July Newsletter – Will More Risk Ever Mean More Reward?

Will More Risk Ever Translate Into More Return?

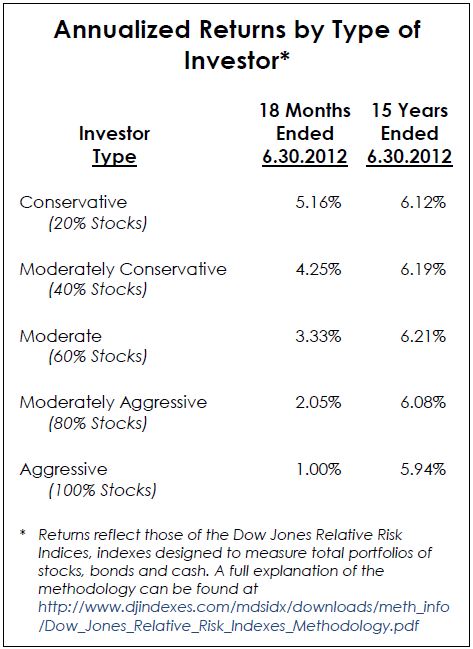

The last Eighteen Months looks the same as the last Fifteen Years

Let’s review of the dogmas of the investing world:

Let’s review of the dogmas of the investing world:

- Over the long run, stocks ALWAYS outperform bonds;

- The more aggressive you are as an investor, the more you will be rewarded with higher long term returns;

- If you want higher returns, you simply have to be a more aggressive investor;

- To be more aggressive as an investor, you simply have to own more stocks and fewer bonds

The evidence, we insist, does not support the claim. Over the last eighteen months, it has been beneficial to hold fewer stocks in your investment account. For the last fifteen years, it has made almost no difference whether you were conservative or aggressive; the returns are almost identical across all five indices.

Rational investors, provided with this evidence, would obviously prefer to be more conservative with their portfolios. Why would we take extra risk if there is no reward?

On the back page, we elaborate on this topic from two perspectives:

- What might be the reasons the historical risk/reward relationship has disappeared?

- If we cannot count on the logical relationship to continue, how can investors expect to generate the returns necessary to succeed in retirement?

“We have too many shopping malls selling stuff, but not enough factories making stuff. We have too many kids in college studying liberal arts, and not enough in the workforce acquiring skills that will actually increase their productivity. Banks are loaning too much money to individuals to buy houses, and not enough money to entrepreneurs to buy equipment. We have too many tax-takers riding in the wagon, and not enough taxpayers pulling it. The list is long, but the solutions are short.”

Peter Schiff, “Damn the Torpedoes”, Euro Pacific Capital, June 8, 2012 (www.europac.net)

Economic Growth and Market Returns

Stock prices are driven by corporate profits, which rely on general economic growth

Corporate profits and dividends are the reason we are willing to add risk to our portfolios. We can share in the growth of our economy through the profits and dividends companies return to us as shareholders.

Corporate profits and dividends are the reason we are willing to add risk to our portfolios. We can share in the growth of our economy through the profits and dividends companies return to us as shareholders.

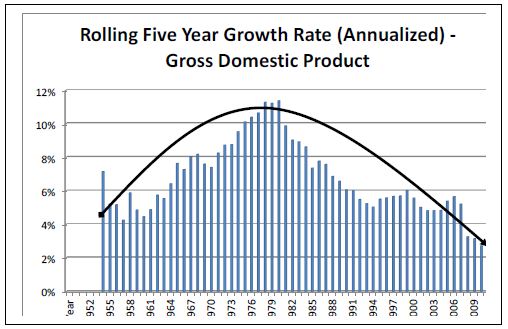

Disturbingly, we are witnessing a long-term erosion in economic growth. From the early 1950s through 1997, average economic growth (including inflation) exceeded 7% annually.

The average over the last fifteen is less than 5% and is currently below 3%. In 2009, we suffered our first nominal year over year decline in at least fifty years.

What we may be experiencing is deterioration in the risk/reward relationship that is more permanent than we had hoped for. Such deterioration can only lead to continued subpar returns for the foreseeable future.

Starting Points Matter!

Bad economies do not necessarily make for bad markets

A lower growth economy makes it more difficult to find investment returns, but does not make it impossible. Just like the great thrift store shoppers of our time, the secret is finding useful, functional goods at VERY good prices. We like to accept a little more risk (shop at more stores) when prices are great, and patiently wait for a better day when prices seem a little too high.

Price/Earnings ratios (the way stock “goods” are priced) have been extremely low at the beginning of each of the four bull markets since 1900*. Bull markets beginning in 1921, 1933, 1942 and 1982 were all marked by P/E ratios near or below 10:1.

Contrast those starting points with a P/E ratio of 31:1 we saw in 1997, and you can begin to understand why returns over the last fifteen years have been so poor. The markets were shopping at Tiffany’s in the late 90s, and no one was concerned about the price tag.

Even with a “permanent” decline in our long term growth, there is good news: Patience can indeed be rewarded. A little less risk during pricey markets, and a little more risk during relatively cheap markets, can improve your long term portfolio returns. We continue to exhibit patience with the risk exposure of our client accounts.

The bad news: The poor returns of the last 15 years have only reduced the P/E ratio to about 20:1 – and no bear market has ever ended at levels this high.

* Crestmont Research is our source for the returns and P/E data cited. Their website, www.crestmontresearch.com, contains a number of valuable articles on long term investment returns and is worth a visit.

How About the Experts?

For equity investors, no name is bigger than Warren Buffet (The “Oracle” of Omaha). But Mr. Buffet’s Berkshire Hathaway stock has returned just 6.71% over the last fifteen years, not much better than the relative risk indices.

Jack Bogle is retired founder of Vanguard and recognized as the champion of “buy and hold” investing. Yet, Vanguard’s flagship 500 Index fund returned only 4.75% since June, 1997.

There is a winner among the experts, however…

Bill Gross is the long-time manager of the PIMCO Total Return Bond Fund, the largest bond fund in the world.

The fund’s fifteen year return of 6.92% exceeds the relative risk averages after expenses and without investing in a single equity!