Posts by Jay Jandasek

BeManaged July Newsletter: Late Rally Saves 2nd Quarter

The following topics are covered in this month’s Research Newsletter from the BeManaged Research Department.

Late Rally Saves Second Quarter Statements

Fiduciary and Suitability Standards: Copybook Headings for Investors

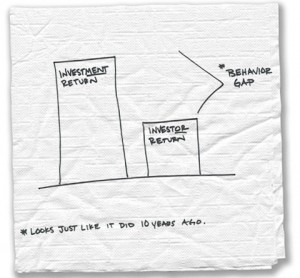

2011 Dalbar Study Finds That Investors are Still Their Own Worst Enemy

Going back to the early 2000’s, our friends at Dalbar have been conducting a study to determine whether investors’ investment decisions impacts their investment performance. Unfortunately, it does. In a BIG way.

Read MoreBeManaged June Newsletter: Modest Declines in World Equity Markets

The following topics are covered in this month’s Research Newsletter from the BeManaged Research Department.

Modest Declines in World Equity Markets in May

Consumer Confidence Dives in Latest Reading

When Investing, Trusting Your Gut Can Be Bad For Your Health

I believe in trusting my instincts when making decisions. However, when it comes to investment decisions, I have learned firsthand that my gut will often lead me down the wrong path. Many studies and surveys continue to support I am not the only one in that camp.

Read MoreBeManaged May Newsletter: More Equity Gains in April, Valuations are Concerning

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Worker Attitudes Toward Retirement Savings Needs

More Equity Gains in April – Valuations are Concerning

Survey Reveals 89% of 401k Investors Want Asset Allocation Help

A survey conducted by the Boston Consulting Group found that investors find retirement planning is confusing and 89% want help creating their ‘investment recipe’ (aka asset allocation). Here are the other findings of the 2,600 investors surveyed:

84% want help calculating and/or creating retirement income

79% would like an annual review “to set and measure their progress”

48% feel they are “in consult of their retirement plan investments”

BeManaged April Newsletter: “We’re Still Dancing!”

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Market Environment Reminds Us of the 3rd Quarter of 2007

New Form ADV Part II available

Equity Markets End 1st Quarter on Positive Note

Getting a Tax Refund? Be Like the 50% of People Using it Wisely

Tax day is only a few weeks away. If you are receiving a tax refund, you have some fun decisions to make. A recent study found that only 31% plan to put some of the refund toward their retirement savings, and another 19% plan to pay down debt…meaning only half of people are taking steps to improve their financial situation with their refund.

We know. You get a check in the mail or it shows up in your checking/savings account. Saving it or paying down debt is about as fun and exciting as…well…I don’t know, but it’s not. Unfortunately, doing the right thing sometimes isn’t that fun. However, it is a good feeling when you do the right thing.

Read MoreComing Soon to 401k Statements: Participants’ Account Balance as Monthly Income?

Fred Reish (he’s getting a lot of attention from us this month) and Bruce Ashton of Drinker Biddle posted an article that discussed having 401k statements illustrate a participant’s account balance in the form of a monthly income. The article is illustrated below and we find this to be an excellent idea, but the following points would need to be considered in order create a consistent message across providers:

Read Morefi360 Webinar Recording: The Combined Effects of the DOL’s Proposed Advice Regulation and 408(b)(2)

CEFEX and fi360 sponsored attorney Fred Reish to provide a thorough overview of the proposed advice and 408(b)(2) regulations. If you are a plan fiduciary who has hired a person or firm to provide your employees advice on their 401k, or an advisor/broker that works with 401k participants, this is essentially a must-listen event. The following were a number of interesting points which affect plan sponsors and advisors:

Read More