Posts by Jay Jandasek

5 Participant Success Features to Add to Your 401k Plan

Last month, we brought on a new client that was going through a provider change. During our interaction with their employees, we were shocked to find what their old 401k provider DIDN’T offer compared with what their new provider DID. For the sake of full disclosure, we tend to be a little naive in assuming that certain features are a given when it comes to the capabilities of 401k provider websites. That being said, it’s 2011. I can order a burrito from my phone. Thus, if your provider offers any of these functions, the following are some basic online tools (in our naive minds) that we have found participants enjoy, and quite frankly expect in today’s digital age:

Read MoreBeManaged March Newsletter – February Good for Small Cap Stocks

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Sales and Earnings Gains Projected to Continue in 2011

Small Cap Stocks Big Winners in February

Investment Returns and Overall Account Growth

WSJ – Once Bitten, Twice Bold: Look Who’s Buying Stocks Now

Jason Zweig is one of my favorite writers at the Wall Street Journal. Last weekend, he wrote an interesting article regarding some of the classic sell low, buy high behaviors taking place due to the sustained gains of the market rally that is now nearing 24 months in length. It’s a must-read for anyone wanting to learn what NOT to do with their portfolio. Here are a few snippets from the article:

Read MoreSurvey Demonstrates Better Results for 401k Participants Using Advice

A recent study illustrated finds that 401k participants using advice are better diversified and have larger balances. Here are some interesting findings of the survey:

Improved Diversification – Participants held 74% more funds in their portfolio (8.67 versus 4.98 funds)

Improved Performance – 3 Year Annualized Return was 2.67% better than do-it-yourself investors

Larger Balances Seek Advice – Average balance of participants using advice was $107,558 versus $44,178 of do-it-yourself investors

These results are very similar to our experience with 401k investors. We find that participants using advice (or managed accounts) are better diversified and experience better downside protection due to improved risk management. Additionally, the larger the balance, the more likely the participant is to seek advice.

BeManaged February Newsletter – Commodity Prices Continue to Increase

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Commodity Price Increases Continue in January

Q-Ratio Reaching Historic Peaks

7 Steps to Keep from Getting Carried Away by the Market Rally

The Wall Street Journal recently wrote a very good article on keeping your expectations in check in light of the market rally that took place during the second half of 2010. The following are seven points to consider in as you make decisions on your portfolio:

Read MoreBeManaged January Newsletter – 2010 Review and Look Forward at 2011

The following are some topics covered in this month’s Research Newsletter from the BeManaged Research Department.

Asset Price Inflation Wins in 2010

2010 Market Returns Positive Across the Board

The State of Corporate Balance Sheets

Government Debt and Deficits

Don’t Get Burned – Put More Focus on the Recipe Than the Ingredients

A few months ago, I made a big pot of chili. I have made my Mom’s recipe my own, and always enjoy how it turns out. However, I incorporated a few new ingredients that time, and the initial result was quite interesting. I discovered an important lesson – I have some learning to do when cooking with cayenne pepper. When I checked it after it had been cooking for a couple of hours, I found it to look and smell like chili. After tasting it however, it was so spicy that I thought it was molten lava going down my throat.

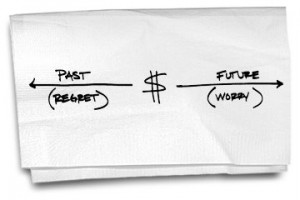

Read More5 Tips to Help Stop Worrying About Money

The following article by Carl Richards at the NYTimes.com made some really good points regarding our propensity to beat ourselves up over past mistakes as well as worrying about the future with respect to money. I have been guilty of this, so this really hit home for me. Simply put, we are all human and make mistakes in many aspects of our lives, including financial decisions.

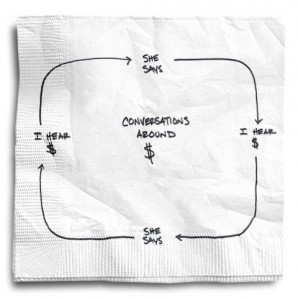

Read MoreConversations About Money…Even When They Are Not

If you follow this blog at all, you know I am a fan of Carl Richards, who does a fantastic job of simplifying investing concepts but also our behaviors around money. The following post from the New York Times is a fantastic example and advice from which we can all (mostly us men) can benefit from.

Read More