Posts Tagged ‘401k tips’

October Newsletter – Bond Panic Subsides While the Fed’s Message is Ignored

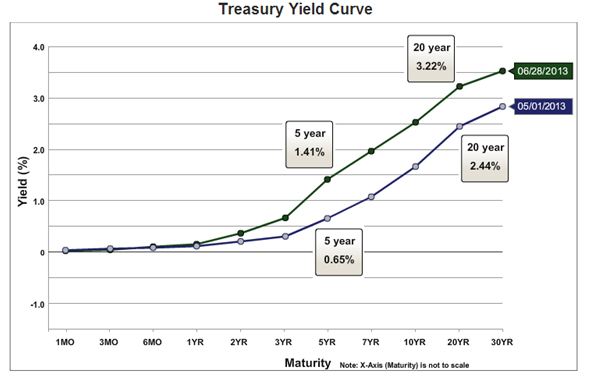

Bond Panic Subsides, Quietly Says “Nevermind” And the Fed’s Message Goes Largely Ignored In May, a rumor that the Fed might be considering reducing their bond purchasing (coined “Tapering”), instigated the worst losses in recent bond market history, as discussed in the September newsletter. In mid-September, in what was widely described as “a surprise move,”…

Read MoreSeptember Newsletter – Should You Move Your Money Out of Bonds?

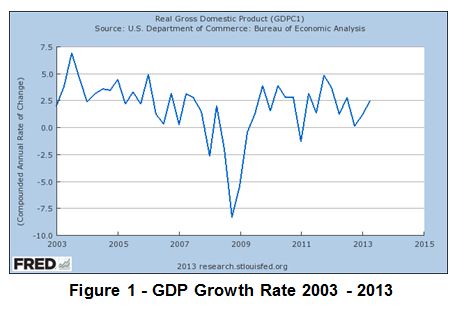

Should You Move Your Money Out of Bonds? In the last four months we have seen some of the worst bond performance in history, and the volatility and potential downside has been a cause for concern for many of our clients. Figure 1 shows the performance of a typical US Bond Index Fund used in…

Read MoreAugust Newsletter – U.S. Equity Funds See Highest-Ever Inflows in July

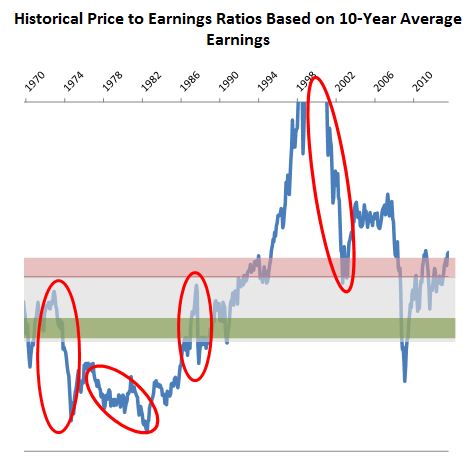

U.S. Equity Funds See Highest-Ever Inflows in July Bubbles, Bubbles, Bubbles Stock valuations (the price you pay to own a share of a company stock) have reached silly extremes with July’s market gains. Meanwhile, bond prices fell during the summer, with some bond funds suffering their worst three month period in recent history. How do…

Read MoreJuly Newsletter – Second Quarter Ends with a Whimper

Second Quarter Ends with a Whimper Balanced Portfolio Returns Hindered by Rising Interest Rates, Poor Foreign Stock Performance Stock markets around the world took a turn for the worse after Ben Bernanke’s May 22nd testimony to Congress gave very subtle hints that the Federal Reserve might consider a gradual slowing of the $85 billion dollar…

Read MoreJune Newsletter – Prices Paid for U.S. Stocks Continue to Balloon

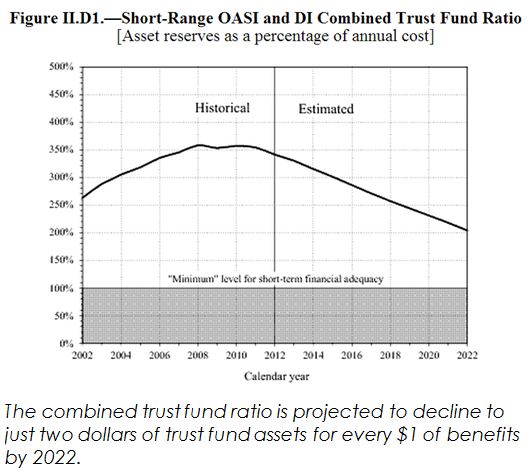

Social Security Trustees Report on Fund Status Disability Insurance “Trust Fund” projected to deplete in 2016 Old-Age and Survivors Insurance and Federal Disability Insurance (commonly referred to as Social Security) is providing benefit payments to about 40 million retired workers, 6 million survivors of deceased workers and 11 million disabled workers and dependents of disabled…

Read MoreApril Newsletter – What Risk? Aggressive Investors Rewarded in First Quarter

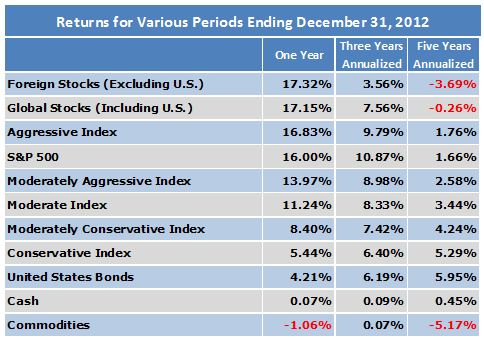

What Risk? Aggressive Investors Rewarded in First Quarter Some historical perspective on risk-based returns The headlines are trumpeting another great quarter of returns for the equity markets. The S&P 500 gained more than 10% in the first three months of this year, in spite of a slowing economy, slowing sales growth for companies worldwide, and…

Read MoreMarch Newsletter – 10 Rules of Investing

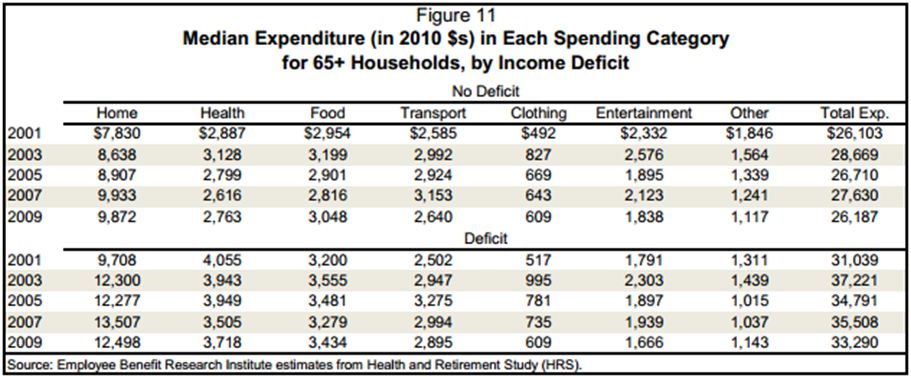

A Look at Income Composition and Trends for Older Households Information in this article comes from the Employee Benefit Research Institute, Brief #383; February, 2013 The Employee Benefit Research Institute released findings from an examination of the income patterns of older U.S. households. Among the findings: • In 2009, households ages 65–74 and households with…

Read More9 Things You Should Know About Social Security

A very good article about Social Security was posted at money.usnews.com that provides a great summary for individuals. The following are some key highlights direct from USNews.com: You contribute 6.2% of your income: Workers pay 6.2 percent of their earnings into the Social Security system, up to $113,700 in 2013. Employers pay a matching 6.2 percent for…

Read More2012 Year in Review – Battling the Challenges of Markets Unhinged

Battling the Challenges of Markets Unhinged We know that retirement plan investors need to focus on the long term performance of their investment portfolios. Changes in strategies, risk profiles, etc. based on short term moves in the market almost always lead to sub-optimal decision making. What we witnessed in 2012 was a complete decoupling of…

Read MoreDecember Newsletter – Double Digit Stock Market Gains So Far in 2012

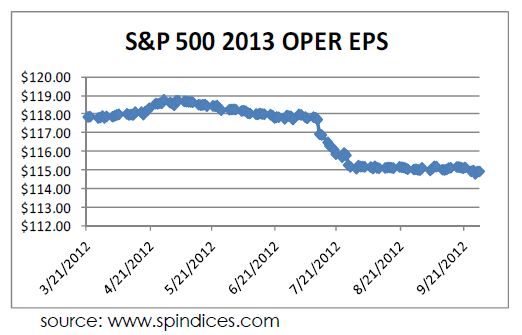

Double Digit Stock Market Gains So Far in 2012 Low Corporate Earnings Growth Offset by Expansion of Price/Earnings Ratio World stock markets bounced back during the second half of November, turning near-term losses into small positive gains for November and for the fourth quarter. Gains were small, but broad-based. Declines were witnessed only in the…

Read More