Posts Tagged ‘401k fiduciary’

The New DOL Fiduciary Rule

On June 9th of this month, the Department of Labor’s Fiduciary Rule went into a phased implementation period with an effective date of January 1, 2018. The rule was designed to protect investors’ retirement savings. While the rule is thousands of words long, the main focus is this: require anyone providing investment advice to individuals…

Read MoreBeManaged Recognized for 10th Year of CEFEX Certification

A few weeks ago, I was fortunate to represent BeManaged in Nashville for our tenth year of being CEFEX certified. Your next question is likely, “Ok, what is CEFEX and why does that matter?” According to the CEFEX (Centre for Fiduciary Excellence) Site: CEFEX is an independent global assessment and certification organization. It works closely with…

Read MoreDraper, Inc. Wins 2014 PlanSponsor of the Year by PlanSponsor Magazine

BeManaged is honored to be the advice provider for the Draper, Inc. retirement plan, which won the 2014 PlanSponsor of the Year for plans <$50MM. Draper’s diligence and commitment to the success of their participants is impressive and it is great to see them recognized for their efforts. We would like to note that utilization…

Read MoreBeManaged Expands to Minneapolis/St. Paul Market

We are proud and excited to announce that we have expanded into the Minneapolis/St. Paul market, serving the great state of Minnesota. We look forward to serving the area with our unique, 1-on-1 401k participant advice solutions. The expansion was made final by the Vikings securing a stadium for the next 2+ decades. (joking) If…

Read MoreVideo – The Difference Between Fiduciaries and Brokers

Over the past few years, I have become a big fan of whiteboard illustrations that simplify concepts which can be challenging to understand. The video below by HighTower Whiteboard Animation does a great job of simplifying the confusion over the difference between brokers and a fiduciary in a nice little analogy. Can’t view? Click here…

Read MoreIRS Contribution Limits for 2012

Today the IRS posted the 2012 retirement plan limits, and for the first time since 2009, they are increasing! The new limits are as follows: Elective Deferrals for 401k/403b/457: $17,000 (increased from $16,500 in 2011) Catch-Up Contributions for 401k/403b/457: Remains at $5,500 Annual Compensation: $250,000 (increased from $245,000 in 2011) Annual Additions Limit for Defined Contribution…

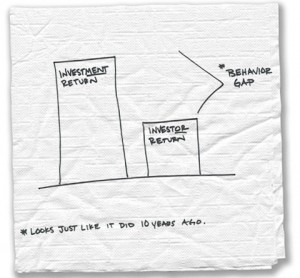

Read More2011 Dalbar Study Finds That Investors are Still Their Own Worst Enemy

Going back to the early 2000’s, our friends at Dalbar have been conducting a study to determine whether investors’ investment decisions impacts their investment performance. Unfortunately, it does. In a BIG way.

Read MoreWhen Investing, Trusting Your Gut Can Be Bad For Your Health

I believe in trusting my instincts when making decisions. However, when it comes to investment decisions, I have learned firsthand that my gut will often lead me down the wrong path. Many studies and surveys continue to support I am not the only one in that camp.

Read MoreSurvey Reveals 89% of 401k Investors Want Asset Allocation Help

A survey conducted by the Boston Consulting Group found that investors find retirement planning is confusing and 89% want help creating their ‘investment recipe’ (aka asset allocation). Here are the other findings of the 2,600 investors surveyed:

84% want help calculating and/or creating retirement income

79% would like an annual review “to set and measure their progress”

48% feel they are “in consult of their retirement plan investments”

Coming Soon to 401k Statements: Participants’ Account Balance as Monthly Income?

Fred Reish (he’s getting a lot of attention from us this month) and Bruce Ashton of Drinker Biddle posted an article that discussed having 401k statements illustrate a participant’s account balance in the form of a monthly income. The article is illustrated below and we find this to be an excellent idea, but the following points would need to be considered in order create a consistent message across providers:

Read More