlation with the performance of the stock and bond funds in your retirement account.

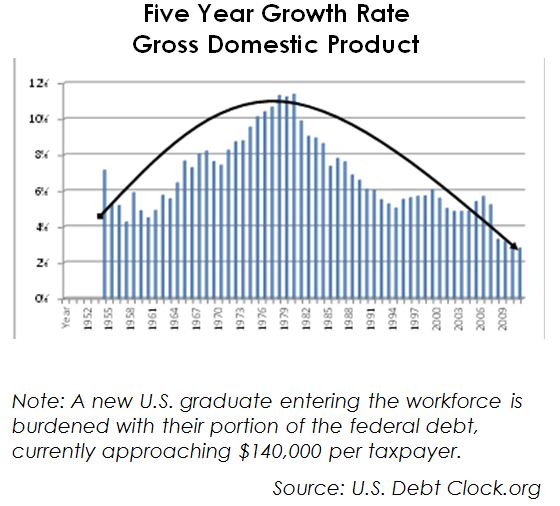

However, if you have been a reader of our past newsletters, you know our focus is on the long term performance of your assets. To the right, we reproduce a graph from last month’s newsletter. Our long term economic growth has been in decline for a few years, and our largest concern is the possibility that the decline is more than just cyclical.

In the article below, we highlight research demonstrating that an extremely high level of government indebtedness diminishes economic growth.

Will young people like Brittany Wenger have access to an economic environment that allows innovation to flourish? Or, will our fears be realized? Will continued insistence on borrowing from the capital of future generations lead to a long period of decline in U.S. growth, resulting in significant lower long term returns for our investment portfolios?

Is Government “Stimulus” Really an Economic Stimulus?

Analysis of Worldwide Research Challenges Myth of Excess Government Spending

The Quarterly Review and Outlook from Hoisington Investment Management discusses three recent academic studies from economists in the U.S., Europe and Sweden.

The Quarterly Review and Outlook from Hoisington Investment Management discusses three recent academic studies from economists in the U.S., Europe and Sweden.

The conclusions from these studies:

- High levels of public debt can be associated with declines in GDP growth of 1.2% per year with an average duration of 23 years.

- An increase in government size by 10 percentage points is associated with a 1/2% to 1% lower annual growth rate.

- As government debt rises to higher levels, the adverse growth consequences tend to accelerate.

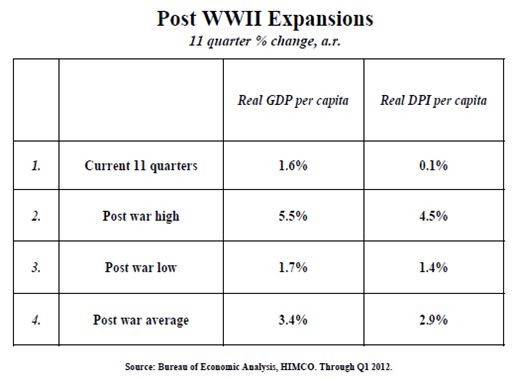

Growth in real gross domestic product and real disposable personal income over the last 11 quarters is the lowest in the Post-War Era. The last 11 quarters have also experienced accelerated growth in government spending and borrowing. Government “stimulus” is having the expected negative impact, at least according to this analysis.

CFA Institute Integrity List:

50 Ways to Restore Trust in the Investment Industry

The Chartered Financial Analyst Institute Code of Ethics and Standards of Professional Conduct were adopted by BeManaged at its inception. CFA Institute members stand apart in their dedication to sound investment ethics, demonstrating trust and competence to their clients, employers, and colleagues. And every CFA member commits to adhere to the highest ethical standards in daily practice, ensuring that investors always come first.

Following the 2008 financial crisis, and on the occasion of the Institute’s 50th Anniversary, the Institute published the Integrity List; 50 ways to restore trust in the investment industry. In this and following issues, we want to share that list to assist you in understanding the drivers of our daily operation. Here are the first ten:

1. Commit to a gold standard code of ethics and professional

2. Require training on ethical decision-making for yourself and your firm.

3. Place the client’s interests before your own.

4. Name and shame unethical behavior.

5. Recommend products with transparent payoffs, costs, and risks

6. Help clients focus on risk as much as they do on performance.

7. Disclose your educational achievements and how you improve professional competence.

8. Strive for a conflict-free business model.

9. Advocate for stronger regulations that protect investors.

10. Act with integrity 24/7 – not just at the office.